David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Wei Chuan Foods Corporation (TPE:1201) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Wei Chuan Foods

How Much Debt Does Wei Chuan Foods Carry?

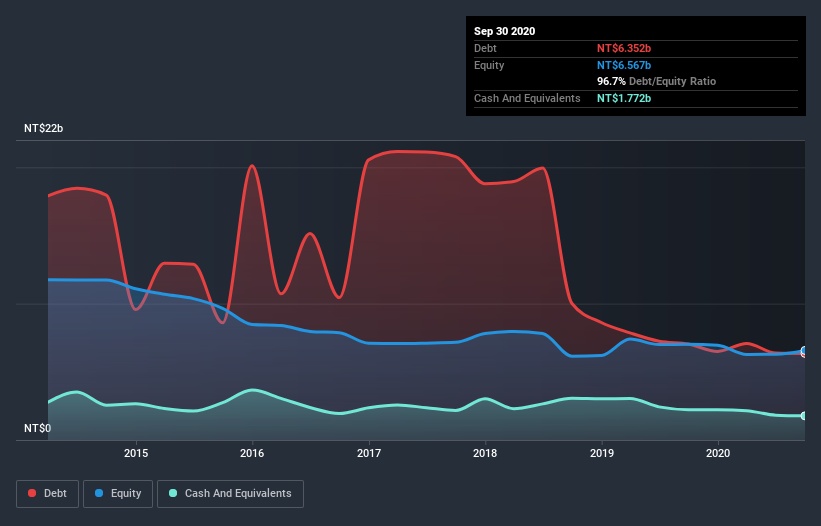

As you can see below, Wei Chuan Foods had NT$6.35b of debt at September 2020, down from NT$7.04b a year prior. However, it does have NT$1.77b in cash offsetting this, leading to net debt of about NT$4.58b.

How Strong Is Wei Chuan Foods' Balance Sheet?

The latest balance sheet data shows that Wei Chuan Foods had liabilities of NT$7.61b due within a year, and liabilities of NT$4.45b falling due after that. Offsetting these obligations, it had cash of NT$1.77b as well as receivables valued at NT$3.07b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by NT$7.21b.

This deficit is considerable relative to its market capitalization of NT$10.2b, so it does suggest shareholders should keep an eye on Wei Chuan Foods' use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Wei Chuan Foods's debt is 3.2 times its EBITDA, and its EBIT cover its interest expense 4.0 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Even more troubling is the fact that Wei Chuan Foods actually let its EBIT decrease by 3.8% over the last year. If that earnings trend continues the company will face an uphill battle to pay off its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Wei Chuan Foods can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Wei Chuan Foods's free cash flow amounted to 43% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

On this analysis Wei Chuan Foods's level of total liabilities and net debt to EBITDA both make us a little nervous. But at least its conversion of EBIT to free cash flow is not so bad. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Wei Chuan Foods stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 3 warning signs with Wei Chuan Foods , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Wei Chuan Foods, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wei Chuan Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1201

Wei Chuan Foods

Engages in the manufacturing, processing, and sale of dairy, beverages, and instant food products in Taiwan, Mainland China, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives