- Taiwan

- /

- Healthcare Services

- /

- TPEX:3218

Universal Vision Biotechnology And 2 Top Dividend Stocks For Income Growth

Reviewed by Simply Wall St

Amidst a backdrop of volatile global markets, with U.S. stocks experiencing fluctuations driven by AI competition fears and mixed corporate earnings, investors are increasingly seeking stability through dividend stocks. In this uncertain environment, selecting robust dividend-paying companies can provide a reliable income stream and potential for growth, making them an attractive option for those looking to navigate the current economic landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.80% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.12% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.12% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.56% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.93% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

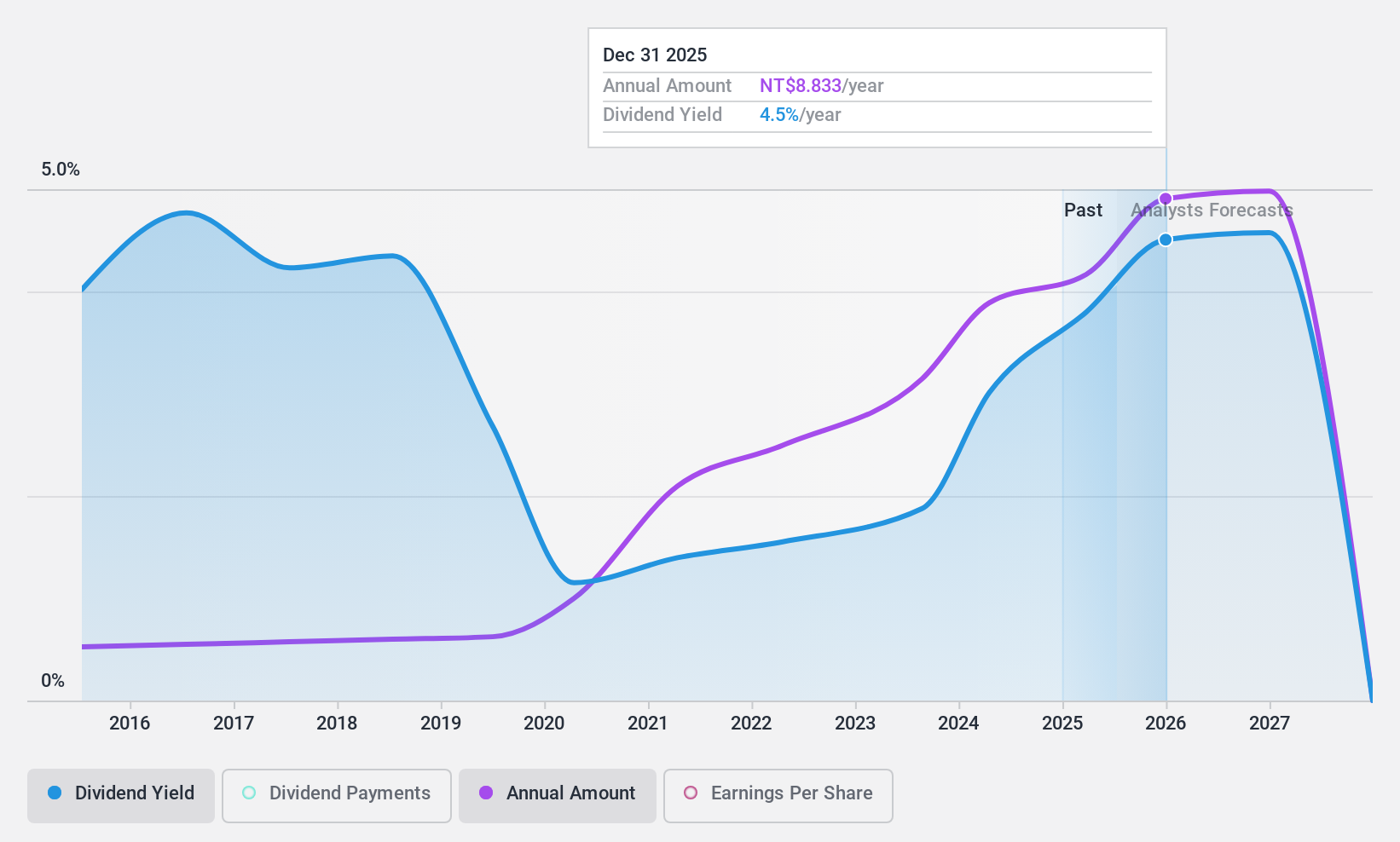

Universal Vision Biotechnology (TPEX:3218)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Universal Vision Biotechnology Co., Ltd. operates a chain of eye care clinics in Taiwan and China, with a market cap of NT$17.79 billion.

Operations: Universal Vision Biotechnology Co., Ltd. generates revenue primarily through its network of eye care clinics located in Taiwan and China.

Dividend Yield: 3.3%

Universal Vision Biotechnology offers a stable dividend profile, with payments reliably growing over the past decade. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 55% and 48.6%, respectively. Despite a lower yield of 3.33% compared to top-tier payers in Taiwan, its dividends remain attractive for their stability and growth potential. Recent earnings show modest sales growth but a slight dip in net income year-over-year.

- Delve into the full analysis dividend report here for a deeper understanding of Universal Vision Biotechnology.

- Our valuation report here indicates Universal Vision Biotechnology may be undervalued.

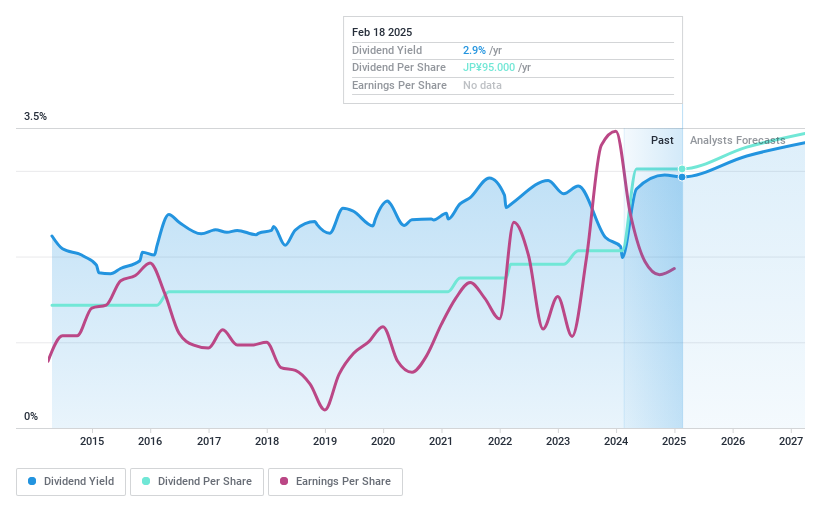

Osaka Gas (TSE:9532)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Osaka Gas Co., Ltd. operates in the energy sector, offering gas, electricity, and other energy products and services both domestically in Japan and internationally, with a market cap of ¥1.25 trillion.

Operations: Osaka Gas Co., Ltd.'s revenue is primarily derived from its Domestic Energy segment, which accounts for ¥1.69 billion, followed by Life & Business Solutions at ¥273.71 million and Overseas Energy at ¥128.40 million.

Dividend Yield: 3%

Osaka Gas provides a stable dividend history, with consistent growth over the past decade. However, its current dividend yield of 3.05% is below the top 25% in Japan and is not well covered by free cash flows, indicated by a high cash payout ratio. While earnings cover dividends with a low payout ratio of 40.8%, profit margins have declined recently. A recent share buyback suggests management confidence despite financial challenges.

- Click here to discover the nuances of Osaka Gas with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Osaka Gas' current price could be inflated.

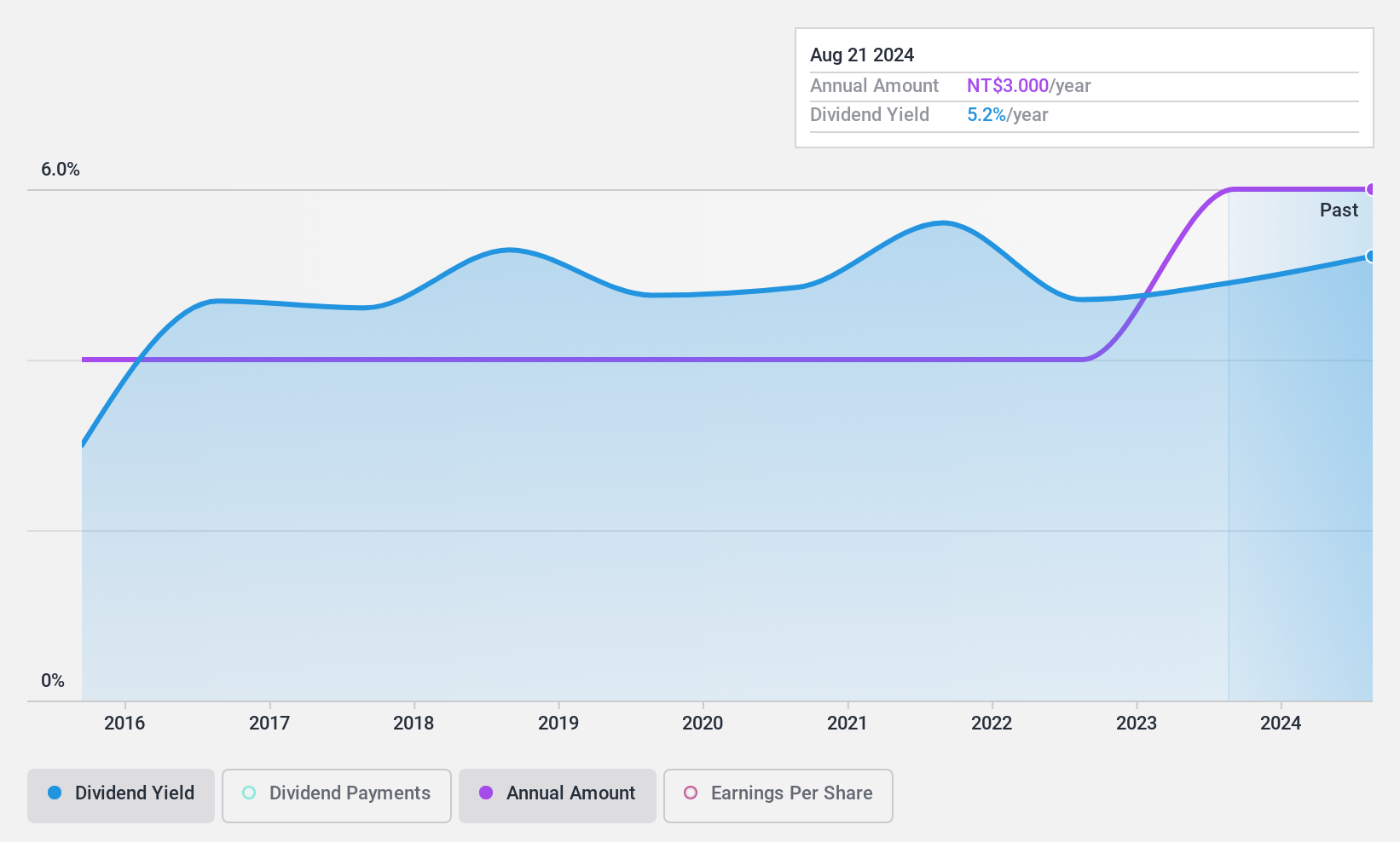

Y.C.C. Parts Mfg (TWSE:1339)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Y.C.C. Parts Mfg. Co., Ltd. specializes in the manufacturing and sale of automotive plastic parts across North America, Central America, South America, Europe, Asia, and Taiwan with a market cap of NT$4.20 billion.

Operations: Y.C.C. Parts Mfg. Co., Ltd.'s revenue is derived from Domestic Operations amounting to NT$1.50 billion and Foreign Operations contributing NT$491.17 million.

Dividend Yield: 5.3%

Y.C.C. Parts Mfg. offers a high and reliable dividend yield of 5.29%, ranking in the top 25% of Taiwanese dividend payers, with dividends consistently growing over the past decade. The company's earnings growth supports its payout ratio of 55.5%, ensuring dividends are covered by earnings and cash flows, despite a higher cash payout ratio of 87.5%. Recent leadership changes may impact governance, but financial fundamentals remain strong for dividend sustainability.

- Take a closer look at Y.C.C. Parts Mfg's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Y.C.C. Parts Mfg is trading behind its estimated value.

Where To Now?

- Access the full spectrum of 1960 Top Dividend Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3218

Universal Vision Biotechnology

Operates a chain of eye care clinics in Taiwan and China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives