- Taiwan

- /

- Personal Products

- /

- TWSE:8480

What Type Of Returns Would Taisun Int'l (Holding)'s(TPE:8480) Shareholders Have Earned If They Purchased Their Shares Three Years Ago?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Taisun Int'l (Holding) Corporation (TPE:8480) shareholders, since the share price is down 13% in the last three years, falling well short of the market return of around 82%. The silver lining is that the stock is up 1.3% in about a week.

View our latest analysis for Taisun Int'l (Holding)

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Although the share price is down over three years, Taisun Int'l (Holding) actually managed to grow EPS by 15% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

It is a little bizarre to see the share price down, despite a strong improvement to earnings per share. Therefore, we should look at some other metrics to try to understand why the market is disappointed.

We note that the dividend seems healthy enough, so that probably doesn't explain the share price drop. It's good to see that Taisun Int'l (Holding) has increased its revenue over the last three years. If the company can keep growing revenue, there may be an opportunity for investors. You might have to dig deeper to understand the recent share price weakness.

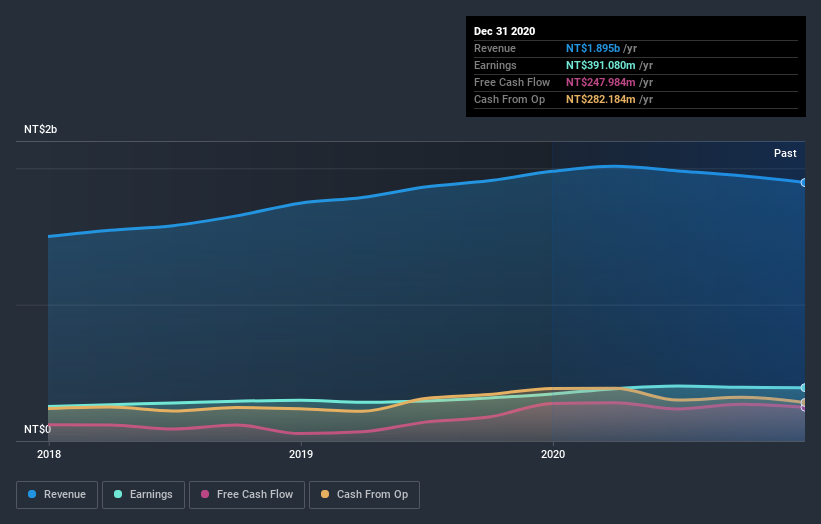

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Taisun Int'l (Holding), it has a TSR of -1.9% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

The last twelve months weren't great for Taisun Int'l (Holding) shares, which cost holders 4.3%, including dividends, while the market was up about 74%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 0.6% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Taisun Int'l (Holding) you should know about.

But note: Taisun Int'l (Holding) may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Taisun Int'l (Holding), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Taisun Int'l (Holding) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:8480

Taisun Int'l (Holding)

Taisun Int'l (Holding) Corporation, together with its subsidiaries, manufactures and sells disposable baby diapers and pull-ups, adult diapers, adult rehabilitation pants, sanitary napkins, and wet tissues.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives