As global markets experience broad-based gains, with U.S. indexes approaching record highs and positive sentiment driven by strong labor market reports, investors are increasingly looking for stable income-generating opportunities amidst ongoing geopolitical uncertainties. In this context, dividend stocks can offer a compelling option for those seeking consistent returns; they provide regular income and potential capital appreciation, making them a valuable consideration in today's dynamic market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.25% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.57% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.32% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.81% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

Click here to see the full list of 1947 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

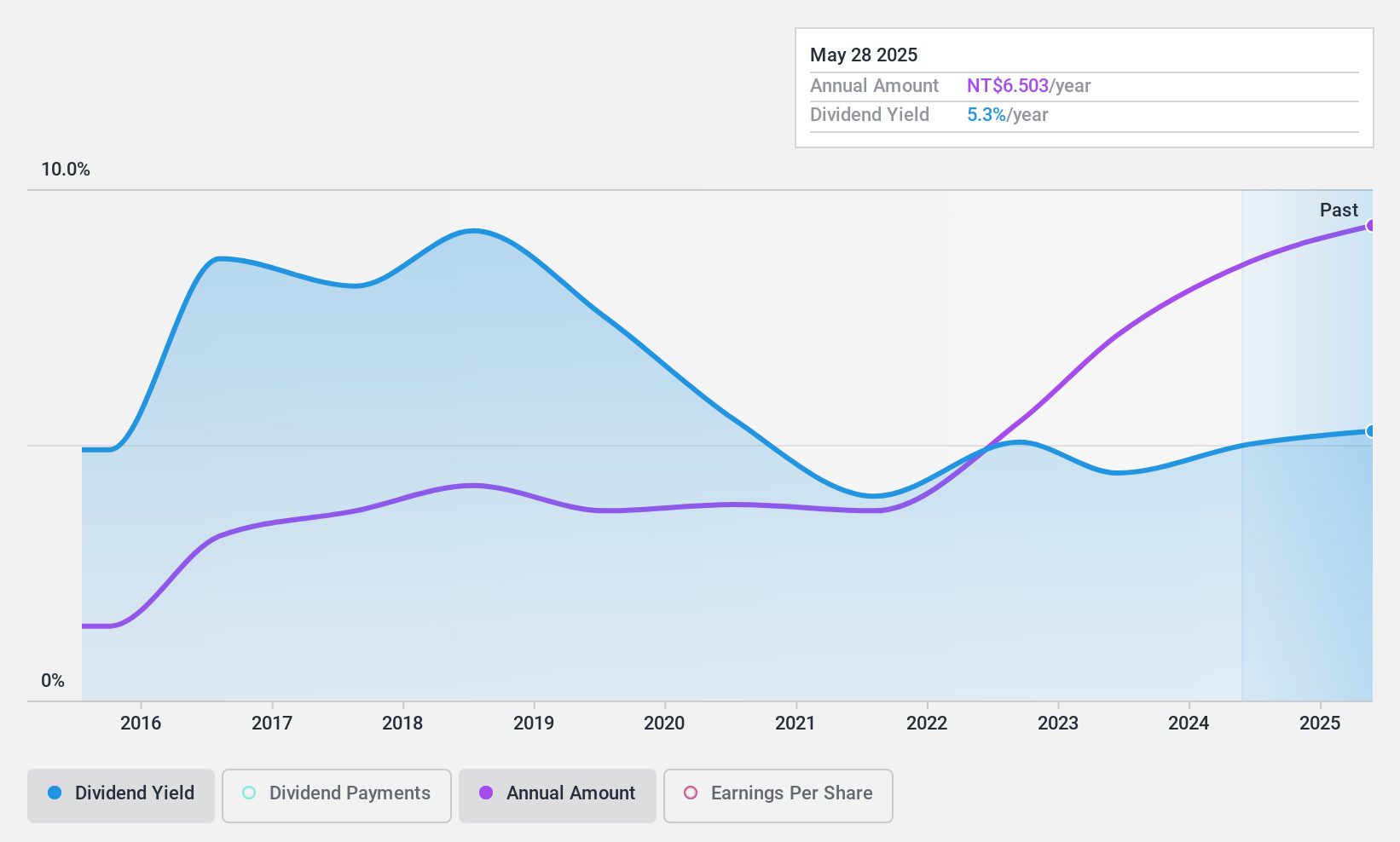

Dimerco Data System (TPEX:5403)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dimerco Data System Corporation, along with its subsidiaries, focuses on designing, developing, and selling various software products in Taiwan and has a market cap of approximately NT$8.24 billion.

Operations: Dimerco Data System Corporation generates its revenue through the design, development, and sale of software products in Taiwan.

Dividend Yield: 5.6%

Dimerco Data System's dividend yield of 5.56% is among the top 25% in the TW market, but its sustainability is questionable due to high cash payout ratios (137.1%) and volatile dividend history over the past decade. Despite a favorable price-to-earnings ratio of 15.3x compared to the market, recent earnings reports show a decline in net income and EPS, raising concerns about future dividend reliability and coverage by free cash flows.

- Click here and access our complete dividend analysis report to understand the dynamics of Dimerco Data System.

- Our comprehensive valuation report raises the possibility that Dimerco Data System is priced higher than what may be justified by its financials.

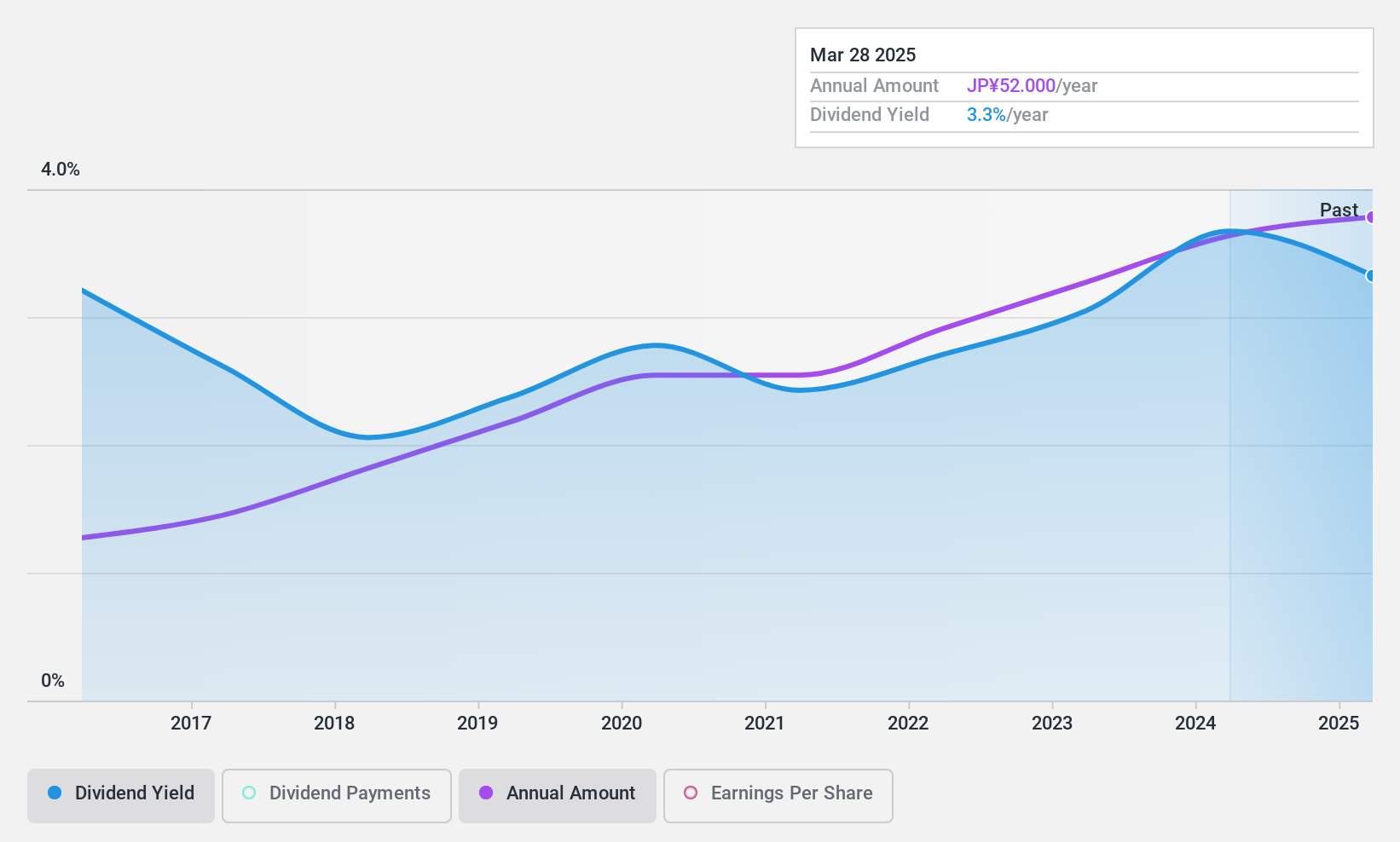

Pro-Ship (TSE:3763)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Pro-Ship Incorporated develops, sells, consults, and customizes solution packages for asset management and sales management in Japan with a market cap of ¥18.73 billion.

Operations: Pro-Ship Incorporated generates revenue from the development, sale, consulting, and customization of solution packages focused on asset management and sales management in Japan.

Dividend Yield: 3.4%

Pro-Ship pays a reliable dividend yield of 3.43%, supported by low payout (41.8%) and cash payout ratios (39.5%), indicating strong earnings and cash flow coverage. Its dividends have been stable and growing over the past decade, with a recent shift to a progressive dividend policy aiming for sustained increases while maintaining at least a 40% payout ratio. Despite trading below estimated fair value, it was recently dropped from the S&P Global BMI Index.

- Click here to discover the nuances of Pro-Ship with our detailed analytical dividend report.

- Our valuation report unveils the possibility Pro-Ship's shares may be trading at a discount.

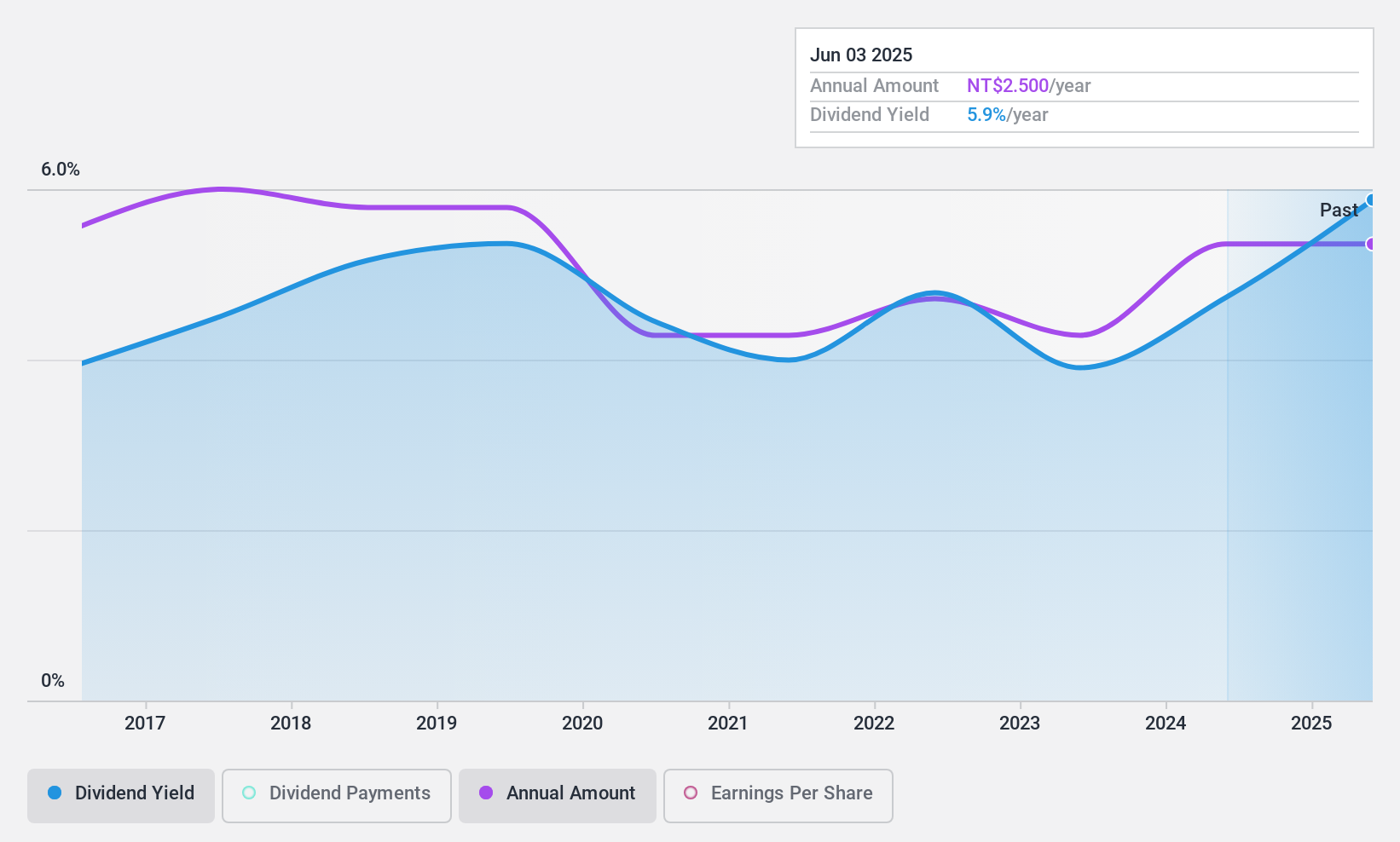

Namchow Holdings (TWSE:1702)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Namchow Holdings Co., Ltd. operates in Taiwan, China, and Thailand, focusing on the manufacturing and sale of edible and non-edible oil, frozen dough, and dish and laundry liquid detergent products with a market cap of NT$13.42 billion.

Operations: Namchow Holdings Co., Ltd.'s revenue segments include NT$13.29 billion from edible and non-edible oil detergent products, NT$4.47 billion from food excluding frozen dough, NT$2.39 billion from frozen dough, NT$2.09 billion from ice products, NT$859.42 million from catering, and NT$479.49 million from cleaning products.

Dividend Yield: 4.6%

Namchow Holdings offers a dividend yield of 4.62%, placing it in the top quartile of TW market payers, though its dividend history has been volatile over the past decade. Despite this, recent earnings growth and a reasonable payout ratio of 53.5% suggest dividends are well-covered by earnings and cash flows (cash payout ratio: 63.9%). The company reported increased sales for Q3 2024 but saw a decline in net income compared to last year.

- Unlock comprehensive insights into our analysis of Namchow Holdings stock in this dividend report.

- In light of our recent valuation report, it seems possible that Namchow Holdings is trading behind its estimated value.

Key Takeaways

- Take a closer look at our Top Dividend Stocks list of 1947 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5403

Dimerco Data System

Engages in the design, development, and sale of various software products in Taiwan.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives