As global trade tensions show signs of easing, Asian markets have been buoyed by optimism and strategic economic measures, with key indices in China and Japan experiencing gains. In this dynamic environment, dividend stocks can offer a stable income stream, making them an attractive option for investors seeking to enhance their portfolios amidst shifting market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.89% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.60% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.20% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.89% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.53% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.41% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.98% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.14% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.50% | ★★★★★★ |

Click here to see the full list of 1193 stocks from our Top Asian Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

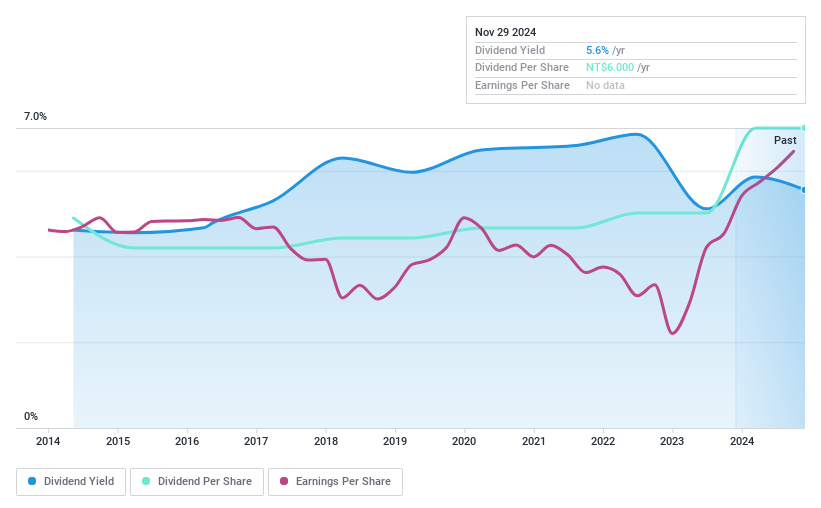

Formosa Optical TechnologyLtd (TPEX:5312)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Formosa Optical Technology Co., Ltd. operates in Taiwan, offering eyecare products, with a market cap of NT$8.23 billion.

Operations: Formosa Optical Technology Co., Ltd.'s revenue is primarily derived from its Bio Division, which contributes NT$918.70 million, and its Bio Technology segment, generating NT$2.91 billion.

Dividend Yield: 5.5%

Formosa Optical Technology Ltd. offers a dividend yield of 5.47%, placing it in the top 25% of dividend payers in Taiwan, though its high payout ratio of 91% indicates dividends are not well covered by earnings. Despite this, dividends have been stable and growing over the past decade. Recent financial results show robust sales growth to TWD 3.97 billion and an increase in net income to TWD 494.81 million, supporting future dividend sustainability concerns amidst recent earnings improvements.

- Click here to discover the nuances of Formosa Optical TechnologyLtd with our detailed analytical dividend report.

- According our valuation report, there's an indication that Formosa Optical TechnologyLtd's share price might be on the expensive side.

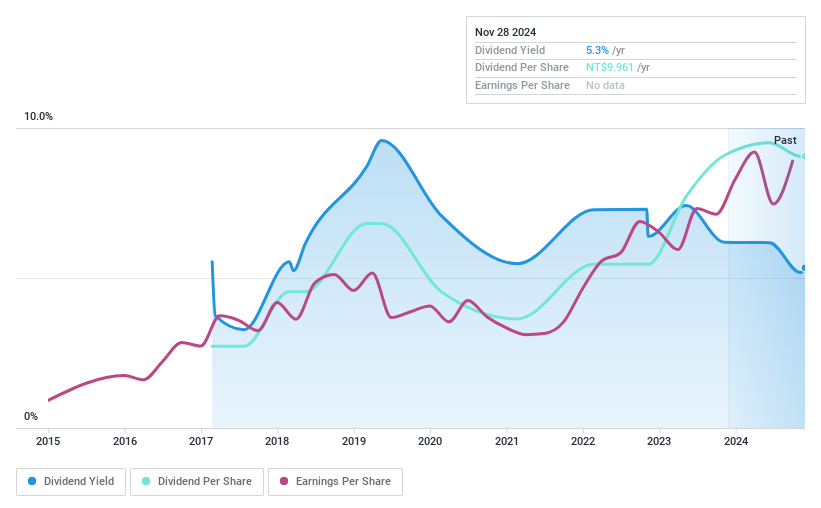

Nova Technology (TPEX:6613)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nova Technology Corporation offers services to semiconductor, photonics, solar energy, biotech, pharmaceutical, and chemical industrial manufacturers across Taiwan, China, and internationally with a market cap of NT$13.54 billion.

Operations: Nova Technology Corporation generates revenue of NT$6.72 billion from China and NT$4.02 billion from Taiwan, serving various industrial manufacturers.

Dividend Yield: 6.8%

Nova Technology Corporation's dividend yield of 6.84% ranks it among the top 25% in Taiwan, supported by a payout ratio of 69.6%, indicating dividends are covered by earnings. Despite recent profit growth and solid cash flow coverage at a 50.3% cash payout ratio, its dividend history is unstable with volatility over the past eight years. The company announced a TWD 9 per share dividend for the second half of 2024, totaling TWD 700 million in distributions.

- Dive into the specifics of Nova Technology here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Nova Technology is trading behind its estimated value.

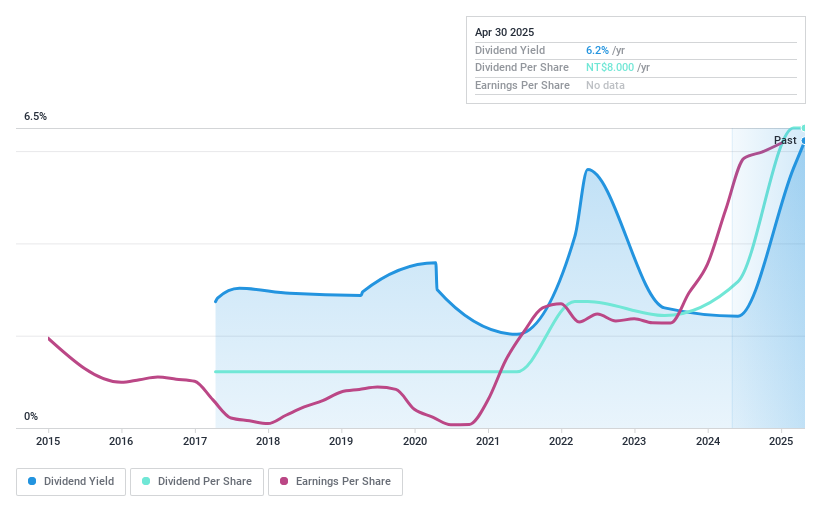

DingZing Advanced Materials (TWSE:6585)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DingZing Advanced Materials Inc. is involved in the research, development, production, and sale of composite materials and technical films for various industries in Taiwan with a market cap of NT$9.32 billion.

Operations: DingZing Advanced Materials Inc. generates revenue primarily from its Specialty Chemicals segment, which accounts for NT$3.28 billion.

Dividend Yield: 6.1%

DingZing Advanced Materials offers a dividend yield of 6.13%, placing it in the top 25% of Taiwan's market, with dividends covered by earnings and cash flows at a payout ratio of 76.6%. Despite only eight years of dividend history, payments have been stable and growing. Recent financial results show strong performance with net income rising to TWD 738.25 million for 2024, prompting a proposed cash dividend distribution totaling TWD 571.61 million or TWD 8 per share.

- Delve into the full analysis dividend report here for a deeper understanding of DingZing Advanced Materials.

- Our expertly prepared valuation report DingZing Advanced Materials implies its share price may be lower than expected.

Where To Now?

- Click through to start exploring the rest of the 1190 Top Asian Dividend Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nova Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6613

Nova Technology

Provides services for semiconductor plants, photonics plants, solar energy, biotech, pharmaceutical, and chemical industrial manufacturers in Taiwan, China, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives