- Taiwan

- /

- Basic Materials

- /

- TWSE:2504

Exploring Three Undiscovered Gems in Asia with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and mixed economic indicators, small-cap stocks have shown resilience, with indices like the S&P MidCap 400 and Russell 2000 advancing for several weeks. In this context, identifying promising opportunities in Asian markets requires a keen eye for companies that demonstrate strong fundamentals and the ability to adapt to fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hangzhou Biotest BiotechLtd | 0.04% | -64.70% | -41.68% | ★★★★★★ |

| Center International GroupLtd | 18.73% | 1.34% | -36.04% | ★★★★★★ |

| HeBei Jinniu Chemical IndustryLtd | NA | -1.52% | 14.74% | ★★★★★★ |

| Tibet Development | 0.69% | -0.88% | 53.81% | ★★★★★★ |

| Shenzhen Keanda Electronic Technology | 3.64% | -5.89% | -13.61% | ★★★★★☆ |

| Beijing Bashi Media | 72.78% | -1.47% | -15.16% | ★★★★★☆ |

| Hunan Investment GroupLtd | 7.39% | 30.03% | 18.30% | ★★★★★☆ |

| Ningbo Kangqiang Electronics | 43.28% | 3.45% | -5.24% | ★★★★★☆ |

| Suzhou Sepax Technologies | 4.44% | 21.44% | 34.83% | ★★★★★☆ |

| Xinya Electronic | 60.42% | 30.49% | 3.46% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Guangdong Huicheng Vacuum Technology (SZSE:301392)

Simply Wall St Value Rating: ★★★★★☆

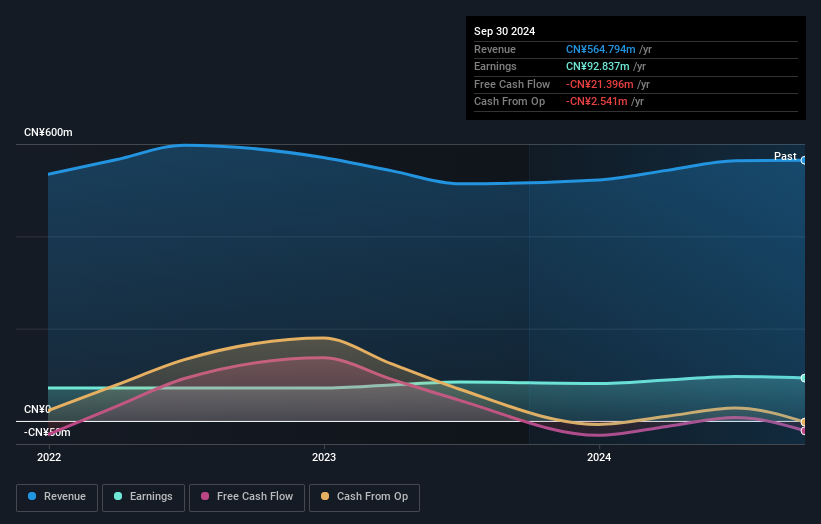

Overview: Guangdong Huicheng Vacuum Technology Co., Ltd. specializes in the development and manufacturing of vacuum technology equipment, with a market capitalization of CN¥12.49 billion.

Operations: Huicheng Vacuum Technology generates revenue primarily from its Machinery & Industrial Equipment segment, which reported CN¥564.79 million. The company's financial performance is highlighted by a notable trend in its gross profit margin.

Huicheng Vacuum Technology, a nimble player in the machinery sector, reported first-quarter 2025 sales of CNY 97.39 million, up from CNY 71.7 million the previous year, despite net income slipping to CNY 8.32 million from CNY 10.12 million. The company’s debt-to-equity ratio improved over five years from 8.3 to 6.8 and interest payments are well-covered with EBIT at a robust 24.9 times coverage, indicating financial resilience amidst volatility in share prices recently observed over three months as earnings growth outpaced industry averages by a significant margin last year at 12.4%.

Dynapack International Technology (TPEX:3211)

Simply Wall St Value Rating: ★★★★★★

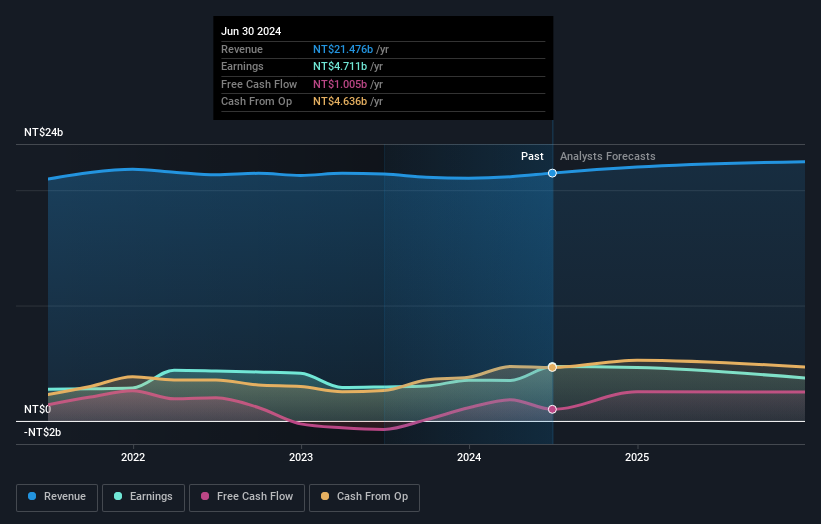

Overview: Dynapack International Technology Corporation manufactures and sells lithium-ion battery packs across Taiwan, the United States, and internationally, with a market cap of NT$28.30 billion.

Operations: The company's revenue primarily stems from the sale of lithium-ion battery packs. It has a market cap of NT$28.30 billion, reflecting its significant presence in the industry.

Dynapack International Technology, a nimble player in Asia's electronics sector, has shown impressive financial resilience. Despite a dip in Q1 2025 sales to TWD 2.36 billion from TWD 3.43 billion the previous year, it maintained net income at TWD 163 million. The company's earnings surged by nearly triple digits last year, outpacing the industry growth of 23.9%. With a price-to-earnings ratio of just 10.8x compared to the market's 18.2x and reduced debt-to-equity from 71% to under 14% over five years, Dynapack presents an intriguing investment profile amid its high volatility and robust cash flow generation capabilities.

Goldsun Building Materials (TWSE:2504)

Simply Wall St Value Rating: ★★★★★★

Overview: Goldsun Building Materials Co., Ltd. operates in the production and sale of premixed concrete, cement, and calcium silicate board across Taiwan and Mainland China, with a market cap of NT$50.14 billion.

Operations: The company's primary revenue streams are the Taiwan ready-mixed business, generating NT$18.77 billion, and the Mainland China ready-mixed cement business, contributing NT$1.03 billion.

Goldsun Building Materials, a smaller player in the market, showcases a solid performance with net income rising to TWD 4.59 billion from TWD 3.53 billion last year, reflecting an earnings per share increase to TWD 3.9 from TWD 3. Despite this growth, future earnings are expected to decrease by an average of 14.6% annually over the next three years. The company's debt-to-equity ratio improved from 47.4% to 36.7% over five years, indicating prudent financial management while maintaining a satisfactory net debt-to-equity ratio of 23.4%. A recent dividend hike further highlights its commitment to shareholder returns with a payout of TWD 2.8 per share.

- Get an in-depth perspective on Goldsun Building Materials' performance by reading our health report here.

Learn about Goldsun Building Materials' historical performance.

Key Takeaways

- Click here to access our complete index of 2702 Asian Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2504

Goldsun Building Materials

Engages in the production and sale of premixed concrete, cement, and calcium silicate board in Taiwan and Mainland China.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives