Here's What To Make Of Formosan Rubber Group's (TPE:2107) Decelerating Rates Of Return

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. However, after briefly looking over the numbers, we don't think Formosan Rubber Group (TPE:2107) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Formosan Rubber Group:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.071 = NT$811m ÷ (NT$12b - NT$818m) (Based on the trailing twelve months to December 2020).

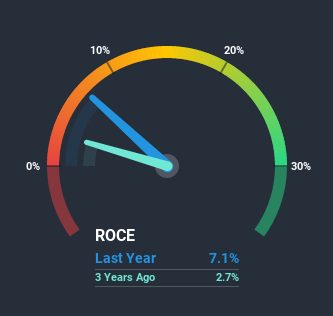

Thus, Formosan Rubber Group has an ROCE of 7.1%. Even though it's in line with the industry average of 6.8%, it's still a low return by itself.

View our latest analysis for Formosan Rubber Group

Historical performance is a great place to start when researching a stock so above you can see the gauge for Formosan Rubber Group's ROCE against it's prior returns. If you'd like to look at how Formosan Rubber Group has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What Can We Tell From Formosan Rubber Group's ROCE Trend?

Over the past five years, Formosan Rubber Group's ROCE and capital employed have both remained mostly flat. Businesses with these traits tend to be mature and steady operations because they're past the growth phase. With that in mind, unless investment picks up again in the future, we wouldn't expect Formosan Rubber Group to be a multi-bagger going forward.

One more thing to note, even though ROCE has remained relatively flat over the last five years, the reduction in current liabilities to 6.7% of total assets, is good to see from a business owner's perspective. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously.

The Bottom Line

In summary, Formosan Rubber Group isn't compounding its earnings but is generating stable returns on the same amount of capital employed. Although the market must be expecting these trends to improve because the stock has gained 59% over the last five years. But if the trajectory of these underlying trends continue, we think the likelihood of it being a multi-bagger from here isn't high.

If you'd like to know about the risks facing Formosan Rubber Group, we've discovered 1 warning sign that you should be aware of.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you decide to trade Formosan Rubber Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2107

Formosan Rubber Group

Formosan Rubber Group Inc., together with its subsidiaries, manufacturing and selling rubber and plastic sheets, plastic foam, resin sheets, and related materials.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives