- Taiwan

- /

- Basic Materials

- /

- TWSE:1109

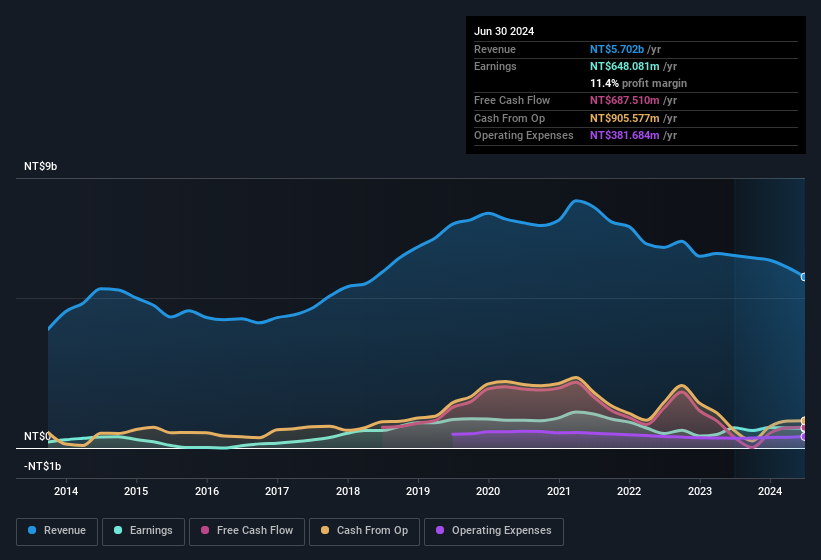

Hsing Ta CementLtd's (TWSE:1109) Anemic Earnings Might Be Worse Than You Think

Despite Hsing Ta Cement Co.,Ltd's (TWSE:1109) recent earnings report having lackluster headline numbers, the market responded positively. While shareholders may be willing to overlook soft profit numbers, we believe that they should also be taking into account some other factors which may be cause for concern.

View our latest analysis for Hsing Ta CementLtd

How Do Unusual Items Influence Profit?

To properly understand Hsing Ta CementLtd's profit results, we need to consider the NT$63m gain attributed to unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that's as you'd expect, given these boosts are described as 'unusual'. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hsing Ta CementLtd.

Our Take On Hsing Ta CementLtd's Profit Performance

Arguably, Hsing Ta CementLtd's statutory earnings have been distorted by unusual items boosting profit. Therefore, it seems possible to us that Hsing Ta CementLtd's true underlying earnings power is actually less than its statutory profit. In further bad news, its earnings per share decreased in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Hsing Ta CementLtd, you'd also look into what risks it is currently facing. For example, we've found that Hsing Ta CementLtd has 2 warning signs (1 makes us a bit uncomfortable!) that deserve your attention before going any further with your analysis.

This note has only looked at a single factor that sheds light on the nature of Hsing Ta CementLtd's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Hsing Ta CementLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1109

Hsing Ta CementLtd

Produces and sells cement and clinker products in Taiwan and China.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.