- Taiwan

- /

- Metals and Mining

- /

- TWSE:2014

Chung Hung Steel Corporation (TWSE:2014) Looks Just Right With A 26% Price Jump

Chung Hung Steel Corporation (TWSE:2014) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.7% over the last year.

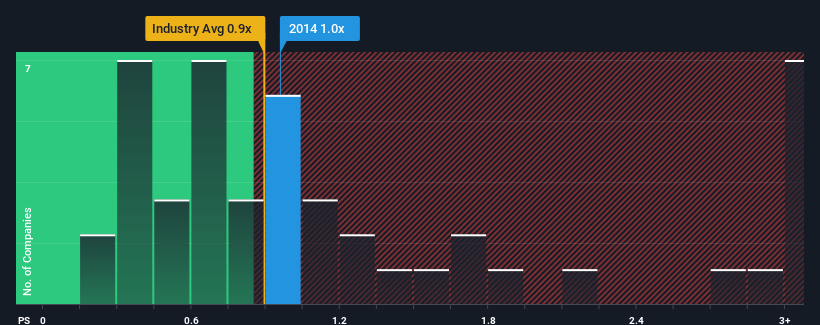

Even after such a large jump in price, there still wouldn't be many who think Chung Hung Steel's price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in Taiwan's Metals and Mining industry is similar at about 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Chung Hung Steel

What Does Chung Hung Steel's P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, Chung Hung Steel has been very sluggish. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Chung Hung Steel will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Chung Hung Steel's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 10%. This means it has also seen a slide in revenue over the longer-term as revenue is down 33% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 3.7% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 3.3%, which is not materially different.

With this information, we can see why Chung Hung Steel is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Chung Hung Steel's P/S?

Its shares have lifted substantially and now Chung Hung Steel's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Chung Hung Steel maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Chung Hung Steel, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2014

Chung Hung Steel

Manufactures, process, and sells steel products in Taiwan.

Reasonable growth potential with worrying balance sheet.

Market Insights

Community Narratives