What Do The Returns At Wei Chuan Foods (TPE:1201) Mean Going Forward?

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. So when we looked at Wei Chuan Foods (TPE:1201) and its trend of ROCE, we really liked what we saw.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Wei Chuan Foods:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.048 = NT$532m ÷ (NT$19b - NT$7.6b) (Based on the trailing twelve months to September 2020).

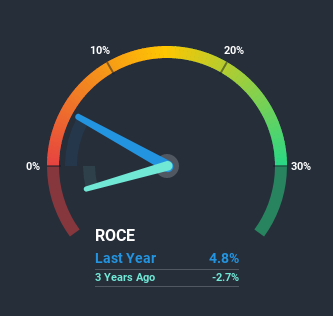

Therefore, Wei Chuan Foods has an ROCE of 4.8%. Ultimately, that's a low return and it under-performs the Food industry average of 8.5%.

View our latest analysis for Wei Chuan Foods

In the above chart we have measured Wei Chuan Foods' prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Wei Chuan Foods here for free.

How Are Returns Trending?

It's great to see that Wei Chuan Foods has started to generate some pre-tax earnings from prior investments. The company was generating losses five years ago, but now it's turned around, earning 4.8% which is no doubt a relief for some early shareholders. At first glance, it seems the business is getting more proficient at generating returns, because over the same period, the amount of capital employed has reduced by 30%. This could potentially mean that the company is selling some of its assets.

One more thing to note, Wei Chuan Foods has decreased current liabilities to 41% of total assets over this period, which effectively reduces the amount of funding from suppliers or short-term creditors. Therefore we can rest assured that the growth in ROCE is a result of the business' fundamental improvements, rather than a cooking class featuring this company's books. However, current liabilities are still at a pretty high level, so just be aware that this can bring with it some risks.The Key Takeaway

From what we've seen above, Wei Chuan Foods has managed to increase it's returns on capital all the while reducing it's capital base. Since the stock has only returned 37% to shareholders over the last five years, the promising fundamentals may not be recognized yet by investors. So with that in mind, we think the stock deserves further research.

If you want to continue researching Wei Chuan Foods, you might be interested to know about the 3 warning signs that our analysis has discovered.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you decide to trade Wei Chuan Foods, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wei Chuan Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1201

Wei Chuan Foods

Engages in the manufacturing, processing, and sale of dairy, beverages, and instant food products in Taiwan, Mainland China, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives