As global markets navigate a landscape marked by easing trade concerns and mixed economic signals, investors are increasingly focused on strategies that can provide stability amid uncertainty. In such an environment, dividend stocks often stand out as attractive options due to their potential for providing steady income streams and resilience against market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Daito Trust ConstructionLtd (TSE:1878) | 4.24% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.49% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.16% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.06% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.79% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.00% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.07% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.48% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.36% | ★★★★★★ |

Click here to see the full list of 1544 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Shanghai Hanbell Precise Machinery (SZSE:002158)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Hanbell Precise Machinery Co., Ltd. operates in the manufacturing sector, specializing in the production of precise machinery components, with a market cap of CN¥9.25 billion.

Operations: Shanghai Hanbell Precise Machinery Co., Ltd. generates its revenue through various segments within the precise machinery manufacturing industry, though specific segment details are not provided in the available text.

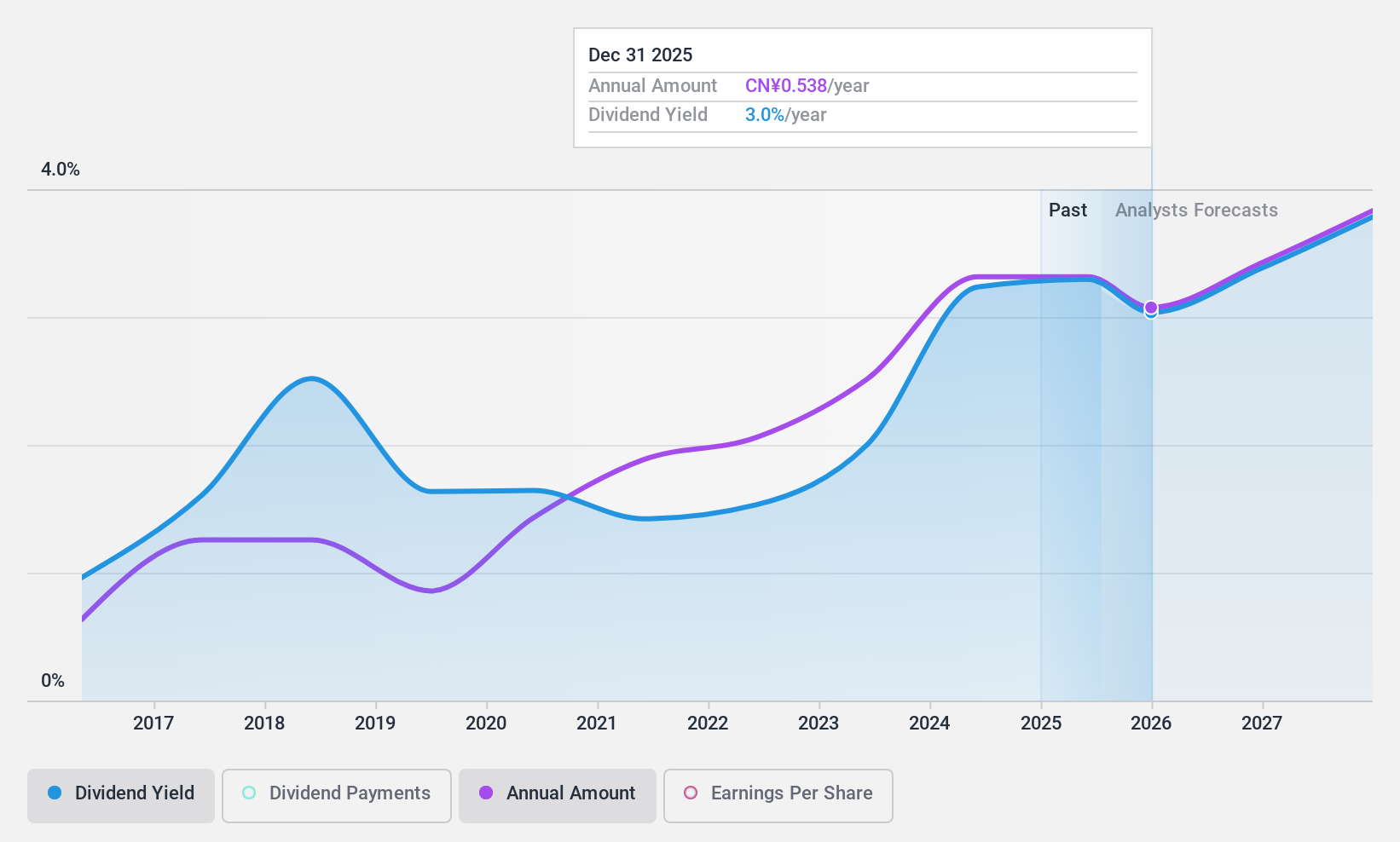

Dividend Yield: 3%

Shanghai Hanbell Precise Machinery recently announced a final cash dividend of CNY 5.80 per 10 shares for 2024, despite reporting lower earnings in Q1 2025 compared to the previous year. The company's dividend yield of 3.05% is among the top in the Chinese market, though it remains poorly covered by free cash flows and has shown volatility over the past decade. Its low payout ratio suggests dividends are currently supported by earnings rather than cash flow stability.

- Click to explore a detailed breakdown of our findings in Shanghai Hanbell Precise Machinery's dividend report.

- Upon reviewing our latest valuation report, Shanghai Hanbell Precise Machinery's share price might be too pessimistic.

Mitsubishi Shokuhin (TSE:7451)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsubishi Shokuhin Co., Ltd. is involved in the wholesale distribution of processed foods, frozen and chilled foods, alcoholic beverages, and confectioneries both in Japan and internationally, with a market cap of ¥234.66 billion.

Operations: Mitsubishi Shokuhin Co., Ltd.'s revenue segments include processed foods, frozen and chilled foods, alcoholic beverages, and confectioneries.

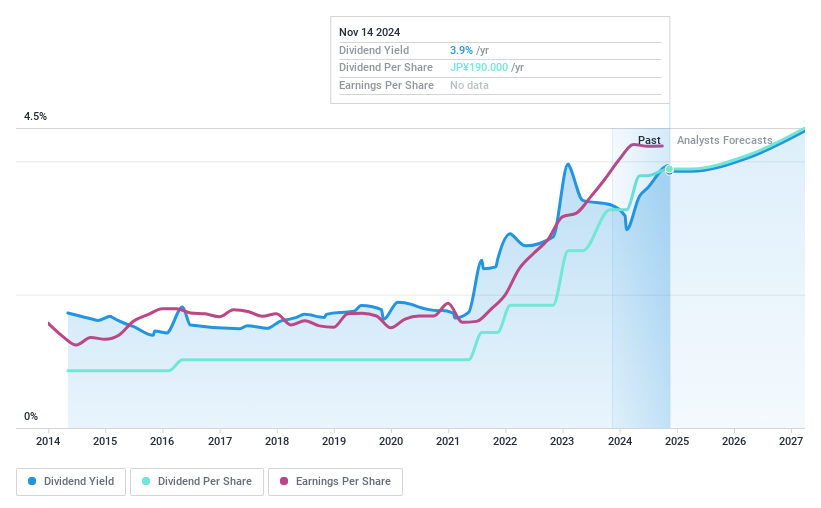

Dividend Yield: 3%

Mitsubishi Shokuhin's dividend yield of 3.04% is below the top tier in Japan, and while dividends have been stable and growing over the past decade, they are not covered by free cash flows. The payout ratio is low at 33.5%, indicating coverage by earnings despite a lack of free cash flow support. Trading at a favorable price-to-earnings ratio of 12.3x compared to the market, it offers reasonable value among peers.

- Navigate through the intricacies of Mitsubishi Shokuhin with our comprehensive dividend report here.

- Our valuation report unveils the possibility Mitsubishi Shokuhin's shares may be trading at a discount.

Ton Yi Industrial (TWSE:9907)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ton Yi Industrial Corp. manufactures and sells tin plate packaging materials in Taiwan, Mainland China, and internationally, with a market cap of NT$31.42 billion.

Operations: Ton Yi Industrial Corp.'s revenue primarily comes from the manufacturing and sale of tin plate packaging materials across Taiwan, Mainland China, and international markets.

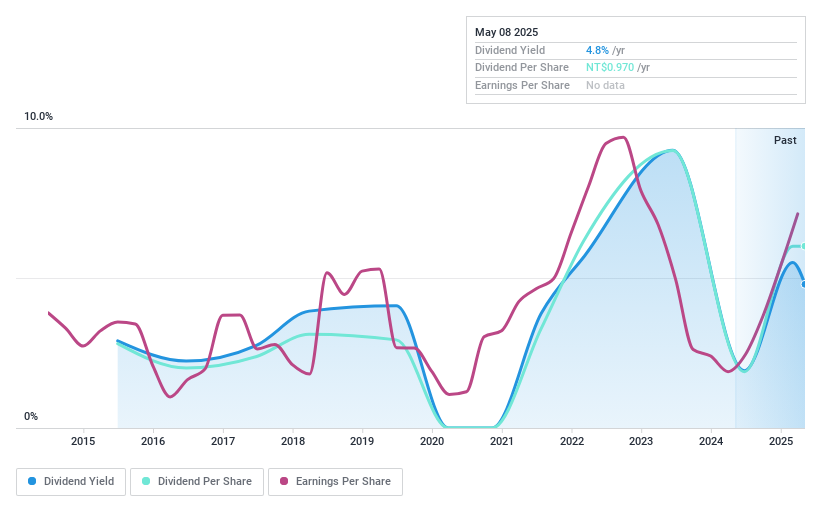

Dividend Yield: 4.8%

Ton Yi Industrial's recent earnings report shows significant growth, with net income rising to TWD 667.88 million for Q1 2025. Despite a history of volatile dividends, the company proposed a cash dividend of TWD 0.97 per share for 2024, covered by both earnings and cash flows with payout ratios of 75.5% and 85.7%, respectively. The stock trades at a price-to-earnings ratio of 15.4x, below the TW market average, offering potential value for investors seeking dividends despite its lower yield compared to top payers in Taiwan.

- Get an in-depth perspective on Ton Yi Industrial's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Ton Yi Industrial is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1544 Top Global Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002158

Shanghai Hanbell Precise Machinery

Shanghai Hanbell Precise Machinery Co., Ltd.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives