- Taiwan

- /

- Semiconductors

- /

- TWSE:2493

Undiscovered Gems Three Small Caps Backed By Strong Fundamentals

Reviewed by Simply Wall St

As global markets continue to show resilience, with U.S. indexes approaching record highs and smaller-cap indexes outperforming large-caps, investors are increasingly looking toward small-cap stocks for potential opportunities. In this environment of broad-based gains and strong economic indicators such as low jobless claims and rising home sales, identifying small-cap companies with robust fundamentals can be a strategic move. A good stock in this context often combines solid financial health with growth potential that remains under the radar of larger market players.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

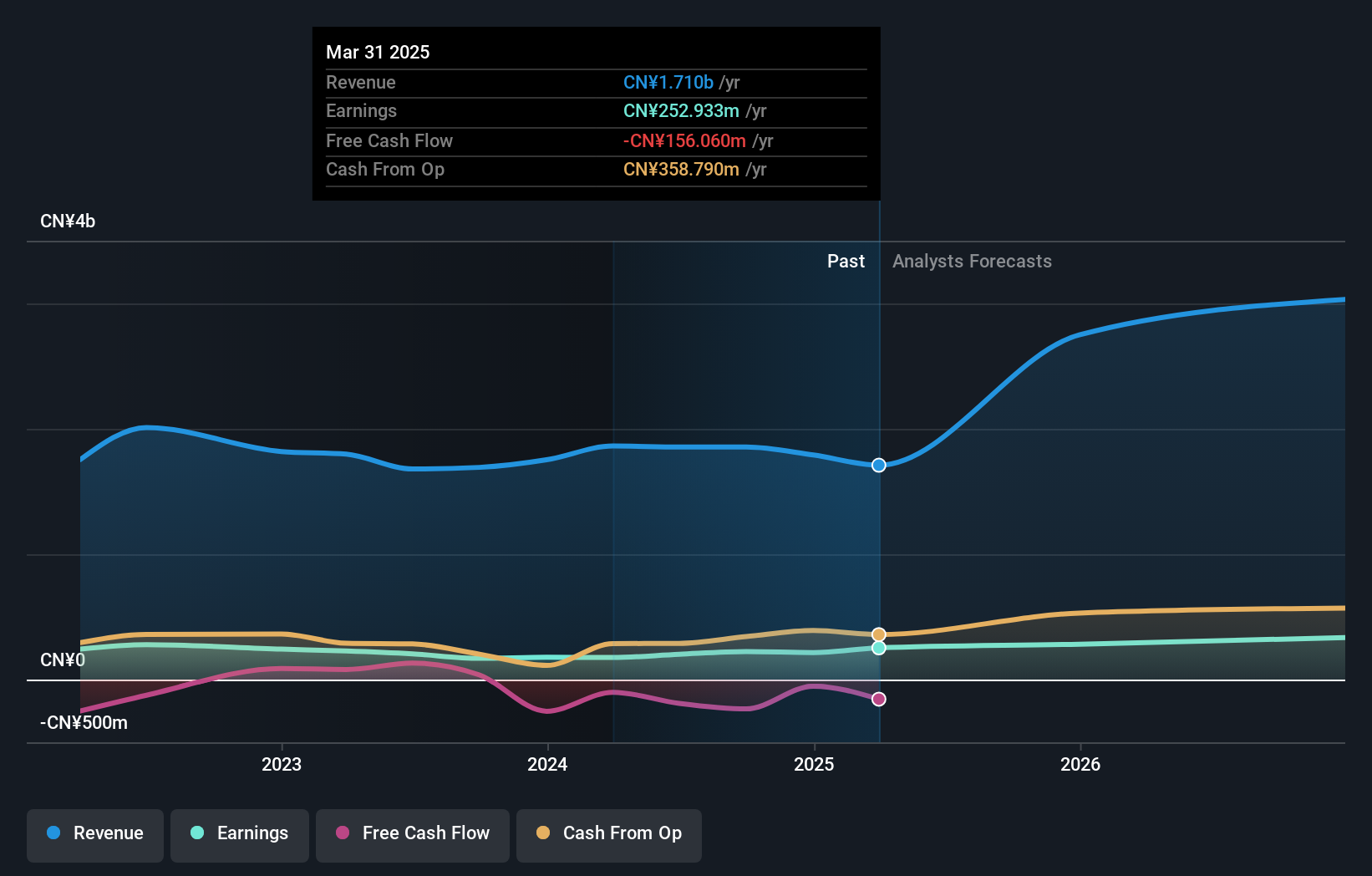

Shenzhen Leo-King Environmental Group (SZSE:301305)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Leo-King Environmental Group Company Limited operates in the organic solid waste treatment sector in China with a market capitalization of CN¥4.47 billion.

Operations: Shenzhen Leo-King Environmental Group generates revenue primarily from its organic solid waste treatment services in China. The company has a market capitalization of CN¥4.47 billion, reflecting its scale within the sector.

Shenzhen Lions King Hi-Tech, formerly Shenzhen Leo-King Environmental Group, showcases a promising profile with a debt to equity ratio reduced from 134.6% to 47.5% over five years and satisfactory net debt to equity at 15.7%. The company’s earnings grew by 31.7%, outpacing the industry’s modest 0.9%, while its price-to-earnings ratio of 20.8x remains below the CN market average of 34.6x, indicating potential value for investors. Despite not being free cash flow positive, it reported CNY1,384 million in sales for nine months ending September 2024, reflecting steady revenue growth compared to CNY1,282 million last year.

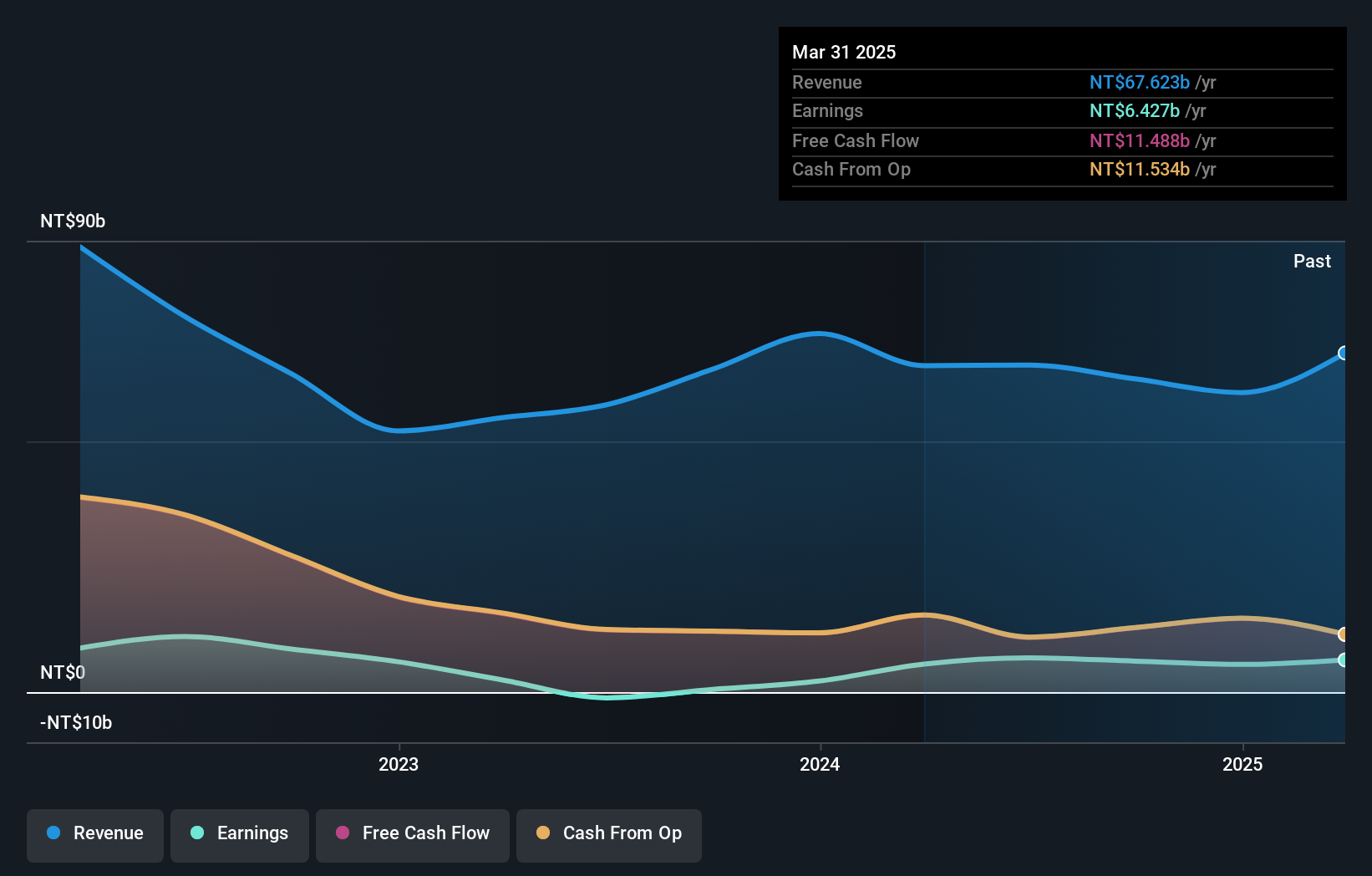

Farglory Life Insurance (TPEX:5859)

Simply Wall St Value Rating: ★★★★★☆

Overview: Farglory Life Insurance Co., Ltd. operates in Taiwan, offering a range of insurance products and services, with a market capitalization of approximately NT$22.43 billion.

Operations: The primary revenue stream for Farglory Life Insurance comes from its life and health insurance segment, generating NT$65.21 billion.

Farglory Life Insurance, a promising player in the insurance sector, stands out with its debt-free status and high-quality earnings. The company reported a significant revenue increase to TWD 20.51 billion for Q2 2024 from TWD 19.26 billion the previous year, while net income rose to TWD 2 billion from TWD 1.81 billion. Basic earnings per share climbed to TWD 1.48 from TWD 1.33 a year ago, showcasing robust financial health and growth potential in profitability compared to industry peers at an impressive rate of over 79%. Trading at about 84% below its estimated fair value indicates considerable investment appeal.

- Unlock comprehensive insights into our analysis of Farglory Life Insurance stock in this health report.

Gain insights into Farglory Life Insurance's past trends and performance with our Past report.

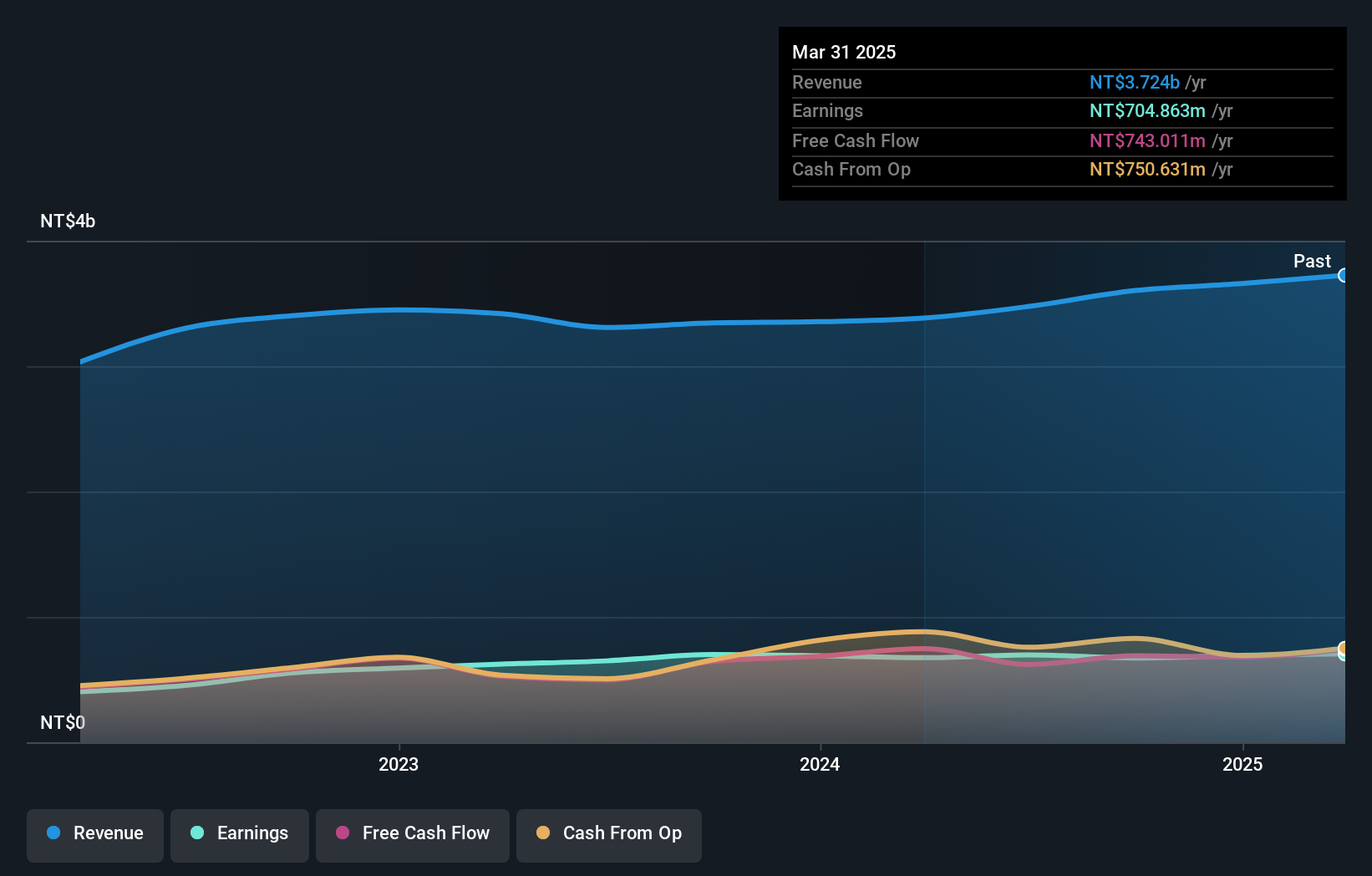

Ampoc Far-East (TWSE:2493)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ampoc Far-East Co., Ltd. is engaged in the research, manufacturing, and supply of equipment and materials for the electronic industry in Taiwan, with a market capitalization of NT$12.47 billion.

Operations: Ampoc Far-East generates revenue primarily from machine equipment and consumable materials, with the Zhongchi segment contributing NT$2.12 billion in machine equipment sales. The Taipei segment adds NT$1.12 billion from consumable materials, highlighting its significance in the company's revenue streams.

Ampoc Far-East, a nimble player in its sector, shows a mixed bag of financials with net income for the third quarter at TWD 181.99 million, down from TWD 206.47 million last year. Despite this dip, sales climbed to TWD 969.28 million from TWD 841.99 million over the same period, suggesting robust demand for its offerings. The company's basic earnings per share slipped to TWD 1.59 from TWD 1.8 previously, hinting at some margin pressures or increased costs impacting profitability. Ampoc's trading value appears attractive as it is priced below fair value estimates by about 24%.

- Dive into the specifics of Ampoc Far-East here with our thorough health report.

Review our historical performance report to gain insights into Ampoc Far-East's's past performance.

Where To Now?

- Investigate our full lineup of 4632 Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2493

Ampoc Far-East

Researches, manufactures, and sells equipment and materials for the electrical industry in Taiwan, China, and Hong Kong.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives