- Taiwan

- /

- Metals and Mining

- /

- TWSE:2014

Chung Hung Steel Corporation (TWSE:2014) Stock Rockets 25% But Many Are Still Ignoring The Company

Chung Hung Steel Corporation (TWSE:2014) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 2.5% isn't as impressive.

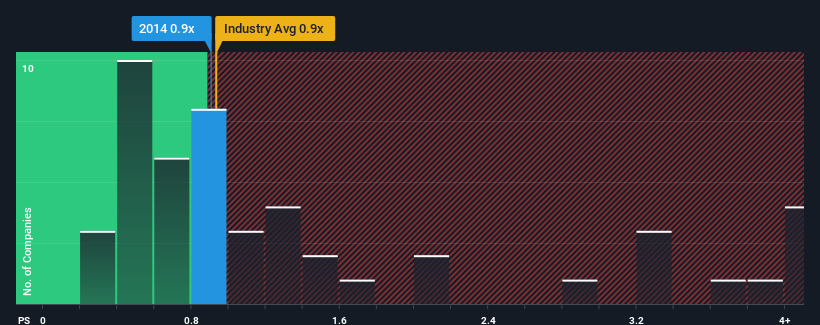

Even after such a large jump in price, there still wouldn't be many who think Chung Hung Steel's price-to-sales (or "P/S") ratio of 0.9x is worth a mention when it essentially matches the median P/S in Taiwan's Metals and Mining industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Chung Hung Steel

How Has Chung Hung Steel Performed Recently?

Recent revenue growth for Chung Hung Steel has been in line with the industry. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on Chung Hung Steel will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think Chung Hung Steel's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Chung Hung Steel's is when the company's growth is tracking the industry closely.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 17% decline in revenue over the last three years in total. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 10% during the coming year according to the dual analysts following the company. With the industry only predicted to deliver 3.6%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Chung Hung Steel is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Chung Hung Steel's P/S

Chung Hung Steel appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Chung Hung Steel's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You always need to take note of risks, for example - Chung Hung Steel has 1 warning sign we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2014

Chung Hung Steel

Manufactures, process, and sells steel products in Taiwan.

Imperfect balance sheet and overvalued.

Market Insights

Community Narratives