- Taiwan

- /

- Metals and Mining

- /

- TWSE:2009

What First Copper Technology Co., Ltd.'s (TWSE:2009) 26% Share Price Gain Is Not Telling You

First Copper Technology Co., Ltd. (TWSE:2009) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 85% in the last year.

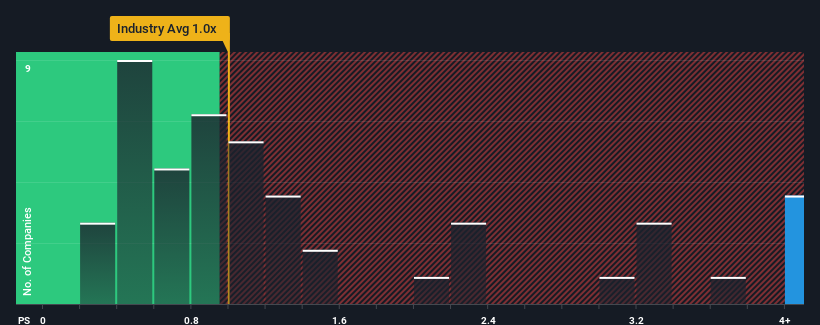

After such a large jump in price, you could be forgiven for thinking First Copper Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 8x, considering almost half the companies in Taiwan's Metals and Mining industry have P/S ratios below 1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for First Copper Technology

How Has First Copper Technology Performed Recently?

As an illustration, revenue has deteriorated at First Copper Technology over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for First Copper Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is First Copper Technology's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like First Copper Technology's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.7%. Regardless, revenue has managed to lift by a handy 12% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 3.6% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that First Copper Technology's P/S exceeds that of its industry peers. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On First Copper Technology's P/S

The strong share price surge has lead to First Copper Technology's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We didn't expect to see First Copper Technology trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Having said that, be aware First Copper Technology is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on First Copper Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2009

First Copper Technology

Produces and sells copper and copper alloy strips in Taiwan and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026