- Taiwan

- /

- Personal Products

- /

- TPEX:4911

If You Had Bought G&E Herbal Biotechnology (GTSM:4911) Stock Three Years Ago, You'd Be Sitting On A 40% Loss, Today

It is doubtless a positive to see that the G&E Herbal Biotechnology Co., Ltd. (GTSM:4911) share price has gained some 48% in the last three months. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 40% in the last three years, falling well short of the market return.

View our latest analysis for G&E Herbal Biotechnology

With just NT$19,475,000 worth of revenue in twelve months, we don't think the market considers G&E Herbal Biotechnology to have proven its business plan. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that G&E Herbal Biotechnology will significantly advance the business plan before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized).

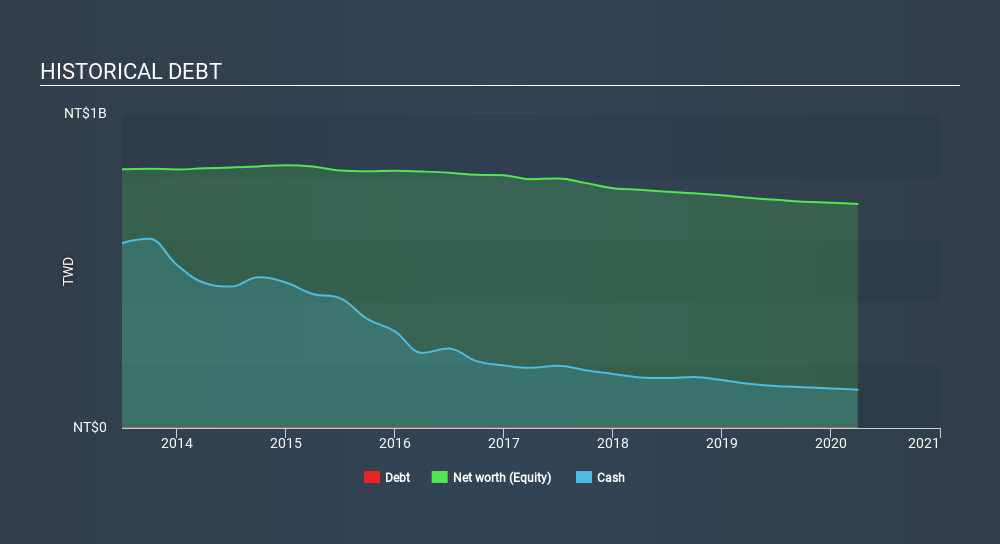

G&E Herbal Biotechnology has plenty of cash in the bank, with cash in excess of all liabilities sitting at NT$109m, when it last reported (March 2020). This gives management the flexibility to drive business growth, without worrying too much about cash reserves. But since the share price has dropped 15% per year, over 3 years , it seems like the market might have been over-excited previously. The image below shows how G&E Herbal Biotechnology's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

Investors in G&E Herbal Biotechnology had a tough year, with a total loss of 20%, against a market gain of about 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8.4% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - G&E Herbal Biotechnology has 4 warning signs (and 2 which are a bit unpleasant) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TPEX:4911

G&E Herbal Biotechnology

Engages in development and commercialization of novel botanical extraction technology and products.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026