- Taiwan

- /

- Medical Equipment

- /

- TWSE:6598

Introducing Applied BioCode (TPE:6598), A Stock That Climbed 11% In The Last Three Years

The last three months have been tough on Applied BioCode Corporation (TPE:6598) shareholders, who have seen the share price decline a rather worrying 40%. In contrast the stock is up over the last three years. In that time, it is up 11%, which isn't bad, but not amazing either.

Check out our latest analysis for Applied BioCode

Applied BioCode wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Applied BioCode's revenue trended up 70% each year over three years. That's much better than most loss-making companies. The stock is up 4% over that time - a decent but not impressive return. We would have thought the top-line growth might have impressed buyers more. It could be that the stock was previously over-priced, or its losses might worry the market. But you might want to take a closer look at this one.

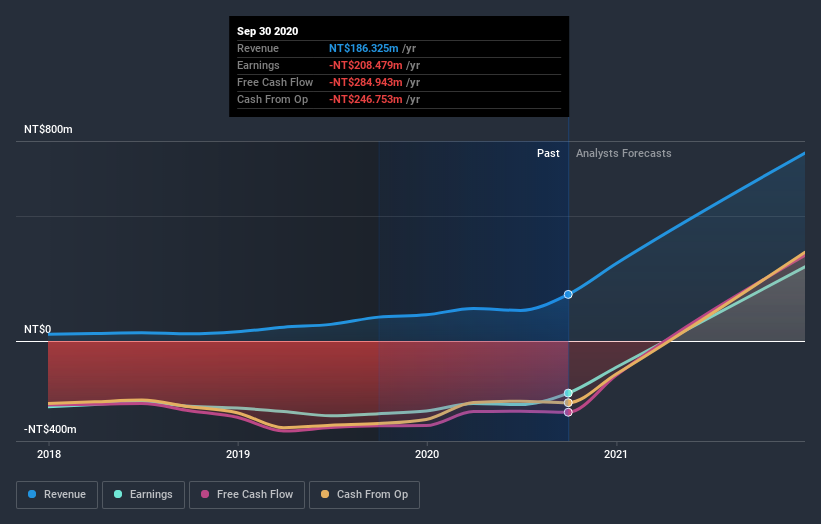

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Over the last year Applied BioCode shareholders have received a TSR of 9.8%. While you don't go broke making a profit, this return was actually lower than the average market return of about 39%. On the other hand, the TSR over three years was worse, at just 4% per year. This suggests the company's position is improving. If the share price is up as a result of improved business performance, then this kind of improvement may be sustained. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Applied BioCode that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading Applied BioCode or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6598

Applied BioCode

Designs, develops, and commercializes multiplex diagnostic testing products in California.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives