Is U-Best Innovative Technology (GTSM:4714) A Risky Investment?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies U-Best Innovative Technology Co., Ltd. (GTSM:4714) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for U-Best Innovative Technology

What Is U-Best Innovative Technology's Net Debt?

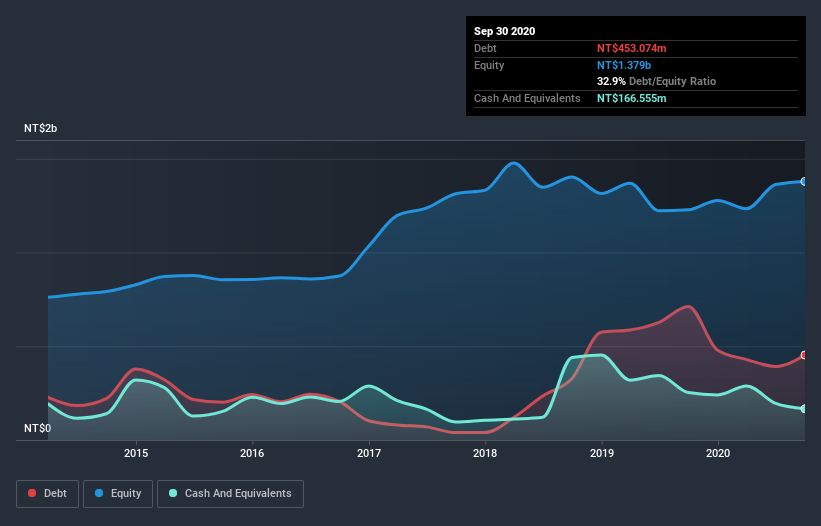

You can click the graphic below for the historical numbers, but it shows that U-Best Innovative Technology had NT$453.1m of debt in September 2020, down from NT$712.6m, one year before. On the flip side, it has NT$166.6m in cash leading to net debt of about NT$286.5m.

A Look At U-Best Innovative Technology's Liabilities

The latest balance sheet data shows that U-Best Innovative Technology had liabilities of NT$573.7m due within a year, and liabilities of NT$15.3m falling due after that. On the other hand, it had cash of NT$166.6m and NT$69.3m worth of receivables due within a year. So it has liabilities totalling NT$353.1m more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since U-Best Innovative Technology has a market capitalization of NT$1.49b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

As it happens U-Best Innovative Technology has a fairly concerning net debt to EBITDA ratio of 8.4 but very strong interest coverage of 1k. This means that unless the company has access to very cheap debt, that interest expense will likely grow in the future. We also note that U-Best Innovative Technology improved its EBIT from a last year's loss to a positive NT$23m. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since U-Best Innovative Technology will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Happily for any shareholders, U-Best Innovative Technology actually produced more free cash flow than EBIT over the last year. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

The good news is that U-Best Innovative Technology's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But we must concede we find its net debt to EBITDA has the opposite effect. All these things considered, it appears that U-Best Innovative Technology can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for U-Best Innovative Technology that you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade U-Best Innovative Technology, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4714

U-Best Innovative Technology

Manufactures and trades in polymer chemical raw materials in Taiwan and internationally.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives