In a week marked by geopolitical tensions and consumer spending concerns, major U.S. indices saw declines, with the S&P 500 experiencing sharp losses that erased early gains. As broader market sentiment remains cautious amid tariff fears and economic uncertainty, small-cap stocks often present unique opportunities for investors seeking growth potential in less crowded spaces. In the current environment, a promising small-cap stock is typically characterized by strong fundamentals, innovative business models, or niche market positions that may allow it to thrive despite broader economic headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Quemchi | 0.66% | 82.67% | 21.69% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| Sociedad Matriz SAAM | 38.79% | -0.59% | -19.23% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Shandong Jincheng Pharmaceutical Group (SZSE:300233)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shandong Jincheng Pharmaceutical Group Co., Ltd focuses on the research, development, production, marketing, and sale of Cephalosporin intermediates both in China and internationally with a market cap of CN¥5.06 billion.

Operations: The company generates revenue primarily from the production and sale of Cephalosporin intermediates. It operates in both domestic and international markets, leveraging its expertise in pharmaceutical development.

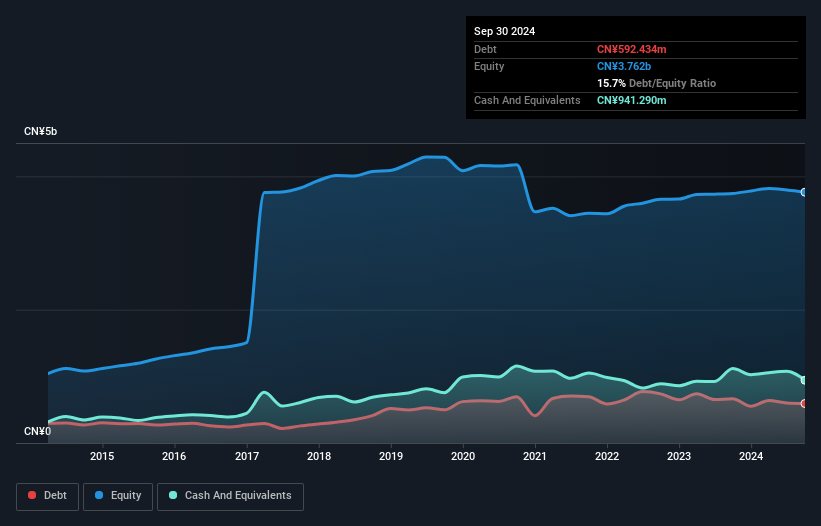

Shandong Jincheng Pharmaceutical Group, a small player in the pharmaceuticals industry, has shown impressive earnings growth of 31.1% over the past year, outpacing the industry's -2.5%. With a price-to-earnings ratio of 26.2x, it stands as a good value compared to the broader Chinese market's 38.1x. The company’s debt-to-equity ratio has risen from 11.6% to 15.7% over five years but remains manageable with interest payments well-covered at 54 times by EBIT. Recent announcements include special dividends of CNY 1.50 per ten shares for shareholders, reflecting its ongoing profitability and cash flow strength.

- Click here and access our complete health analysis report to understand the dynamics of Shandong Jincheng Pharmaceutical Group.

Understand Shandong Jincheng Pharmaceutical Group's track record by examining our Past report.

Chengdu Yunda Technology (SZSE:300440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Chengdu Yunda Technology Co., Ltd. focuses on the research, development, production, and sale of rail transit intelligent systems and solutions in China with a market capitalization of approximately CN¥3.59 billion.

Operations: Chengdu Yunda Technology generates revenue primarily from its Software and Information Technical Service segment, which accounts for CN¥1.10 billion. The company's market capitalization is approximately CN¥3.59 billion.

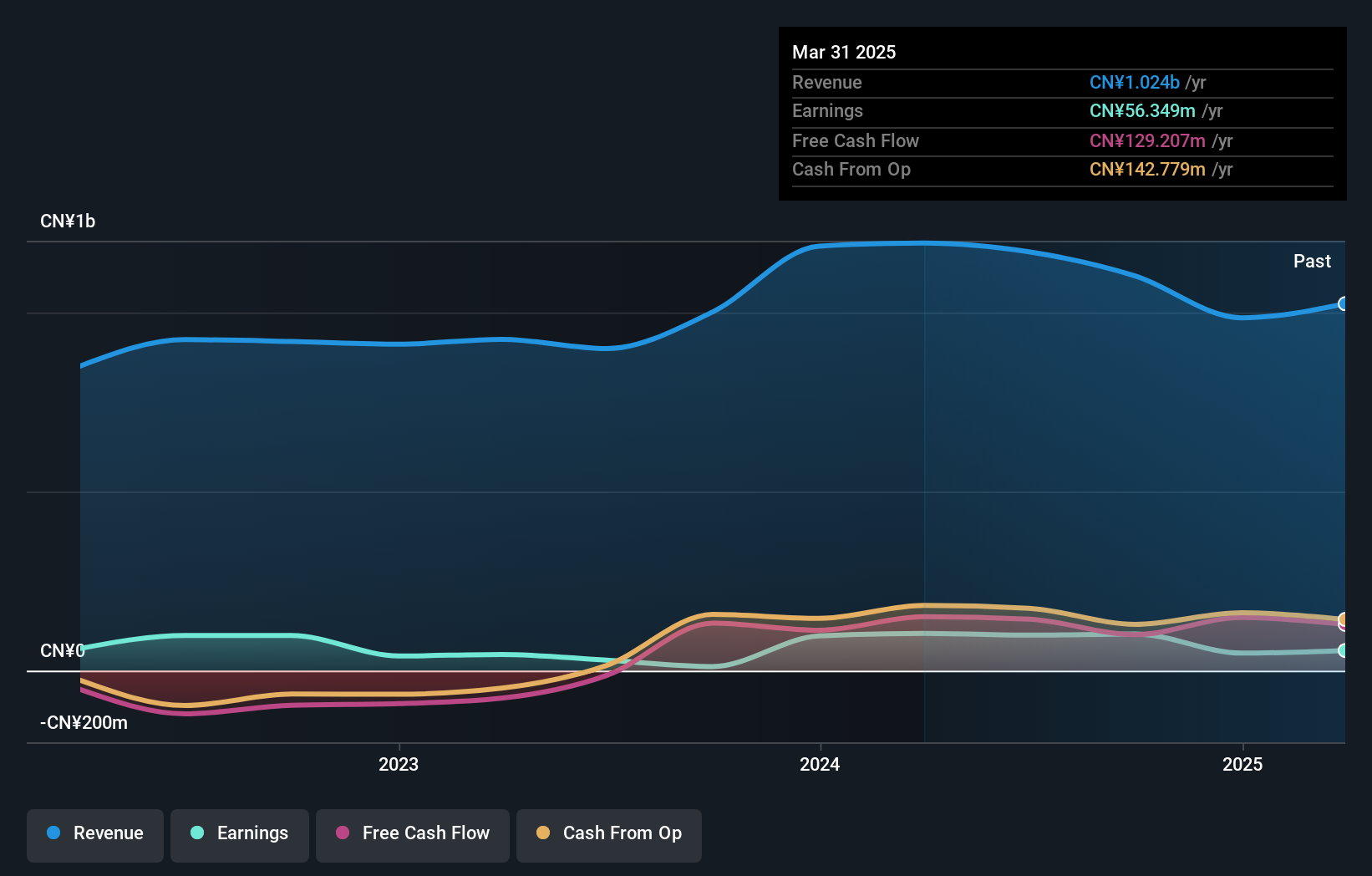

Chengdu Yunda Technology, a smaller player in the tech sector, has shown remarkable earnings growth of 808.4% over the past year, outpacing the electronic industry's modest 1.6%. This surge is partly due to a significant one-off gain of CN¥39.2M impacting recent results as of September 2024. Despite this boost, its earnings have dipped by an average of 15.7% annually over five years, suggesting volatility in performance. The company's price-to-earnings ratio stands at 35.1x, undercutting the broader CN market's average of 38.1x and indicating potential value for investors seeking opportunities within this dynamic industry landscape.

Taiwan Steel Union (TWSE:6581)

Simply Wall St Value Rating: ★★★★★★

Overview: Taiwan Steel Union Co., Ltd. focuses on the manufacturing and trading of zinc oxide and non-metallic mineral products in Taiwan, with a market capitalization of approximately NT$12.74 billion.

Operations: The company's primary revenue stream comes from its own operations, generating NT$1.88 billion, while Taiwan Steel Resources Co., Ltd. contributes NT$551.02 million.

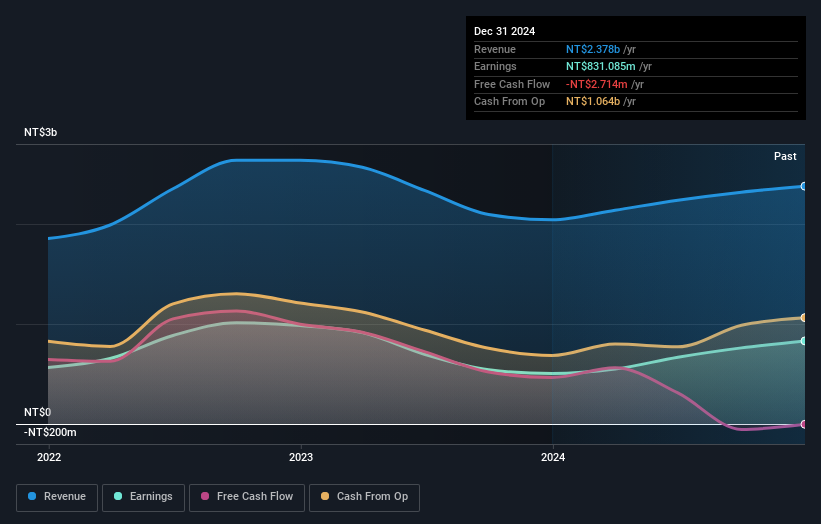

Taiwan Steel Union, a smaller player in the steel industry, has shown impressive growth with earnings jumping 40.4% over the past year, outpacing the Chemicals sector's 13.7%. Their net income soared to TWD 831.09 million from TWD 504.62 million last year, reflecting strong operational performance. The company's price-to-earnings ratio stands at a favorable 16.7x compared to the TW market's 21.9x, suggesting it might be undervalued relative to peers. Despite not being free cash flow positive recently, their net debt to equity ratio is a satisfactory 1.6%, indicating sound financial health and potential for future stability in dividends and operations.

- Click to explore a detailed breakdown of our findings in Taiwan Steel Union's health report.

Assess Taiwan Steel Union's past performance with our detailed historical performance reports.

Key Takeaways

- Investigate our full lineup of 4750 Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300233

Shandong Jincheng Pharmaceutical Group

Researches and develops, produces, markets, and sells Cephalosporin intermediates in China and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives