- Taiwan

- /

- Metals and Mining

- /

- TWSE:2069

Yuen Chang Stainless Steel Co., Ltd. (TPE:2069) Investors Are Less Pessimistic Than Expected

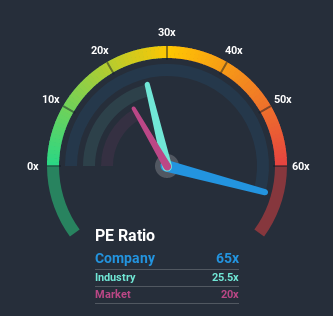

When close to half the companies in Taiwan have price-to-earnings ratios (or "P/E's") below 19x, you may consider Yuen Chang Stainless Steel Co., Ltd. (TPE:2069) as a stock to avoid entirely with its 65x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Yuen Chang Stainless Steel as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Yuen Chang Stainless Steel

Does Growth Match The High P/E?

In order to justify its P/E ratio, Yuen Chang Stainless Steel would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 492%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 83% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's an unpleasant look.

With this information, we find it concerning that Yuen Chang Stainless Steel is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Yuen Chang Stainless Steel's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Yuen Chang Stainless Steel revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Yuen Chang Stainless Steel (2 are a bit concerning) you should be aware of.

Of course, you might also be able to find a better stock than Yuen Chang Stainless Steel. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

If you’re looking to trade Yuen Chang Stainless Steel, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2069

Yuen Chang Stainless Steel

Engages in the processing, manufacturing, and selling of stainless steel products in Taiwan and internationally.

Slight and fair value.

Similar Companies

Market Insights

Community Narratives