- Taiwan

- /

- Medical Equipment

- /

- TPEX:4116

BenQ Medical Technology's (GTSM:4116) Shareholders Are Down 72% On Their Shares

BenQ Medical Technology Corporation (GTSM:4116) shareholders should be happy to see the share price up 12% in the last month. But don't envy holders -- looking back over 5 years the returns have been really bad. In that time the share price has delivered a rude shock to holders, who find themselves down 72% after a long stretch. So we're hesitant to put much weight behind the short term increase. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

Check out our latest analysis for BenQ Medical Technology

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

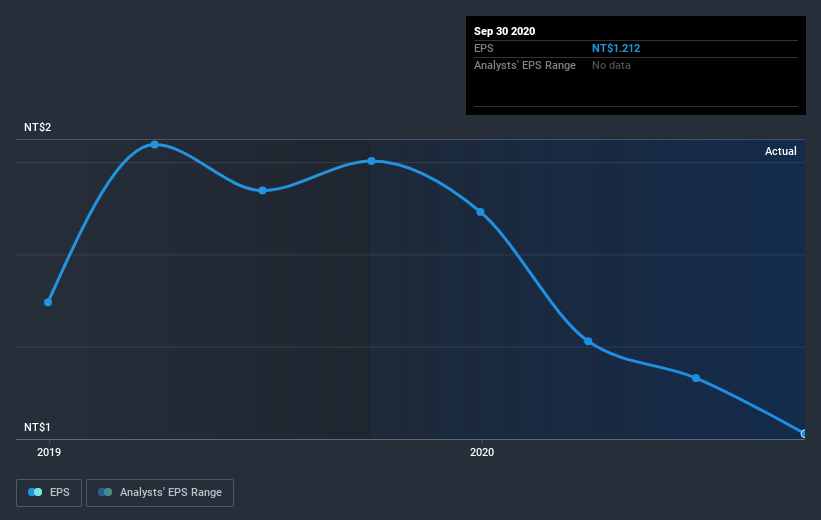

Looking back five years, both BenQ Medical Technology's share price and EPS declined; the latter at a rate of 21% per year. This change in EPS is reasonably close to the 23% average annual decrease in the share price. This implies that the market has had a fairly steady view of the stock. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on BenQ Medical Technology's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of BenQ Medical Technology, it has a TSR of -68% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 26% in the last year, BenQ Medical Technology shareholders lost 7.8% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 11% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with BenQ Medical Technology (including 1 which is is significant) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade BenQ Medical Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BenQ Medical Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:4116

BenQ Medical Technology

Engages in the manufacture, assembly, maintenance, repair, wholesale, retail, leasing, and sale of medical equipment and consumables in Taiwan, Mainland China, India, and internationally.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives