- Taiwan

- /

- Paper and Forestry Products

- /

- TWSE:6655

Keding Enterprises' (TWSE:6655) Earnings Are Weaker Than They Seem

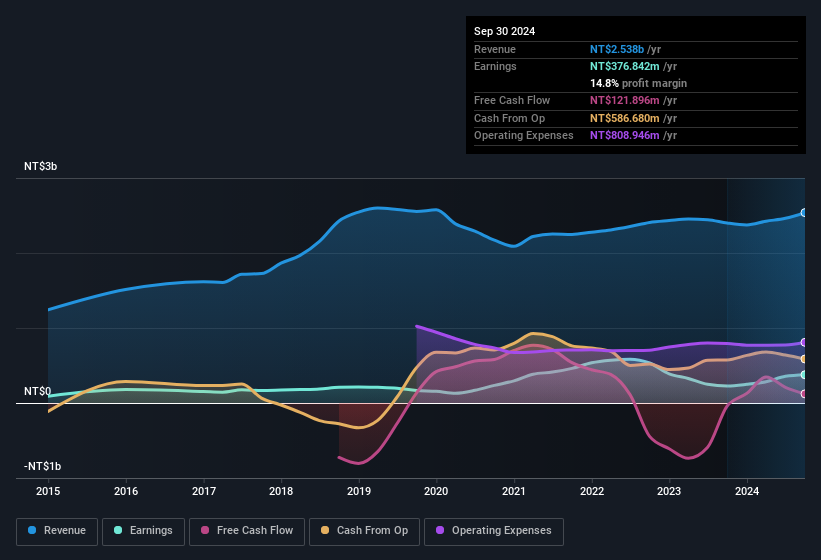

Keding Enterprises Co., Ltd. (TWSE:6655) announced strong profits, but the stock was stagnant. Our analysis suggests that shareholders have noticed something concerning in the numbers.

See our latest analysis for Keding Enterprises

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. In fact, Keding Enterprises increased the number of shares on issue by 11% over the last twelve months by issuing new shares. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Keding Enterprises' historical EPS growth by clicking on this link.

How Is Dilution Impacting Keding Enterprises' Earnings Per Share (EPS)?

Unfortunately, Keding Enterprises' profit is down 18% per year over three years. On the bright side, in the last twelve months it grew profit by 66%. On the other hand, earnings per share are only up 51% over the same period. So you can see that the dilution has had a bit of an impact on shareholders.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So Keding Enterprises shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Keding Enterprises.

Our Take On Keding Enterprises' Profit Performance

Keding Enterprises shareholders should keep in mind how many new shares it is issuing, because, dilution clearly has the power to severely impact shareholder returns. Because of this, we think that it may be that Keding Enterprises' statutory profits are better than its underlying earnings power. But at least holders can take some solace from the 51% EPS growth in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Be aware that Keding Enterprises is showing 3 warning signs in our investment analysis and 1 of those makes us a bit uncomfortable...

Today we've zoomed in on a single data point to better understand the nature of Keding Enterprises' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Keding Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6655

Keding Enterprises

Manufactures, sells, and trades in prefinished veneered panels, eco panels, wooden flooring, and other wooden products in Taiwan.

Low risk unattractive dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026