- Taiwan

- /

- Consumer Durables

- /

- TWSE:6201

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As we step into January 2025, global markets present a mixed picture with U.S. stocks closing out a strong year despite some recent volatility and economic indicators like the Chicago PMI signaling potential challenges ahead. In this environment, dividend stocks can offer investors a measure of stability and income, making them an attractive consideration for those navigating uncertain market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.09% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.02% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.88% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.97% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.15% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.99% | ★★★★★★ |

Click here to see the full list of 1994 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Soft-World International (TPEX:5478)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Soft-World International Corporation develops, operates, and distributes games in Taiwan and China with a market cap of NT$18.88 billion.

Operations: Soft-World International's revenue segments include NT$963.57 million from Yifan, NT$429.46 million from Chinese Gamer International, NT$473.21 million from Xinganxian and Zhifandi, NT$1.44 billion from Neweb Technologies Co., Ltd., and NT$3.37 billion from Soft-World and Soft-World (Hong Kong).

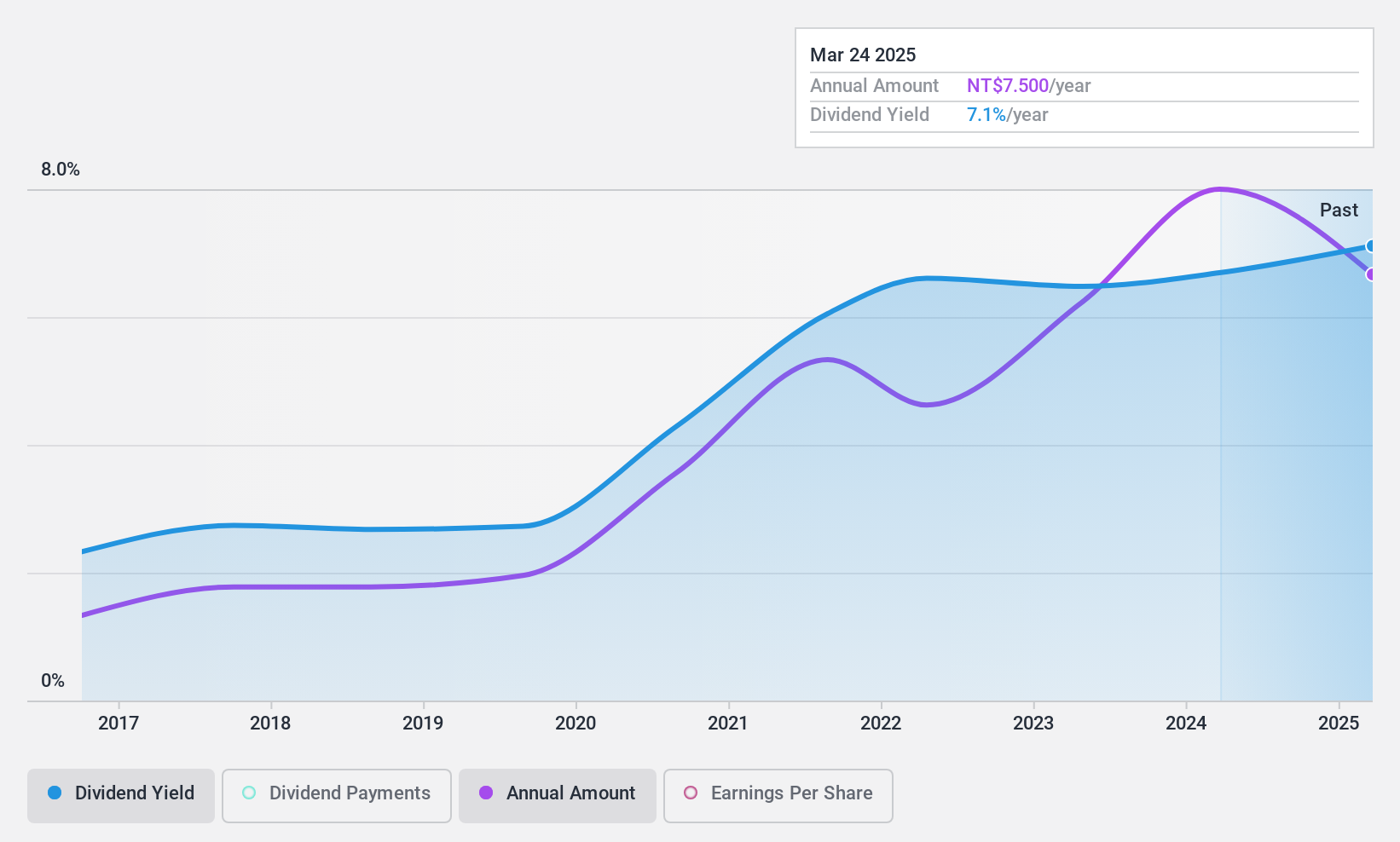

Dividend Yield: 7.1%

Soft-World International's dividend yield of 7.17% ranks in the top 25% of Taiwan's market, yet its sustainability is questionable due to a high payout ratio of 112.5%, indicating dividends exceed earnings coverage. While cash flows cover the dividend with a cash payout ratio of 78.6%, past payments have been volatile and unreliable over the last decade. Recent earnings growth suggests potential stability improvements, but shareholder dilution remains a concern for long-term value retention.

- Click here and access our complete dividend analysis report to understand the dynamics of Soft-World International.

- The valuation report we've compiled suggests that Soft-World International's current price could be quite moderate.

Omni-Plus System (TSE:7699)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Omni-Plus System Limited manufactures and distributes commodity and engineering plastics in Singapore and internationally, with a market cap of ¥16.38 billion.

Operations: Omni-Plus System Limited's revenue is primarily derived from its Engineering Polymer Business, which generated $352.70 million.

Dividend Yield: 5.5%

Omni-Plus System's dividend yield of 5.5% places it among the top 25% in Japan, supported by a low payout ratio of 32.3%, indicating strong earnings coverage. Its cash payout ratio of 35.4% further underscores sustainable dividends, though the company has only a brief three-year history of payouts. Despite recent earnings growth and increased sales to US$198.26 million for six months ending September 2024, share price volatility remains a concern for investors seeking stability.

- Click to explore a detailed breakdown of our findings in Omni-Plus System's dividend report.

- The analysis detailed in our Omni-Plus System valuation report hints at an deflated share price compared to its estimated value.

Ya Horng Electronic (TWSE:6201)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ya Horng Electronic Co., Ltd. is a manufacturer and seller of audio products, household appliances, and healthcare products with operations in Taiwan, the United States, Japan, France, and internationally; it has a market cap of NT$5.09 billion.

Operations: Ya Horng Electronic Co., Ltd.'s revenue segments include NT$3.32 billion from Taiwan's Operational Headquarters and NT$1.37 billion from Production Factories in China and Southeast Asia.

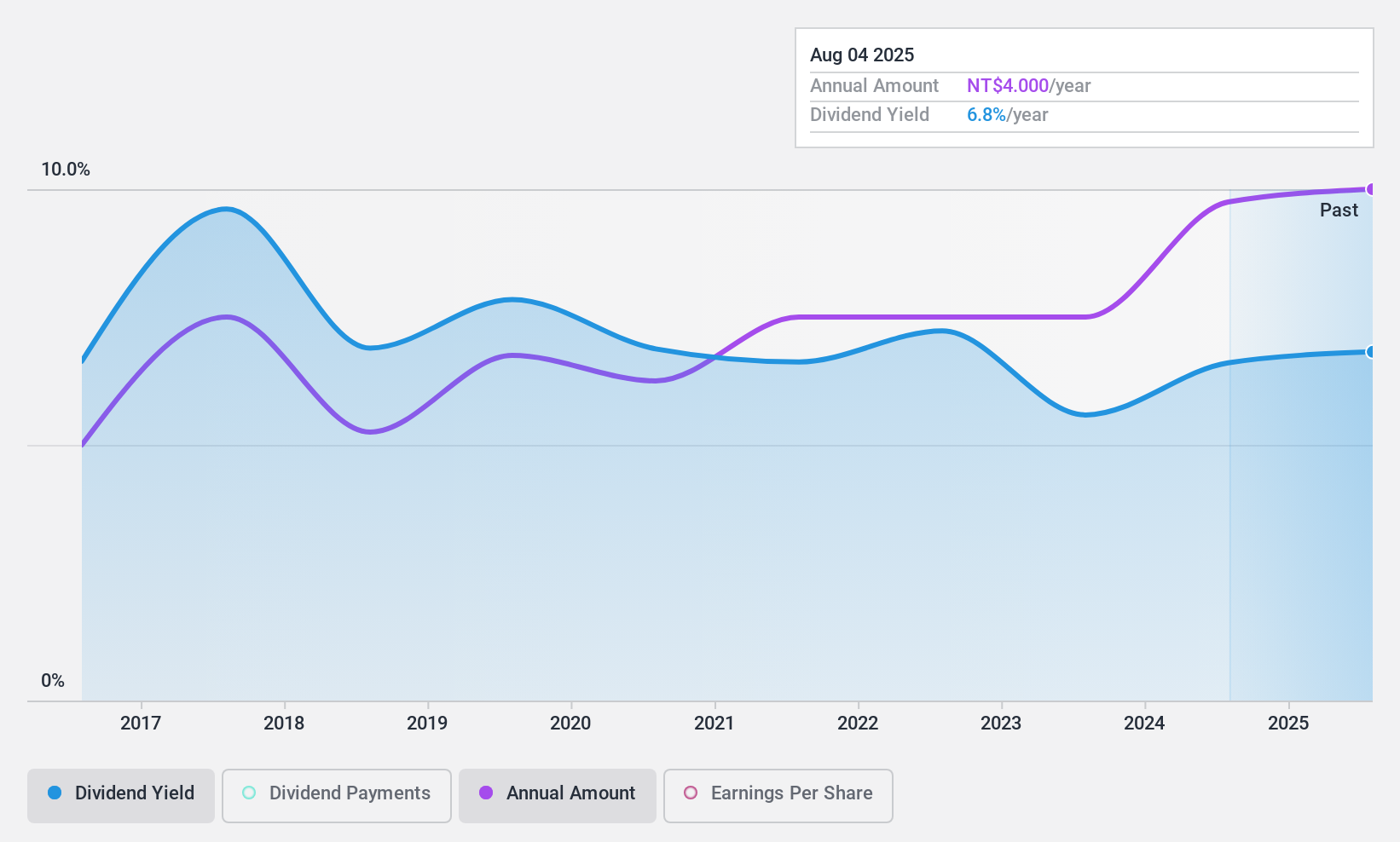

Dividend Yield: 6.8%

Ya Horng Electronic's dividend yield of 6.83% ranks in the top 25% of the Taiwan market, with a payout ratio of 89.2%, indicating dividends are covered by earnings but may be less sustainable long-term due to volatility and an unstable track record over the past decade. Despite trading at a significant discount to its estimated fair value, recent earnings show a slight decline, with Q3 sales at TWD 925.76 million and net income at TWD 109.33 million.

- Navigate through the intricacies of Ya Horng Electronic with our comprehensive dividend report here.

- Our valuation report unveils the possibility Ya Horng Electronic's shares may be trading at a discount.

Next Steps

- Unlock our comprehensive list of 1994 Top Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6201

Ya Horng Electronic

Manufactures and sells audio products, household appliances, and healthcare products in Taiwan, the United States, Japan, France, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives