- Taiwan

- /

- Basic Materials

- /

- TWSE:2504

Undiscovered Gems in Asia for June 2025

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by cooling labor conditions and ongoing trade tensions, small-cap stocks have shown resilience, with indices like the Russell 2000 experiencing notable gains. Against this backdrop, the Asian market presents intriguing opportunities for investors seeking to uncover lesser-known companies that could benefit from regional economic dynamics and potential stimulus measures. Identifying promising stocks often involves looking for companies with strong fundamentals that can thrive despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hangzhou Xili Intelligent TechnologyLtd | NA | 11.73% | 9.57% | ★★★★★★ |

| Wuxi Xinan Technology | NA | 11.99% | 4.45% | ★★★★★★ |

| Hubei Three Gorges Tourism Group | 11.24% | -15.32% | 17.90% | ★★★★★★ |

| Shanghai Guangdian Electric Group | 0.37% | -2.33% | -33.49% | ★★★★★★ |

| Tohoku Steel | NA | 5.34% | -2.26% | ★★★★★★ |

| Zhe Jiang Dayang Biotech Group | 29.02% | 8.38% | -9.33% | ★★★★★☆ |

| ShenZhen QiangRui Precision Technology | 18.68% | 41.36% | 14.12% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 13.81% | -0.34% | -27.47% | ★★★★★☆ |

| Hangzhou Zhengqiang | 26.03% | 2.95% | 16.75% | ★★★★★☆ |

| Yukiguni Factory | 134.59% | -5.63% | -32.04% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Ningbo Lehui International Engineering EquipmentLtd (SHSE:603076)

Simply Wall St Value Rating: ★★★★☆☆

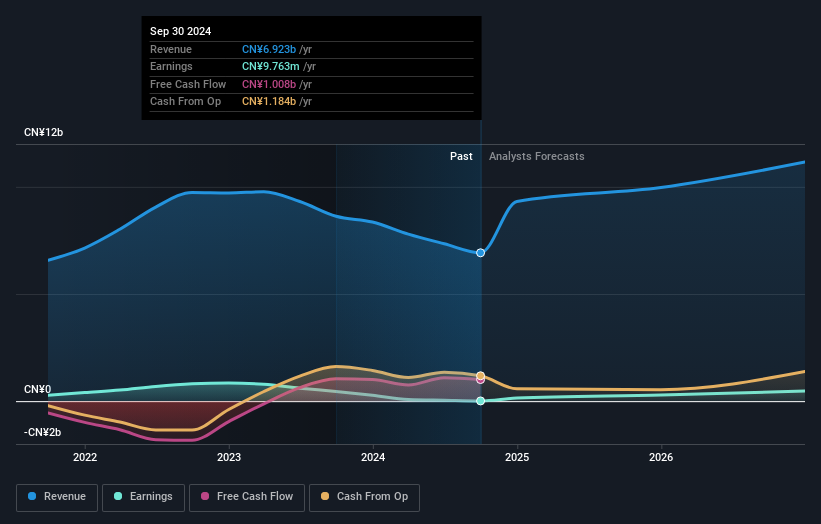

Overview: Ningbo Lehui International Engineering Equipment Co., Ltd. operates in the engineering equipment sector and has a market cap of CN¥4.80 billion.

Operations: The company generates revenue primarily from its engineering equipment segment. It has a market capitalization of CN¥4.80 billion, reflecting its valuation in the industry. The focus on this specific sector suggests targeted revenue streams aligned with engineering solutions.

Ningbo Lehui, a notable player in the machinery sector, has seen its earnings grow by 64.9% over the past year, outpacing industry averages. Despite a volatile share price recently, it remains an attractive prospect as it's trading at 88.8% below estimated fair value. The company's net debt to equity ratio stands at a satisfactory 3.1%, though interest coverage is weak with EBIT covering only 1.8 times interest payments. Recent financials reveal net income of CNY 8.94 million for Q1 2025 and an annual dividend increase to CNY 0.40 per share, reflecting strong profitability and shareholder returns.

Beijing Zhong Ke San Huan High-Tech (SZSE:000970)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing Zhong Ke San Huan High-Tech Co., Ltd. operates in the high-tech industry and has a market capitalization of CN¥14.19 billion.

Operations: Beijing Zhong Ke San Huan High-Tech generates revenue primarily through its operations in the high-tech sector, with a market capitalization of CN¥14.19 billion.

Zhong Ke San Huan, a relatively small player in the tech industry, has shown a mixed financial performance. Over the past year, earnings surged by 64.7%, outpacing the electronic industry's growth of 2.7%. Despite this impressive growth, recent figures reveal challenges; Q1 2025 sales dropped to CNY 1.46 billion from CNY 1.65 billion a year earlier, though net income turned positive at CNY 13.49 million compared to a loss previously reported. The company trades at an attractive valuation—43% below its estimated fair value—and maintains more cash than total debt despite a rising debt-to-equity ratio now at 12.4%.

- Click to explore a detailed breakdown of our findings in Beijing Zhong Ke San Huan High-Tech's health report.

Understand Beijing Zhong Ke San Huan High-Tech's track record by examining our Past report.

Goldsun Building Materials (TWSE:2504)

Simply Wall St Value Rating: ★★★★★★

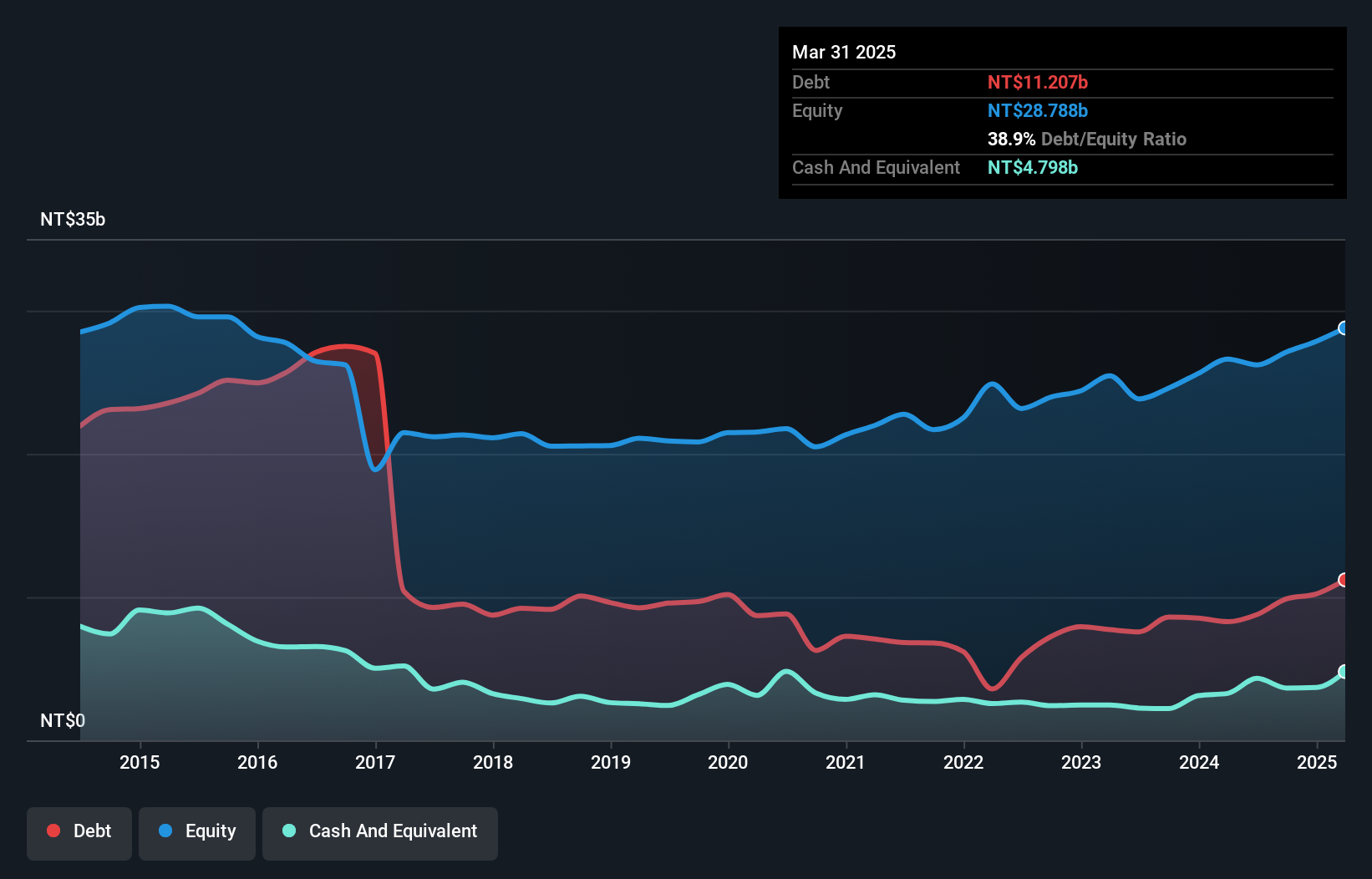

Overview: Goldsun Building Materials Co., Ltd. operates in the production and sale of premixed concrete, cement, and calcium silicate board across Taiwan and Mainland China, with a market capitalization of approximately NT$53.55 billion.

Operations: Goldsun's primary revenue streams are derived from its Taiwan ready-mixed business, generating NT$18.89 billion, and its ready-mixed cement business in Mainland China, contributing NT$1.09 billion.

Goldsun Building Materials, a promising player in the industry, has seen its earnings grow by 31.1% over the past year, outpacing the Basic Materials sector's 15.6%. The company's net debt to equity ratio is at a satisfactory 22.3%, reflecting prudent financial management as it decreased from 40.4% over five years. Despite a notable one-off gain of NT$930 million impacting recent results, Goldsun's Price-To-Earnings ratio of 11.6x remains attractive compared to Taiwan's market average of 18.5x. However, future earnings are projected to decline by an average of 16% annually for the next three years, which may temper investor enthusiasm despite recent dividend increases approved for TWD 2.8 per share.

- Unlock comprehensive insights into our analysis of Goldsun Building Materials stock in this health report.

Learn about Goldsun Building Materials' historical performance.

Next Steps

- Click this link to deep-dive into the 2608 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2504

Goldsun Building Materials

Engages in the production and sale of premixed concrete, cement, and calcium silicate board in Taiwan and Mainland China.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.