- Taiwan

- /

- Metals and Mining

- /

- TWSE:9927

These 4 Measures Indicate That Thye Ming Industrial (TWSE:9927) Is Using Debt Safely

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Thye Ming Industrial Co., Ltd. (TWSE:9927) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Thye Ming Industrial

How Much Debt Does Thye Ming Industrial Carry?

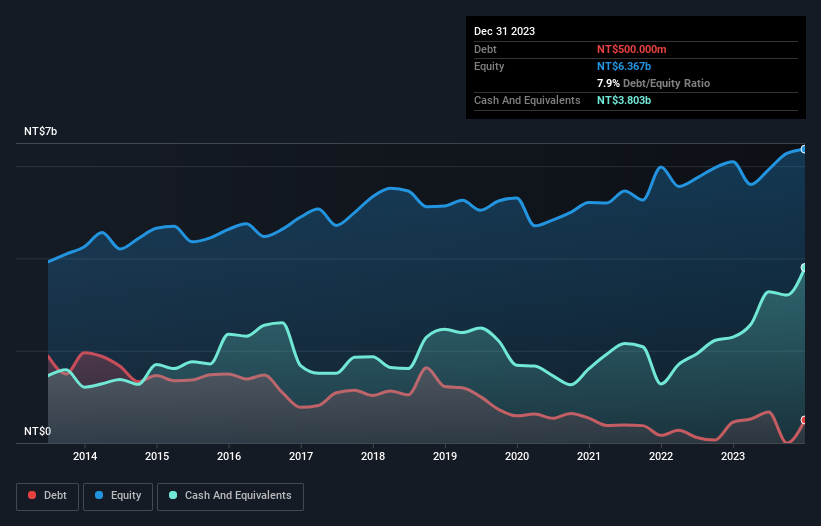

As you can see below, at the end of December 2023, Thye Ming Industrial had NT$500.0m of debt, up from NT$450.0m a year ago. Click the image for more detail. However, it does have NT$3.80b in cash offsetting this, leading to net cash of NT$3.30b.

How Strong Is Thye Ming Industrial's Balance Sheet?

We can see from the most recent balance sheet that Thye Ming Industrial had liabilities of NT$976.0m falling due within a year, and liabilities of NT$297.7m due beyond that. Offsetting this, it had NT$3.80b in cash and NT$1.07b in receivables that were due within 12 months. So it can boast NT$3.60b more liquid assets than total liabilities.

This excess liquidity suggests that Thye Ming Industrial is taking a careful approach to debt. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Simply put, the fact that Thye Ming Industrial has more cash than debt is arguably a good indication that it can manage its debt safely.

In addition to that, we're happy to report that Thye Ming Industrial has boosted its EBIT by 51%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Thye Ming Industrial will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Thye Ming Industrial may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Thye Ming Industrial actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Thye Ming Industrial has net cash of NT$3.30b, as well as more liquid assets than liabilities. And it impressed us with free cash flow of NT$2.2b, being 115% of its EBIT. When it comes to Thye Ming Industrial's debt, we sufficiently relaxed that our mind turns to the jacuzzi. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 1 warning sign we've spotted with Thye Ming Industrial .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Thye Ming Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:9927

Thye Ming Industrial

Manufactures and sells lead alloys and lead oxide in Asia.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026