- Taiwan

- /

- Basic Materials

- /

- TWSE:1104

These 4 Measures Indicate That Universal Cement (TPE:1104) Is Using Debt Safely

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Universal Cement Corporation (TPE:1104) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Universal Cement

How Much Debt Does Universal Cement Carry?

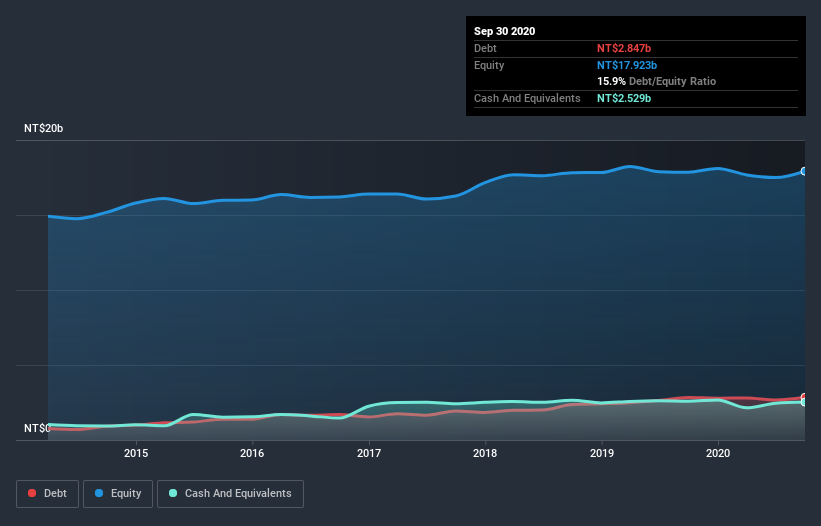

The chart below, which you can click on for greater detail, shows that Universal Cement had NT$2.85b in debt in September 2020; about the same as the year before. However, it does have NT$2.53b in cash offsetting this, leading to net debt of about NT$317.2m.

How Strong Is Universal Cement's Balance Sheet?

We can see from the most recent balance sheet that Universal Cement had liabilities of NT$3.80b falling due within a year, and liabilities of NT$1.41b due beyond that. On the other hand, it had cash of NT$2.53b and NT$1.20b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by NT$1.48b.

Since publicly traded Universal Cement shares are worth a total of NT$15.4b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Universal Cement has a low debt to EBITDA ratio of only 0.64. And remarkably, despite having net debt, it actually received more in interest over the last twelve months than it had to pay. So there's no doubt this company can take on debt while staying cool as a cucumber. Better yet, Universal Cement grew its EBIT by 213% last year, which is an impressive improvement. If maintained that growth will make the debt even more manageable in the years ahead. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Universal Cement can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Universal Cement actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Happily, Universal Cement's impressive interest cover implies it has the upper hand on its debt. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. We think Universal Cement is no more beholden to its lenders, than the birds are to birdwatchers. For investing nerds like us its balance sheet is almost charming. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Take risks, for example - Universal Cement has 1 warning sign we think you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Universal Cement, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1104

Universal Cement

Manufactures and sells cement, ready-mixed concrete, gypsum board panels, and other building materials in Taiwan.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives