- Taiwan

- /

- Metals and Mining

- /

- TWSE:2027

Ta Chen Stainless Pipe Co., Ltd.'s (TWSE:2027) Subdued P/E Might Signal An Opportunity

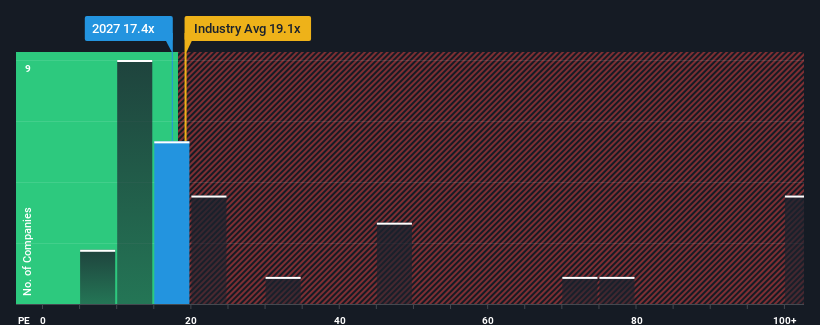

Ta Chen Stainless Pipe Co., Ltd.'s (TWSE:2027) price-to-earnings (or "P/E") ratio of 17.4x might make it look like a buy right now compared to the market in Taiwan, where around half of the companies have P/E ratios above 24x and even P/E's above 41x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Ta Chen Stainless Pipe has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Ta Chen Stainless Pipe

Is There Any Growth For Ta Chen Stainless Pipe?

The only time you'd be truly comfortable seeing a P/E as low as Ta Chen Stainless Pipe's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 54% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 230% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 30% as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 24% growth forecast for the broader market.

In light of this, it's peculiar that Ta Chen Stainless Pipe's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Ta Chen Stainless Pipe's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Ta Chen Stainless Pipe's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Ta Chen Stainless Pipe.

Of course, you might also be able to find a better stock than Ta Chen Stainless Pipe. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Ta Chen Stainless Pipe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2027

Ta Chen Stainless Pipe

Manufactures, processes, and sells stainless steel pipes, plates, and fittings, and venetian blinds in Taiwan, the United States, China, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026