- Taiwan

- /

- Hospitality

- /

- TWSE:2727

Undiscovered Gems With Potential To Explore This November 2024

Reviewed by Simply Wall St

As global markets experience broad-based gains with smaller-cap indexes outperforming large-caps, investors are eyeing opportunities in lesser-known stocks that may benefit from the current economic climate. With U.S. initial jobless claims at a seven-month low and positive sentiment driven by strong labor market and home sales reports, now is an opportune time to explore undiscovered gems that could thrive amid stabilizing conditions and potential interest rate cuts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Al Waha Capital PJSC (ADX:WAHA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Al Waha Capital PJSC is a private equity firm that manages assets across various sectors such as financial services, fintech, healthcare, energy, infrastructure, industrial real estate and capital markets with a market cap of AED2.80 billion.

Operations: Revenue for Al Waha Capital PJSC primarily comes from its private investments, excluding Waha Land, amounting to AED149.88 million.

Al Waha Capital PJSC, a nimble player in the diversified financial sector, has showcased robust performance with a notable 31.6% earnings growth over the past year, outpacing industry trends. Its debt-to-equity ratio has impressively decreased from 140% to 67.7% over five years, indicating effective financial management. The company reported AED 77.56 million in net income for Q3 2024, up from AED 53.63 million the previous year, reflecting solid profitability with basic earnings per share rising to AED 0.041 from AED 0.028. Despite not being free cash flow positive recently, its price-to-earnings ratio of 5.6x suggests good value relative to market peers at 12.9x.

Wowprime (TWSE:2727)

Simply Wall St Value Rating: ★★★★★☆

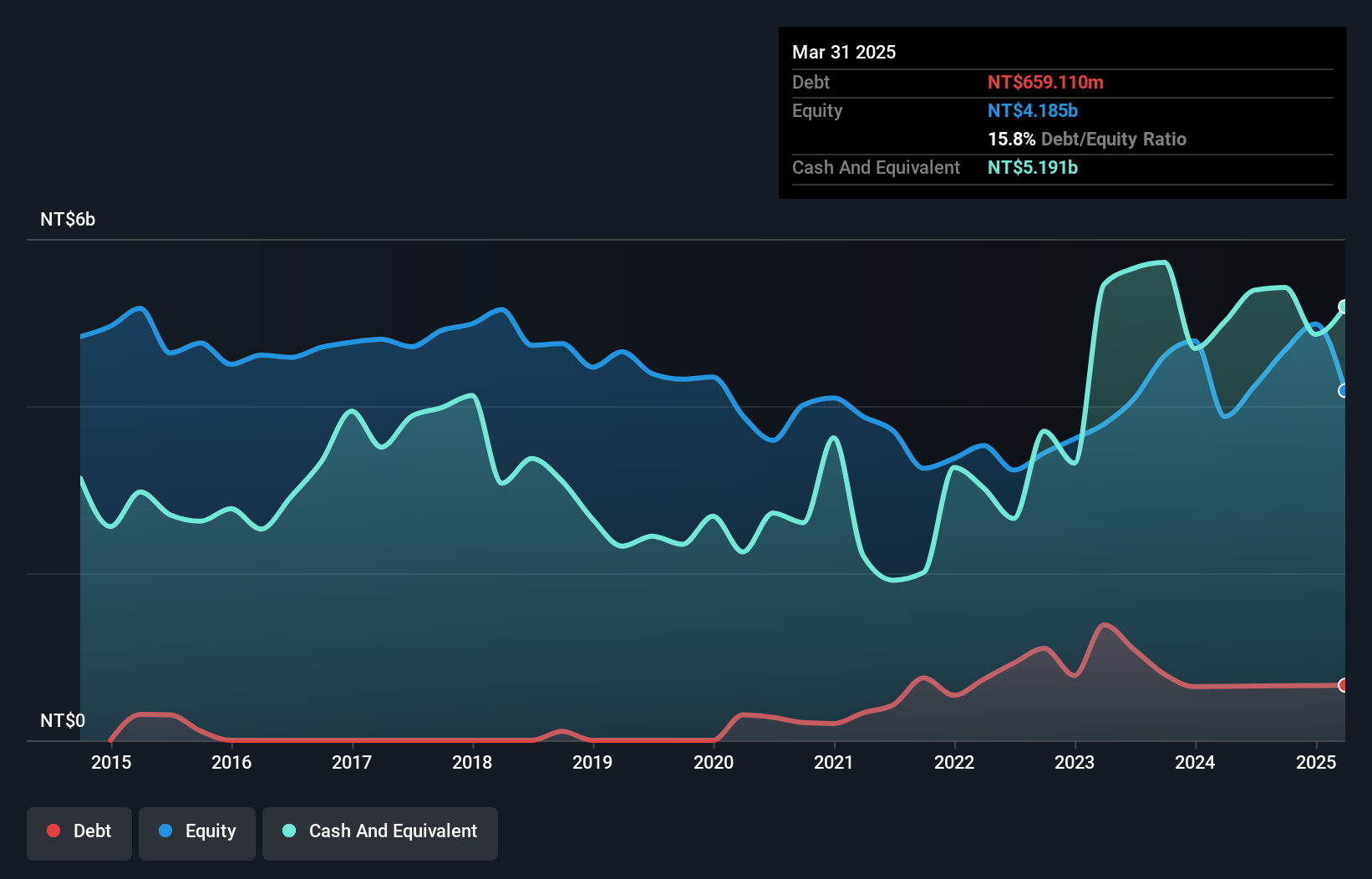

Overview: Wowprime Corp. is a company that operates restaurants and coffee/tea shops in Taiwan and Mainland China, with a market capitalization of NT$19.38 billion.

Operations: The company generates revenue primarily from its operations in Taiwan and Mainland China, with the Taiwan area contributing NT$17.90 billion and the Mainland area NT$4.36 billion to its revenue streams.

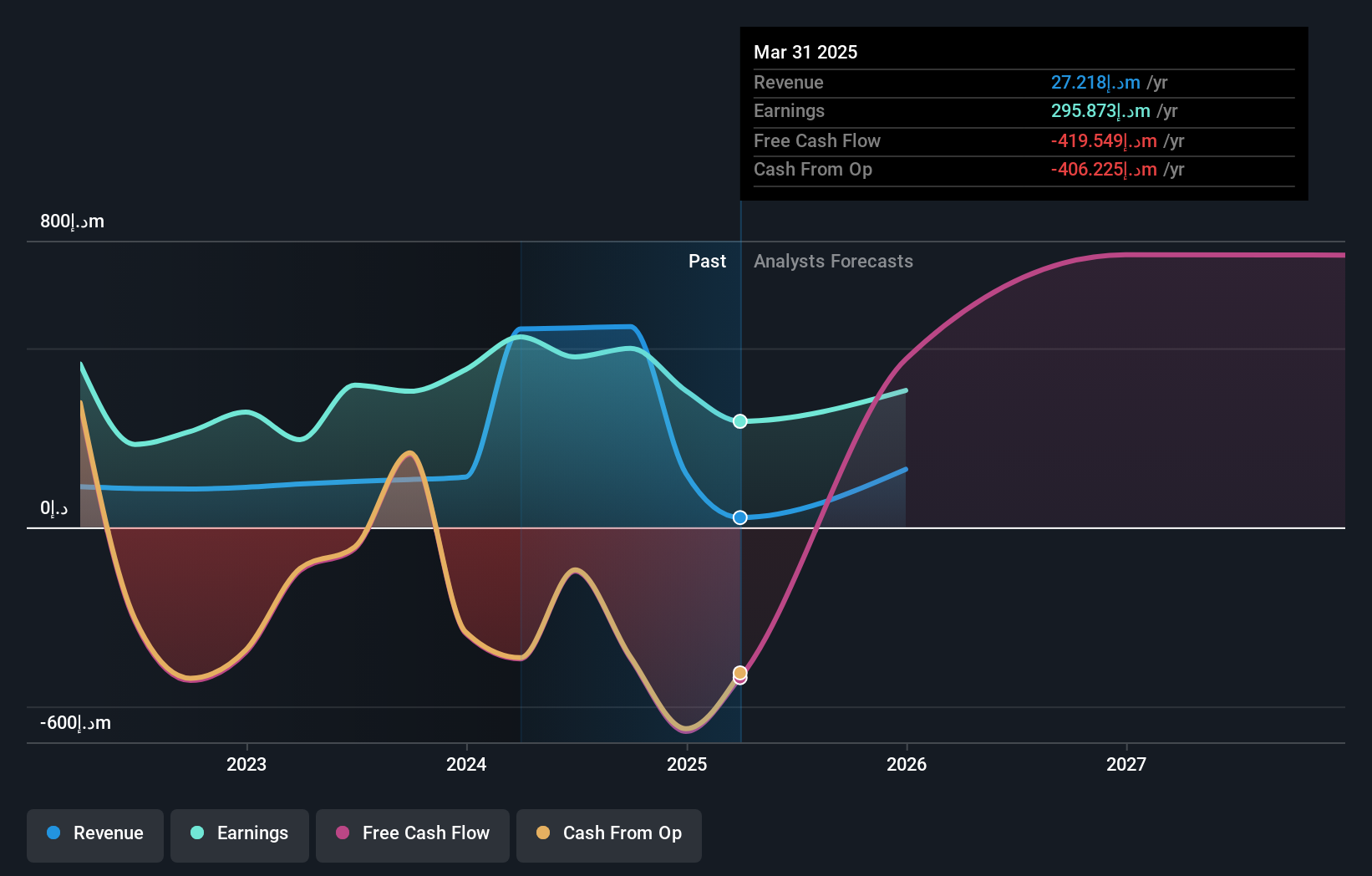

Wowprime, a notable player in the hospitality sector, seems to be navigating challenging waters with its recent earnings report. The company reported third-quarter sales of TWD 5.75 billion, slightly down from TWD 5.82 billion last year. Net income also saw a dip to TWD 362.76 million from TWD 377.71 million previously, reflecting a modest contraction in profitability. Despite these figures, Wowprime's earnings per share from continuing operations remain robust at TWD 4.4 basic and TWD 4.28 diluted for the quarter, showcasing resilience amidst industry headwinds and maintaining investor interest in its potential growth trajectory.

- Get an in-depth perspective on Wowprime's performance by reading our health report here.

Explore historical data to track Wowprime's performance over time in our Past section.

Mühlbauer Holding (XTRA:MUB)

Simply Wall St Value Rating: ★★★★★★

Overview: Mühlbauer Holding AG specializes in the production and personalization of smart cards, passports, solar cells, and RFID solutions across various global markets with a market cap of €522.26 million.

Operations: The company generates revenue primarily from its Automation segment (€230.92 million) and Tecurity® segment (€171.70 million), with additional contributions from Precision Parts & Systems (€53.76 million). The net profit margin is a key metric to consider when analyzing its financial performance, as it provides insight into profitability after accounting for all expenses.

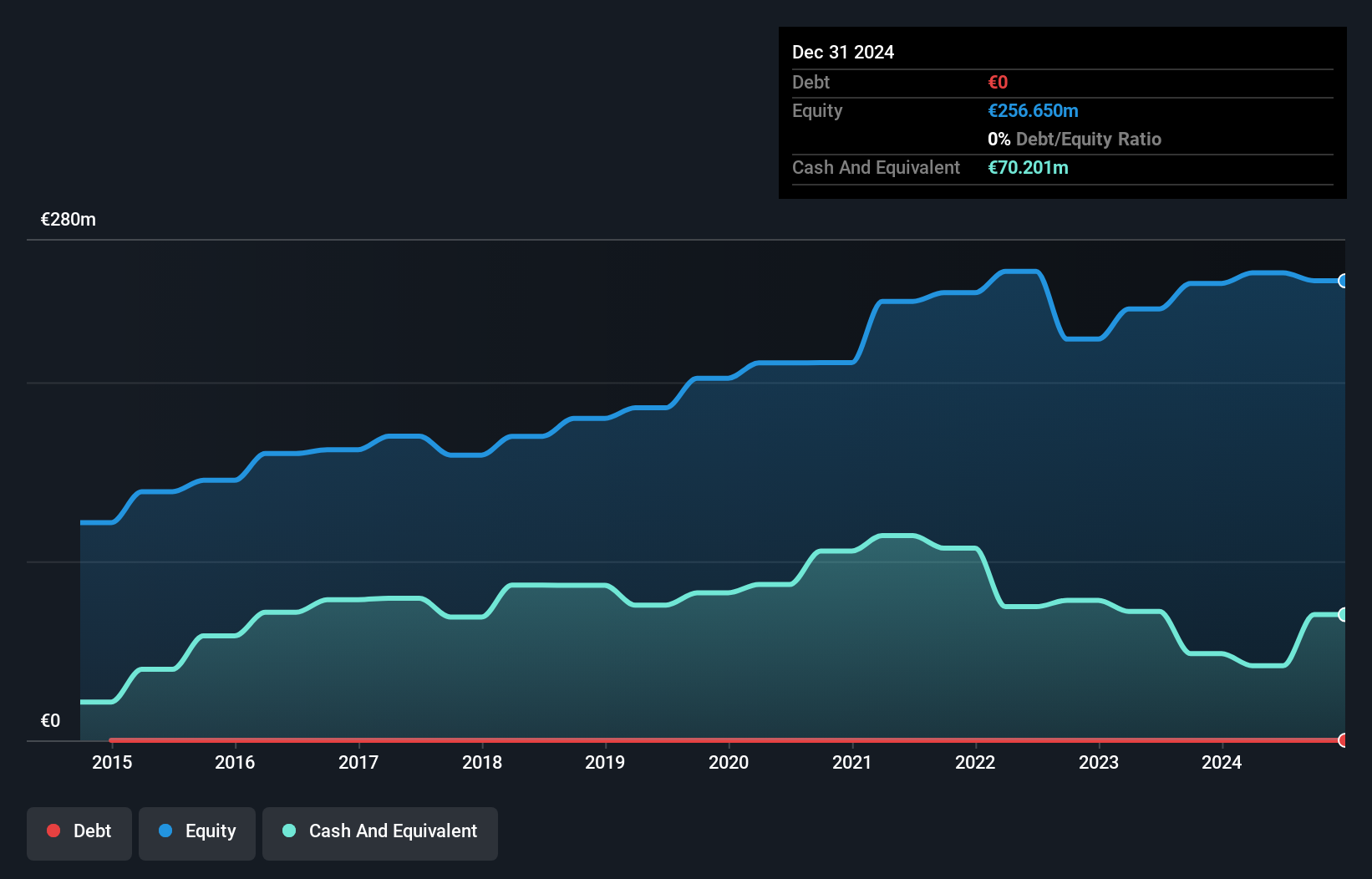

Mühlbauer Holding, a compact player in the machinery sector, showcases impressive financial health with no debt for five years and high-quality earnings. The company has seen a remarkable 174.9% increase in earnings over the past year, significantly outpacing the industry average of -8.6%. However, over five years, its earnings have decreased by 12.7% annually. Despite these fluctuations, Mühlbauer's strong performance last year highlights its potential within its niche market. While specific free cash flow data is unavailable to assess future runway stability, the absence of debt suggests a solid foundation for navigating market challenges ahead.

Seize The Opportunity

- Investigate our full lineup of 4640 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wowprime might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2727

Wowprime

Operates restaurants and coffee/tea shops in Taiwan and Mainland China.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives