- Taiwan

- /

- Paper and Forestry Products

- /

- TWSE:1905

Chung Hwa Pulp (TPE:1905) Is Carrying A Fair Bit Of Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Chung Hwa Pulp Corporation (TPE:1905) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Chung Hwa Pulp

What Is Chung Hwa Pulp's Net Debt?

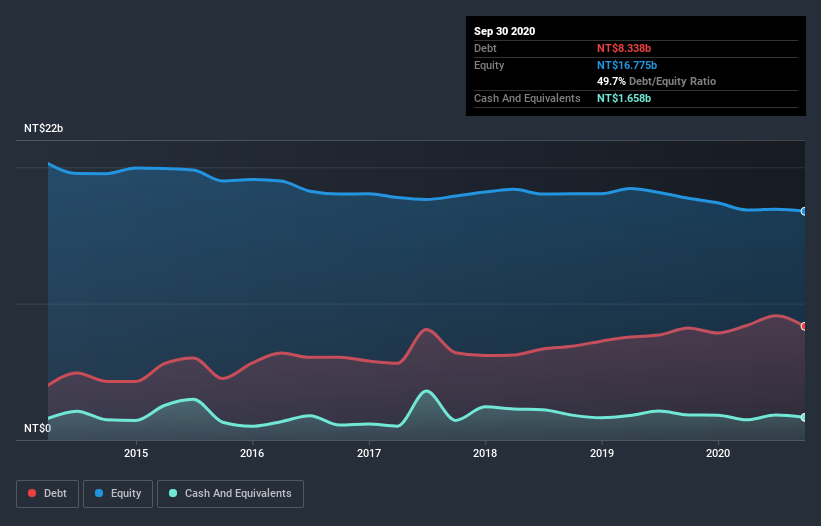

The chart below, which you can click on for greater detail, shows that Chung Hwa Pulp had NT$8.34b in debt in September 2020; about the same as the year before. On the flip side, it has NT$1.66b in cash leading to net debt of about NT$6.68b.

How Strong Is Chung Hwa Pulp's Balance Sheet?

We can see from the most recent balance sheet that Chung Hwa Pulp had liabilities of NT$11.5b falling due within a year, and liabilities of NT$2.24b due beyond that. Offsetting this, it had NT$1.66b in cash and NT$3.12b in receivables that were due within 12 months. So its liabilities total NT$8.94b more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of NT$11.1b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Chung Hwa Pulp's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Chung Hwa Pulp made a loss at the EBIT level, and saw its revenue drop to NT$19b, which is a fall of 14%. We would much prefer see growth.

Caveat Emptor

Not only did Chung Hwa Pulp's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost NT$644m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled NT$771m in negative free cash flow over the last twelve months. So in short it's a really risky stock. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for Chung Hwa Pulp (2 don't sit too well with us!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Chung Hwa Pulp or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1905

Chung Hwa Pulp

Manufactures, sells, and distributes pulp, paper, paperboard, chemical products, and fertilizers in Taiwan and Mainland China.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026