- Japan

- /

- Commercial Services

- /

- TSE:2353

3 Dividend Stocks Yielding Between 3% And 5.3%

Reviewed by Simply Wall St

In a turbulent week for global markets, the S&P 500 Index experienced its steepest decline in 18 months amid concerns over an economic slowdown and seasonal trading patterns. Defensive sectors like utilities and consumer staples fared better, highlighting the importance of stability during uncertain times. In this context, dividend stocks yielding between 3% and 5.3% can offer a compelling combination of income and resilience.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Globeride (TSE:7990) | 4.38% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.26% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.93% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.35% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.90% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.01% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.91% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★☆ |

Click here to see the full list of 2123 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

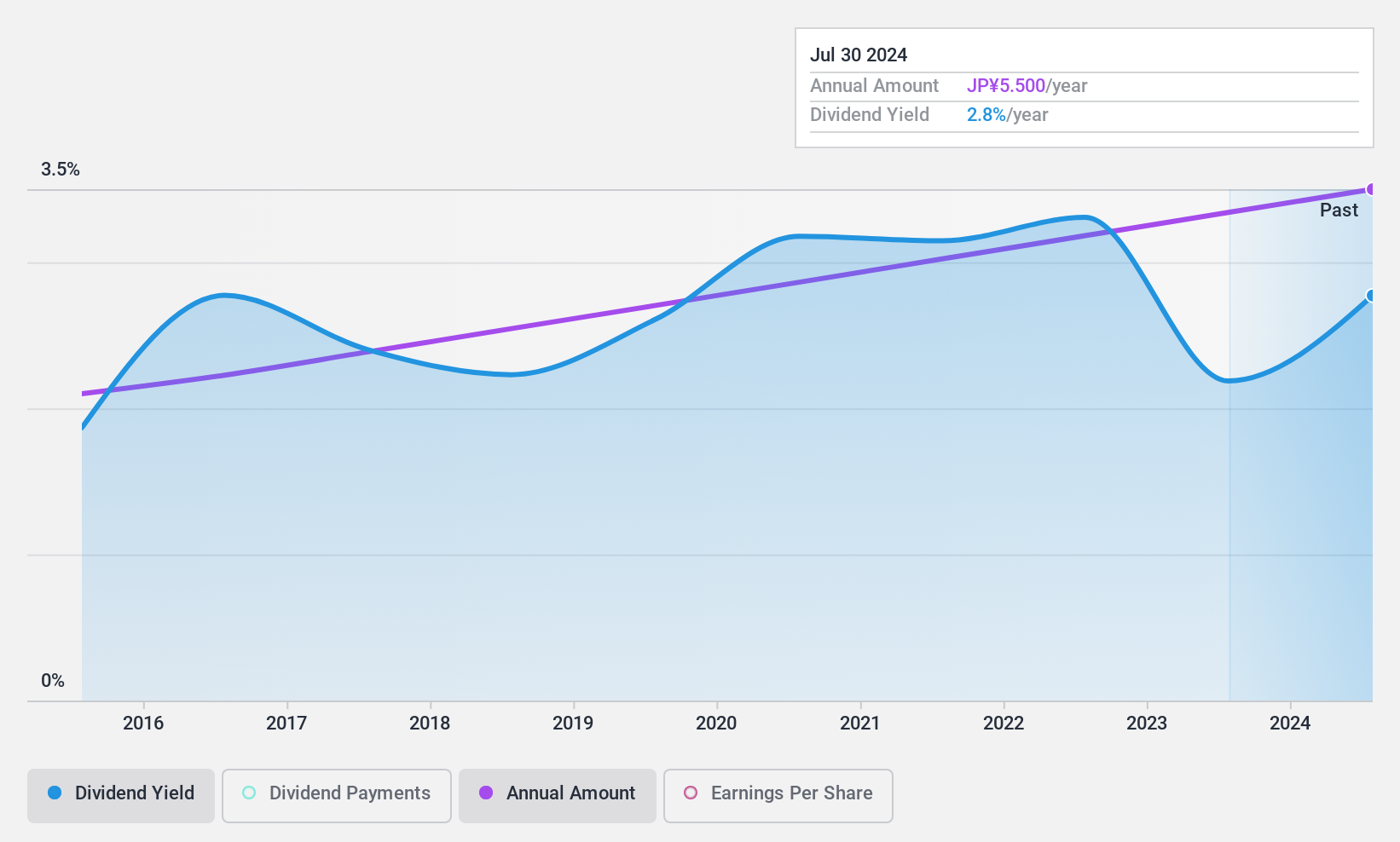

NIPPON PARKING DEVELOPMENTLtd (TSE:2353)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NIPPON PARKING DEVELOPMENT Co., Ltd. offers consulting services for parking lots in Japan and internationally, with a market cap of ¥70.20 billion.

Operations: NIPPON PARKING DEVELOPMENT Co., Ltd. generates revenue through its consulting services for parking facilities both domestically and abroad.

Dividend Yield: 3%

NIPPON PARKING DEVELOPMENT Ltd. has a stable and reliable dividend history, with payments growing over the past 10 years. However, its current dividend yield of 3% is lower than the top quartile of JP market payers (3.87%). Despite a low payout ratio of 38.3%, indicating earnings coverage, the high cash payout ratio (342.6%) raises concerns about sustainability from free cash flows. Recent earnings growth of 15.8% adds some positive context ahead of their fiscal year results on Sep 06, 2024.

- Get an in-depth perspective on NIPPON PARKING DEVELOPMENTLtd's performance by reading our dividend report here.

- According our valuation report, there's an indication that NIPPON PARKING DEVELOPMENTLtd's share price might be on the expensive side.

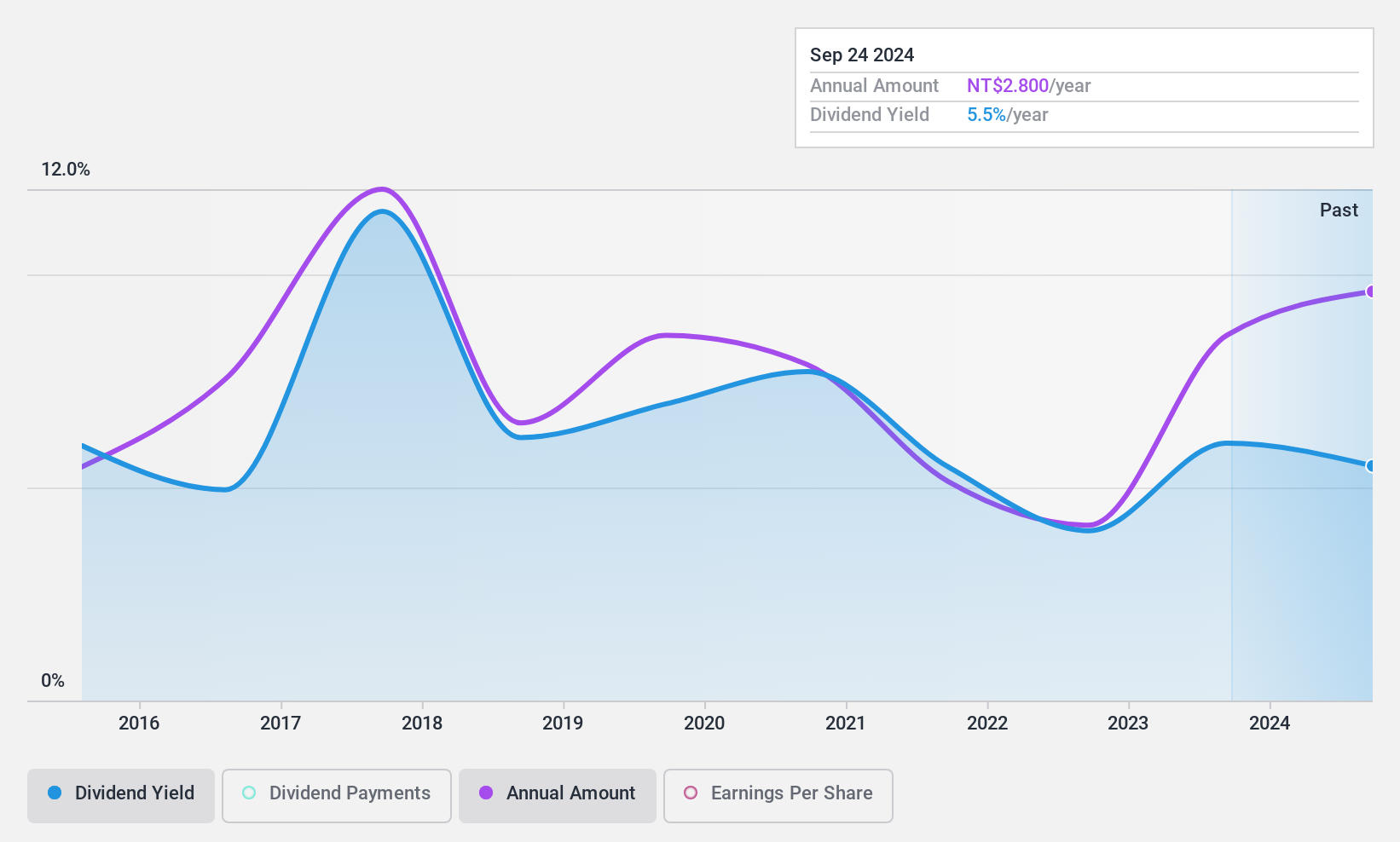

Hanpin Electron (TWSE:2488)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hanpin Electron Co., Ltd. designs, manufactures, and sells electronic consumer products, professional audio products, and professional DJ equipment in Taiwan, China, Hong Kong, and Singapore with a market cap of NT$4.21 billion.

Operations: Hanpin Electron Co., Ltd.'s revenue from the Audio Department is NT$2.63 billion.

Dividend Yield: 5.3%

Hanpin Electron's dividend payments have been volatile over the past 10 years, despite a recent increase approved in June 2024. Trading at 49.3% below estimated fair value, its dividends are well-covered by earnings (56.8%) and cash flows (37.1%). Earnings growth of 10.1% annually over the past five years supports future payouts, but the unstable dividend history warrants caution for income-focused investors ahead of Q2 results on Aug 05, 2024.

- Dive into the specifics of Hanpin Electron here with our thorough dividend report.

- Our valuation report here indicates Hanpin Electron may be undervalued.

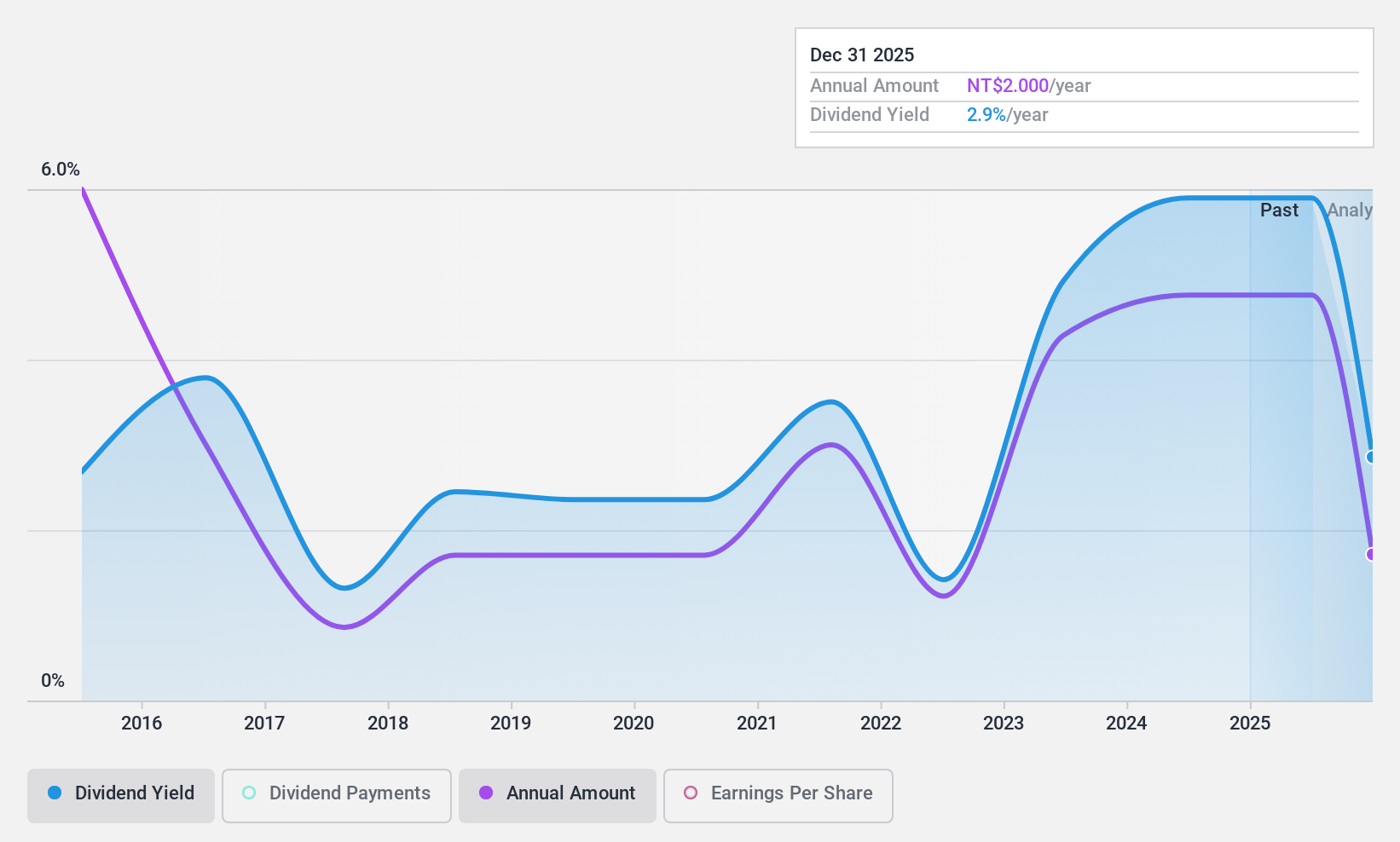

Swancor Holding (TWSE:3708)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swancor Holding Co., LTD. manufactures and trades chemical materials in Taiwan and internationally, with a market cap of NT$12.27 billion.

Operations: Swancor Holding Co., LTD. generates revenue primarily from its Composite Material Department, which accounts for NT$7.54 billion.

Dividend Yield: 4.7%

Swancor Holding's dividend yield (4.74%) ranks in the top 25% of TW market payers, but its sustainability is concerning with a high cash payout ratio (91.1%). Recent earnings showed a significant drop, with Q2 net income falling to TWD 78.23 million from TWD 692.6 million year-on-year. The company announced a share repurchase program worth TWD 5,432.37 million and affirmed dividends for H1 2024 despite volatile past payments and diluted shares over the last year.

- Click here to discover the nuances of Swancor Holding with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Swancor Holding shares in the market.

Seize The Opportunity

- Unlock our comprehensive list of 2123 Top Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIPPON PARKING DEVELOPMENTLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2353

NIPPON PARKING DEVELOPMENTLtd

Provides consulting services for parking lot in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.