- Taiwan

- /

- Entertainment

- /

- TPEX:4946

Is Cayenne Entertainment Technology (GTSM:4946) Using Debt In A Risky Way?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Cayenne Entertainment Technology Co., Ltd. (GTSM:4946) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Cayenne Entertainment Technology

How Much Debt Does Cayenne Entertainment Technology Carry?

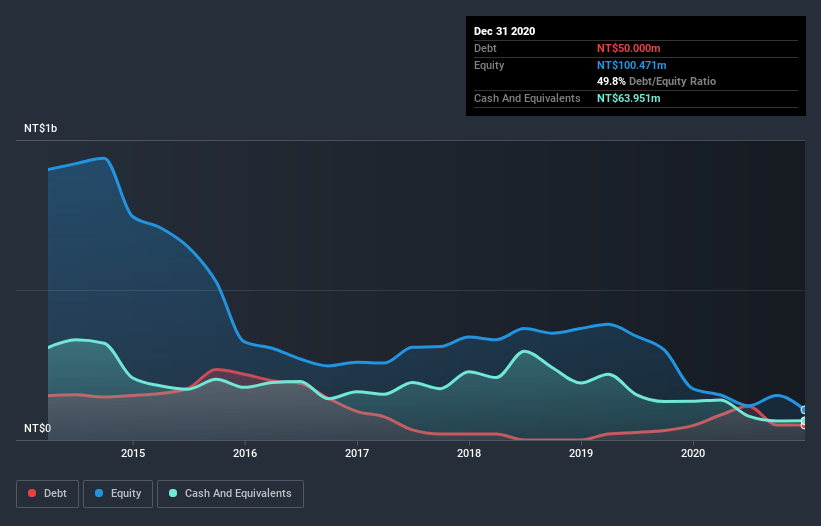

You can click the graphic below for the historical numbers, but it shows that as of December 2020 Cayenne Entertainment Technology had NT$50.0m of debt, an increase on NT$47.8m, over one year. However, its balance sheet shows it holds NT$64.0m in cash, so it actually has NT$14.0m net cash.

How Healthy Is Cayenne Entertainment Technology's Balance Sheet?

We can see from the most recent balance sheet that Cayenne Entertainment Technology had liabilities of NT$119.4m falling due within a year, and liabilities of NT$1.42m due beyond that. Offsetting this, it had NT$64.0m in cash and NT$5.44m in receivables that were due within 12 months. So its liabilities total NT$51.5m more than the combination of its cash and short-term receivables.

Of course, Cayenne Entertainment Technology has a market capitalization of NT$556.0m, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Cayenne Entertainment Technology boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is Cayenne Entertainment Technology's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Cayenne Entertainment Technology made a loss at the EBIT level, and saw its revenue drop to NT$84m, which is a fall of 75%. That makes us nervous, to say the least.

So How Risky Is Cayenne Entertainment Technology?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Cayenne Entertainment Technology lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of NT$124m and booked a NT$55m accounting loss. With only NT$14.0m on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 4 warning signs we've spotted with Cayenne Entertainment Technology (including 1 which is potentially serious) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Cayenne Entertainment Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4946

Cayenne Entertainment Technology

Cayenne Entertainment Technology Co., Ltd.

Flawless balance sheet with low risk.

Market Insights

Community Narratives