- Taiwan

- /

- Metals and Mining

- /

- TWSE:2027

Discover 3 Insider-Favored Growth Stocks

Reviewed by Simply Wall St

As global markets navigate the evolving landscape of trade policies and AI-driven optimism, U.S. stocks are reaching record highs, with growth stocks outperforming value shares for the first time this year. In such an environment, insider ownership can be a compelling indicator of confidence in a company's future prospects, making it an essential factor to consider when evaluating potential growth investments.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 22.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| CD Projekt (WSE:CDR) | 29.7% | 34.6% |

| Waystream Holding (OM:WAYS) | 11.3% | 113.3% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

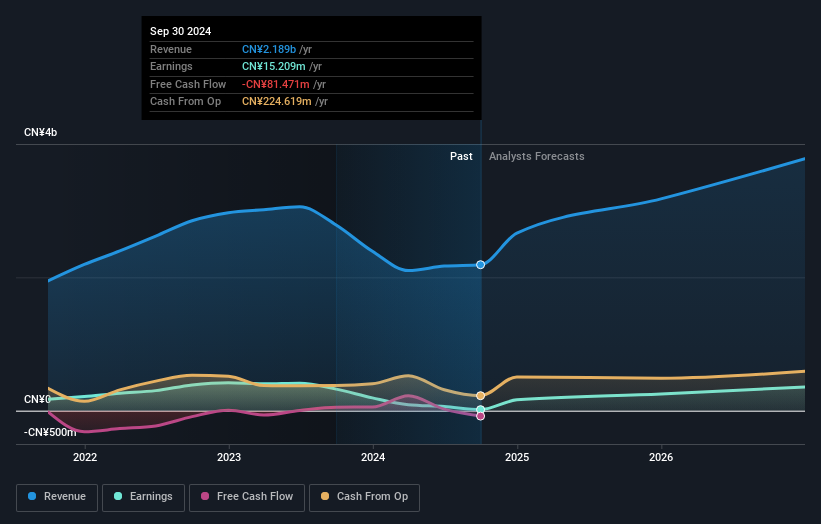

Jiangsu Flag Chemical Industry (SZSE:300575)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Flag Chemical Industry Co., Ltd. focuses on the research, development, production, and sale of green pesticides in China with a market cap of CN¥2.75 billion.

Operations: The company generates revenue from the research, development, production, and sale of environmentally friendly pesticides within China.

Insider Ownership: 36%

Earnings Growth Forecast: 67.6% p.a.

Jiangsu Flag Chemical Industry is poised for significant growth, with earnings expected to rise by 67.57% annually over the next three years, outpacing the broader CN market's forecast. Despite this positive outlook, profit margins have decreased from 11.6% to 0.7%, and its return on equity is projected to remain low at 13.8%. The company's revenue growth is also strong at 22.1% per year, surpassing market averages, although its dividend yield of 2.03% lacks coverage by earnings or free cash flows.

- Delve into the full analysis future growth report here for a deeper understanding of Jiangsu Flag Chemical Industry.

- According our valuation report, there's an indication that Jiangsu Flag Chemical Industry's share price might be on the expensive side.

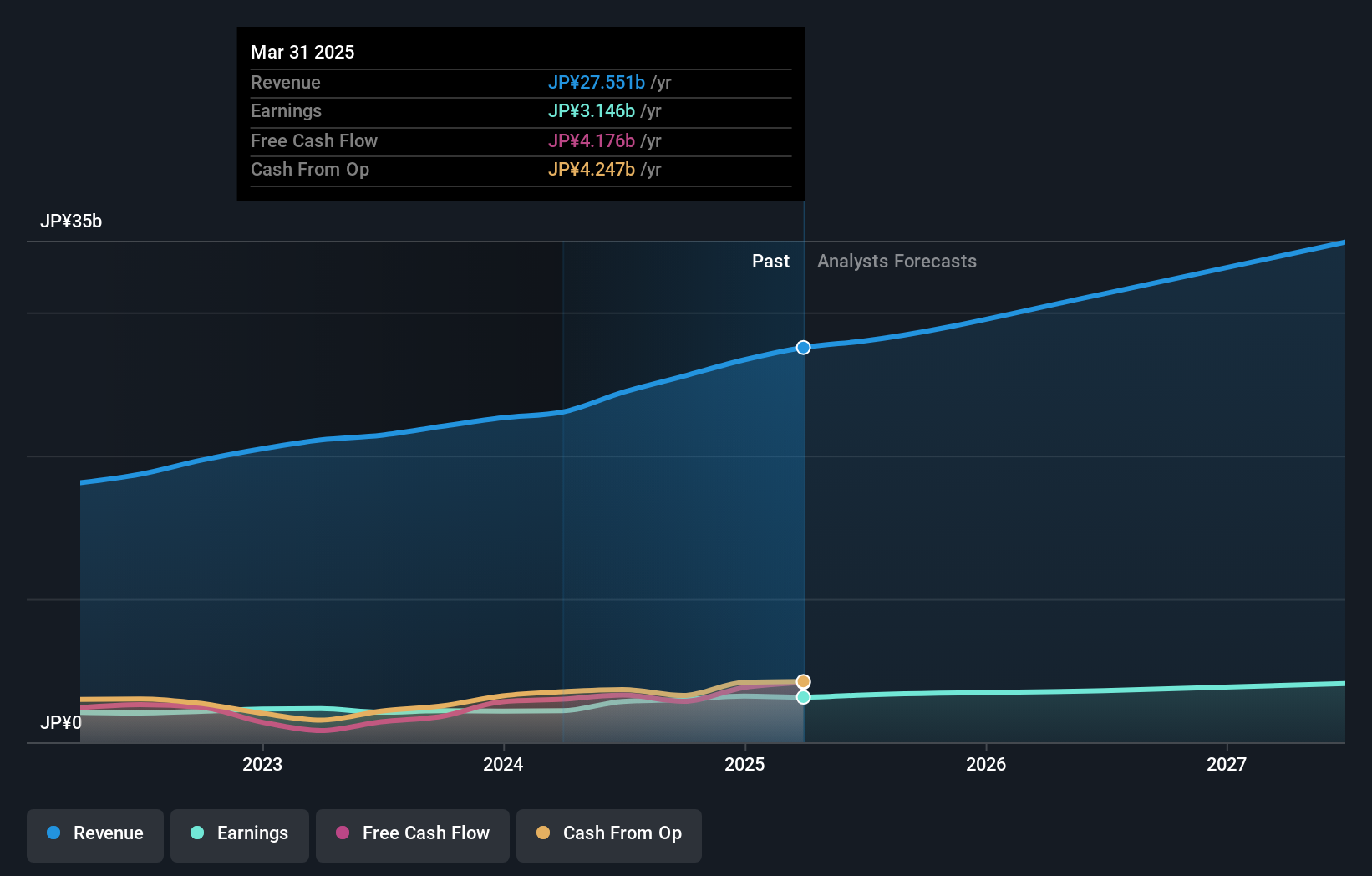

Avant Group (TSE:3836)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Avant Group Corporation, with a market cap of ¥70.72 billion, operates through its subsidiaries to offer accounting, business intelligence, and outsourcing services.

Operations: The company's revenue segments include ¥7.88 billion from the Group Governance Business, ¥8.96 billion from the Management Solutions Business, and ¥9.16 billion from the Digital Transformation Business.

Insider Ownership: 34%

Earnings Growth Forecast: 18.1% p.a.

Avant Group's earnings are projected to grow 18.1% annually, exceeding the JP market's average of 8.1%, while revenue is expected to increase by 15.8% per year, outpacing the market's 4.3%. Despite trading at a substantial discount to its estimated fair value and achieving a high forecasted return on equity of 24.9%, share price volatility remains a concern. The company recently completed a buyback of shares worth ¥828.93 million, representing 1.67% ownership under its announced plan.

- Click here to discover the nuances of Avant Group with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of Avant Group shares in the market.

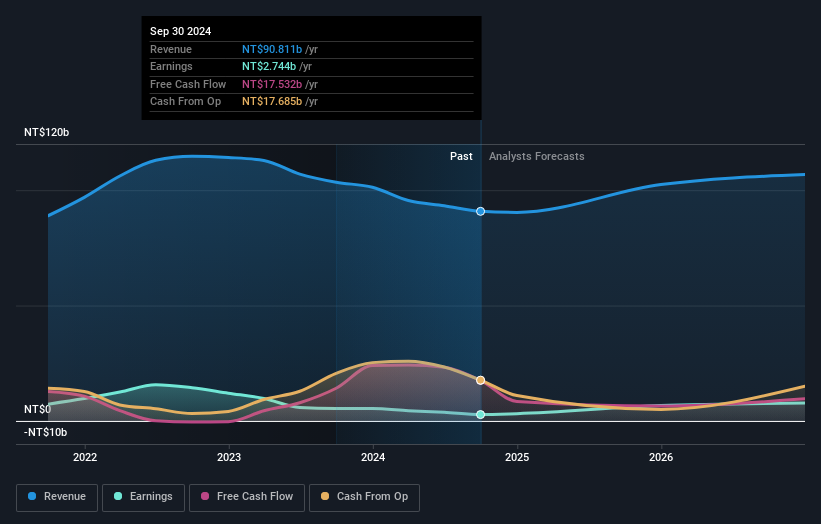

Ta Chen Stainless Pipe (TWSE:2027)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ta Chen Stainless Pipe Co., Ltd. operates in the manufacturing, processing, and sale of stainless steel pipes, plates, fittings, and venetian blinds across Taiwan, the United States, China, and internationally with a market cap of NT$73 billion.

Operations: Ta Chen Stainless Pipe Co., Ltd.'s revenue primarily comes from its Stainless Steel and Aluminum Products Department, generating NT$75.84 billion, followed by the Screws and Nuts Segment with NT$21.82 billion, and Aluminum Products Manufacturing contributing NT$21.68 billion.

Insider Ownership: 11.1%

Earnings Growth Forecast: 85.3% p.a.

Ta Chen Stainless Pipe's earnings are forecasted to grow significantly at 85.3% annually, surpassing the TW market average of 17.4%, while revenue is expected to increase by 14% per year, outpacing the market's 11.3%. Despite these growth prospects, profit margins have declined from last year and recent financial results show decreased sales and net income compared to a year ago. The dividend yield of 3.52% is not well covered by earnings, indicating potential sustainability issues.

- Click to explore a detailed breakdown of our findings in Ta Chen Stainless Pipe's earnings growth report.

- In light of our recent valuation report, it seems possible that Ta Chen Stainless Pipe is trading beyond its estimated value.

Make It Happen

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1468 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Ta Chen Stainless Pipe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2027

Ta Chen Stainless Pipe

Manufactures, processes, and sells stainless steel pipes, plates, and fittings, and venetian blinds in Taiwan, the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives