Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Taiwan Styrene Monomer Corporation (TPE:1310) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Taiwan Styrene Monomer

How Much Debt Does Taiwan Styrene Monomer Carry?

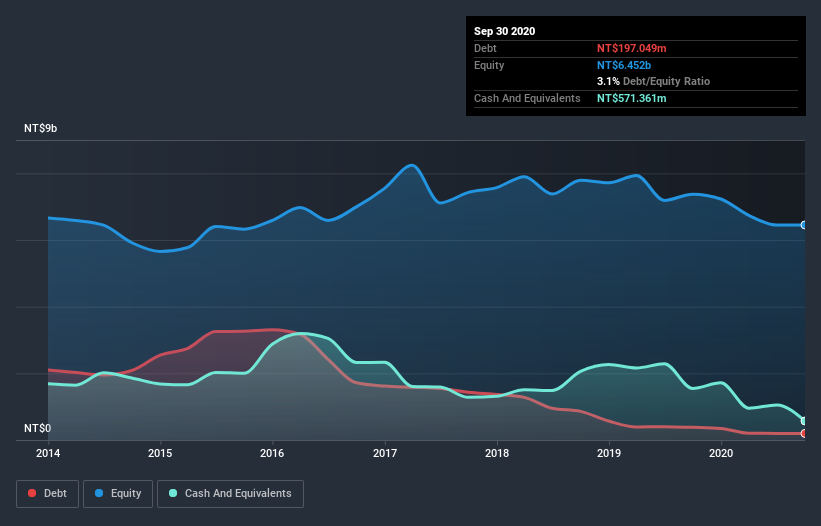

As you can see below, Taiwan Styrene Monomer had NT$197.0m of debt at September 2020, down from NT$378.9m a year prior. But on the other hand it also has NT$571.4m in cash, leading to a NT$374.3m net cash position.

How Healthy Is Taiwan Styrene Monomer's Balance Sheet?

We can see from the most recent balance sheet that Taiwan Styrene Monomer had liabilities of NT$837.3m falling due within a year, and liabilities of NT$310.6m due beyond that. Offsetting this, it had NT$571.4m in cash and NT$692.2m in receivables that were due within 12 months. So it actually has NT$115.7m more liquid assets than total liabilities.

This state of affairs indicates that Taiwan Styrene Monomer's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the NT$9.27b company is short on cash, but still worth keeping an eye on the balance sheet. Simply put, the fact that Taiwan Styrene Monomer has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Taiwan Styrene Monomer can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Taiwan Styrene Monomer made a loss at the EBIT level, and saw its revenue drop to NT$8.3b, which is a fall of 35%. To be frank that doesn't bode well.

So How Risky Is Taiwan Styrene Monomer?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Taiwan Styrene Monomer lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through NT$590m of cash and made a loss of NT$122m. With only NT$374.3m on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Taiwan Styrene Monomer you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Taiwan Styrene Monomer or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Styrene Monomer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:1310

Taiwan Styrene Monomer

Produces and sells styrene monomer, para-diethyl benzene, toluene, and ethyl benzene in Asia and Europe.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives