- Taiwan

- /

- Paper and Forestry Products

- /

- TWSE:6655

Do These 3 Checks Before Buying Keding Enterprises Co., Ltd. (TWSE:6655) For Its Upcoming Dividend

Readers hoping to buy Keding Enterprises Co., Ltd. (TWSE:6655) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. This means that investors who purchase Keding Enterprises' shares on or after the 24th of September will not receive the dividend, which will be paid on the 21st of October.

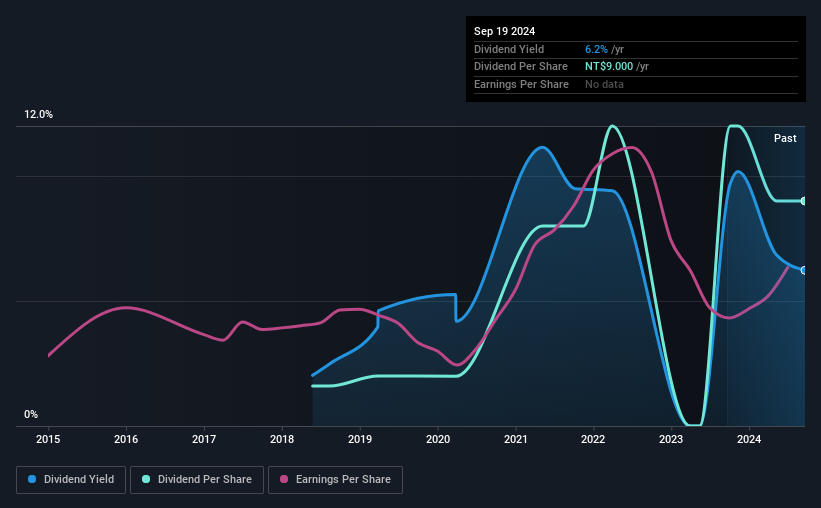

The company's upcoming dividend is NT$9.00 a share, following on from the last 12 months, when the company distributed a total of NT$9.00 per share to shareholders. Looking at the last 12 months of distributions, Keding Enterprises has a trailing yield of approximately 6.2% on its current stock price of NT$144.50. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Keding Enterprises can afford its dividend, and if the dividend could grow.

See our latest analysis for Keding Enterprises

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Keding Enterprises paid out more than half (63%) of its earnings last year, which is a regular payout ratio for most companies. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Keding Enterprises paid out more free cash flow than it generated - 199%, to be precise - last year, which we think is concerningly high. We're curious about why the company paid out more cash than it generated last year, since this can be one of the early signs that a dividend may be unsustainable.

While Keding Enterprises's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Were this to happen repeatedly, this would be a risk to Keding Enterprises's ability to maintain its dividend.

Click here to see how much of its profit Keding Enterprises paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. This is why it's a relief to see Keding Enterprises earnings per share are up 5.5% per annum over the last five years. Earnings have been growing at a steady rate, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Keding Enterprises has delivered an average of 33% per year annual increase in its dividend, based on the past six years of dividend payments. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

Final Takeaway

Has Keding Enterprises got what it takes to maintain its dividend payments? Earnings per share have grown somewhat, although Keding Enterprises paid out over half its profits and the dividend was not well covered by free cash flow. Bottom line: Keding Enterprises has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

So if you're still interested in Keding Enterprises despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. We've identified 3 warning signs with Keding Enterprises (at least 1 which is a bit unpleasant), and understanding these should be part of your investment process.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Keding Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6655

Keding Enterprises

Manufactures, sells, and trades in prefinished veneered panels, eco panels, wooden flooring, and other wooden products in Taiwan.

Second-rate dividend payer with low risk.

Market Insights

Community Narratives