- Taiwan

- /

- Paper and Forestry Products

- /

- TWSE:1909

Is Longchen Paper & Packaging Co., Ltd. (TPE:1909) A Good Dividend Stock?

Is Longchen Paper & Packaging Co., Ltd. (TPE:1909) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

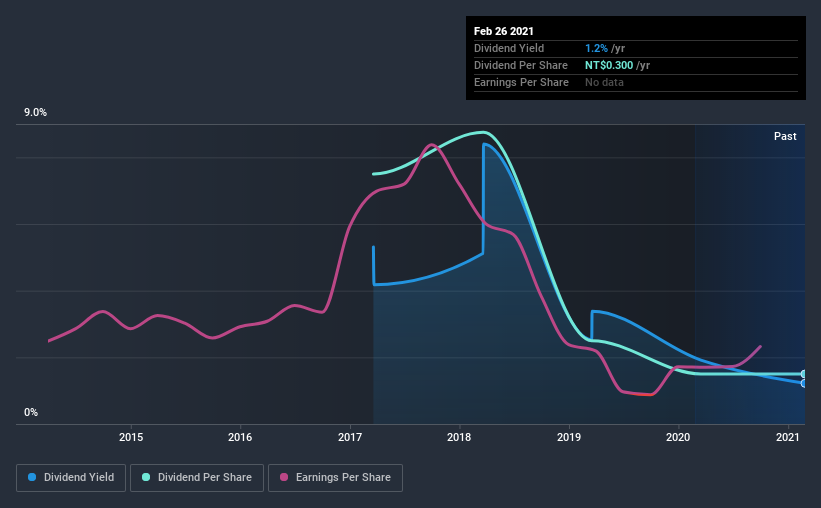

Investors might not know much about Longchen Paper & Packaging's dividend prospects, even though it has been paying dividends for the last four years and offers a 1.2% yield. A 1.2% yield is not inspiring, but the longer payment history has some appeal. Remember though, due to the recent spike in its share price, Longchen Paper & Packaging's yield will look lower, even though the market may now be factoring in an improvement in its long-term prospects. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Longchen Paper & Packaging paid out 38% of its profit as dividends, over the trailing twelve month period. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business. Besides, if reinvestment opportunities dry up, the company has room to increase the dividend.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Last year, Longchen Paper & Packaging paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

We update our data on Longchen Paper & Packaging every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Looking at the data, we can see that Longchen Paper & Packaging has been paying a dividend for the past four years. It has only been paying dividends for a few short years, and the dividend has already been cut at least once. This is one income stream we're not ready to live on. During the past four-year period, the first annual payment was NT$1.5 in 2017, compared to NT$0.3 last year. The dividend has fallen 80% over that period.

A shrinking dividend over a four-year period is not ideal, and we'd be concerned about investing in a dividend stock that lacks a solid record of growing dividends per share.

Dividend Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. It's not great to see that Longchen Paper & Packaging's have fallen at approximately 3.2% over the past five years. Declining earnings per share over a number of years is not a great sign for the dividend investor. Without some improvement, this does not bode well for the long term value of a company's dividend.

We'd also point out that Longchen Paper & Packaging issued a meaningful number of new shares in the past year. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. First, we like Longchen Paper & Packaging's low dividend payout ratio, although we're a bit concerned that it paid out a substantially higher percentage of its free cash flow. Earnings per share are down, and Longchen Paper & Packaging's dividend has been cut at least once in the past, which is disappointing. With this information in mind, we think Longchen Paper & Packaging may not be an ideal dividend stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Longchen Paper & Packaging has 4 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you decide to trade Longchen Paper & Packaging, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1909

Longchen Paper & Packaging

Manufactures, processes, and trade of paper raw materials in Taiwan and Mainland China.

Slightly overvalued with very low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026