- South Korea

- /

- Food

- /

- KOSE:A005610

3 Undiscovered Gems In Asia With Promising Potential

Reviewed by Simply Wall St

Amidst a turbulent global economic landscape, Asian markets are navigating the challenges posed by heightened U.S. tariffs and their ripple effects on trade and growth. Despite these uncertainties, the region continues to offer intriguing opportunities for investors seeking potential in lesser-known small-cap stocks that may thrive due to their unique positioning or innovative approaches.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lumax International | NA | 4.43% | 5.77% | ★★★★★★ |

| CAC Holdings | 4.97% | 0.98% | 14.37% | ★★★★★★ |

| Tsubakimoto Kogyo | NA | 4.34% | 5.54% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | 0.57% | 18.65% | ★★★★★★ |

| Zhejiang Haisen Pharmaceutical | 0.08% | 8.09% | 10.46% | ★★★★★☆ |

| Red phase | 51.88% | -8.63% | -34.64% | ★★★★★☆ |

| Praise Victor Industrial | 85.87% | 17.23% | 388.20% | ★★★★★☆ |

| Dong Fang Offshore | 41.63% | 61.03% | 48.24% | ★★★★★☆ |

| Alltek Technology | 128.37% | 5.70% | 10.35% | ★★★★☆☆ |

| Iljin DiamondLtd | 2.66% | -2.57% | -7.00% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

SPC Samlip (KOSE:A005610)

Simply Wall St Value Rating: ★★★★★★

Overview: SPC Samlip Co., Ltd. is a South Korean company specializing in the production of diverse food products with a market capitalization of ₩510.63 billion.

Operations: SPC Samlip generates revenue primarily from its diverse range of food products. The company's net profit margin shows significant variability, reflecting fluctuations in profitability.

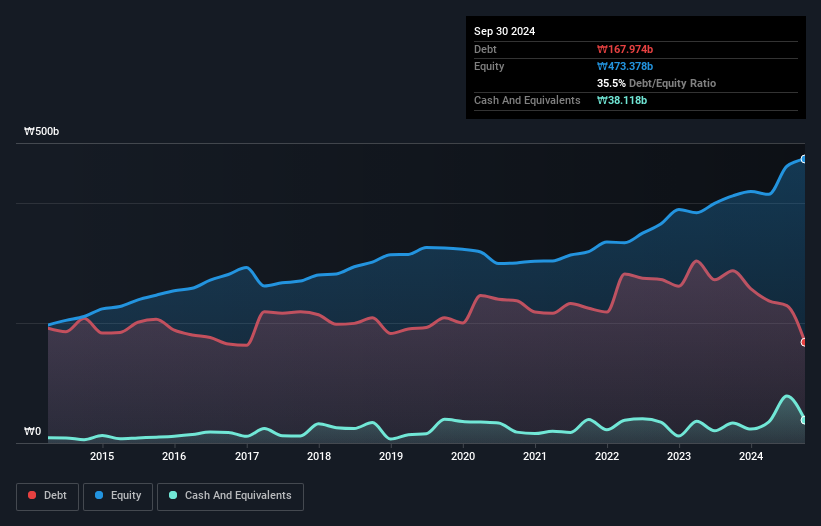

SPC Samlip, a notable player in the food industry, has shown impressive earnings growth of 72% over the past year, outpacing the industry's average of 6.5%. The company’s debt to equity ratio has improved significantly from 61.9% to 31.3% over five years, reflecting prudent financial management. With an EBIT coverage of interest payments at 8.5 times, it demonstrates robust profitability and financial health. However, earnings are projected to decline by an average of 9% annually for the next three years, suggesting potential challenges ahead despite trading at a value estimated to be 43% below its fair value estimate.

- Unlock comprehensive insights into our analysis of SPC Samlip stock in this health report.

Understand SPC Samlip's track record by examining our Past report.

Jiangsu Jiuding New Material (SZSE:002201)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangsu Jiuding New Material Co., Ltd. is engaged in the production and sale of glass fiber yarn, fabrics, and FRP products in China, with a market capitalization of CN¥3.84 billion.

Operations: Jiuding's primary revenue stream is derived from its fiberglass and FRP product manufacturing, generating CN¥1.35 billion.

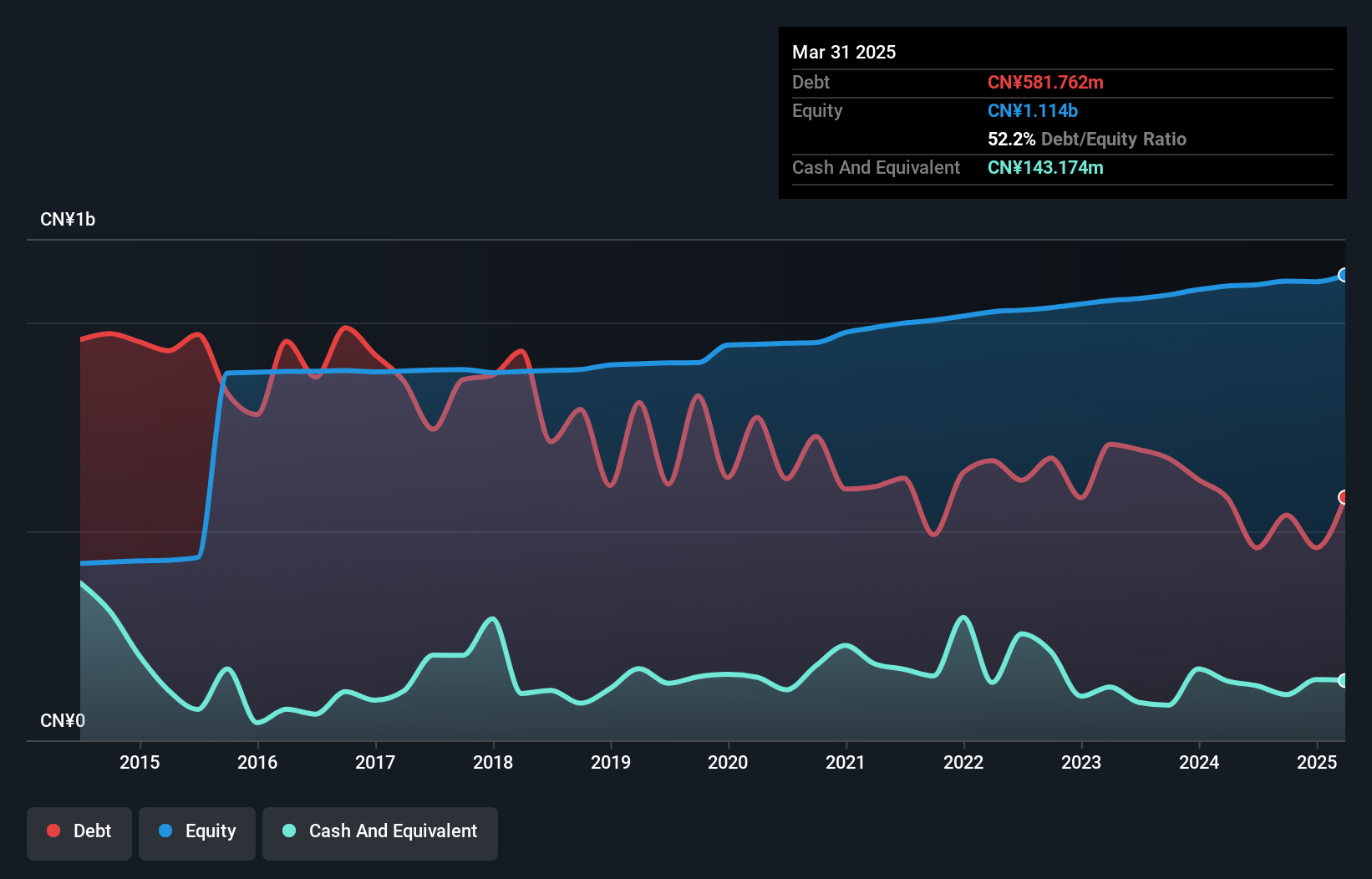

Jiangsu Jiuding New Material, a smaller player in the chemicals sector, has shown resilience despite facing challenges. The company's net debt to equity ratio stands at 45.6%, indicating a high leverage level, while its interest coverage by EBIT is only 2.4x, suggesting some strain in meeting interest obligations. Over the past year, earnings growth was negative at -16.1%, contrasting with the industry average of -4.1%. However, it remains free cash flow positive and has improved its debt to equity ratio from 66.5% to 55.5% over five years, hinting at better financial management ahead despite recent sales and income declines reported for 2024.

TTET Union (TWSE:1232)

Simply Wall St Value Rating: ★★★★★★

Overview: TTET Union Corporation is a soybean crusher with operations in Taiwan, Malaysia, Japan, and internationally, and has a market cap of NT$24.48 billion.

Operations: TTET Union's revenue primarily comes from Big Series Gains, contributing NT$16.57 billion, followed by Master Channels Corporation at NT$5.83 billion. The company experienced a deduction of NT$332.09 million from Income from Internal Divisions.

TTET Union, a smaller player in the food industry, has shown resilience with earnings growing at 1.8% annually over five years. Despite not matching the industry's 12.7% growth last year, it reported a net income of TWD 1.32 billion for 2024, up from TWD 1.20 billion the previous year. The debt-to-equity ratio improved significantly from 3.3 to 1.3 over five years, indicating better financial health and more cash than total debt enhances its stability further. Trading at a substantial discount of around half its estimated fair value suggests potential upside for investors considering this under-the-radar stock.

- Delve into the full analysis health report here for a deeper understanding of TTET Union.

Examine TTET Union's past performance report to understand how it has performed in the past.

Summing It All Up

- Get an in-depth perspective on all 2596 Asian Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005610

Flawless balance sheet with solid track record.

Market Insights

Community Narratives