Some Shareholders Feeling Restless Over Ocean Plastics Co., Ltd.'s (TPE:1321) P/E Ratio

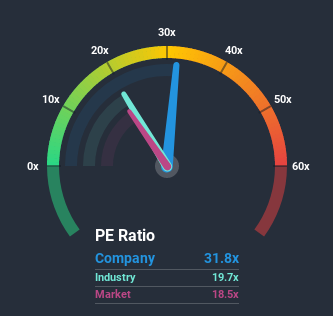

Ocean Plastics Co., Ltd.'s (TPE:1321) price-to-earnings (or "P/E") ratio of 31.8x might make it look like a strong sell right now compared to the market in Taiwan, where around half of the companies have P/E ratios below 18x and even P/E's below 13x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's exceedingly strong of late, Ocean Plastics has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Ocean Plastics

Is There Enough Growth For Ocean Plastics?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Ocean Plastics' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 182%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Ocean Plastics' P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Ocean Plastics' P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Ocean Plastics revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with Ocean Plastics.

If these risks are making you reconsider your opinion on Ocean Plastics, explore our interactive list of high quality stocks to get an idea of what else is out there.

When trading Ocean Plastics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1321

Ocean Plastics

Manufactures and sells plastic raw materials, products, and incidental materials for the plastic industry in Taiwan, India, the United States, China, Japan, and internationally.

Very low risk with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives