David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Green World Hotels Co., Ltd. (GTSM:8077) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Green World Hotels

What Is Green World Hotels's Net Debt?

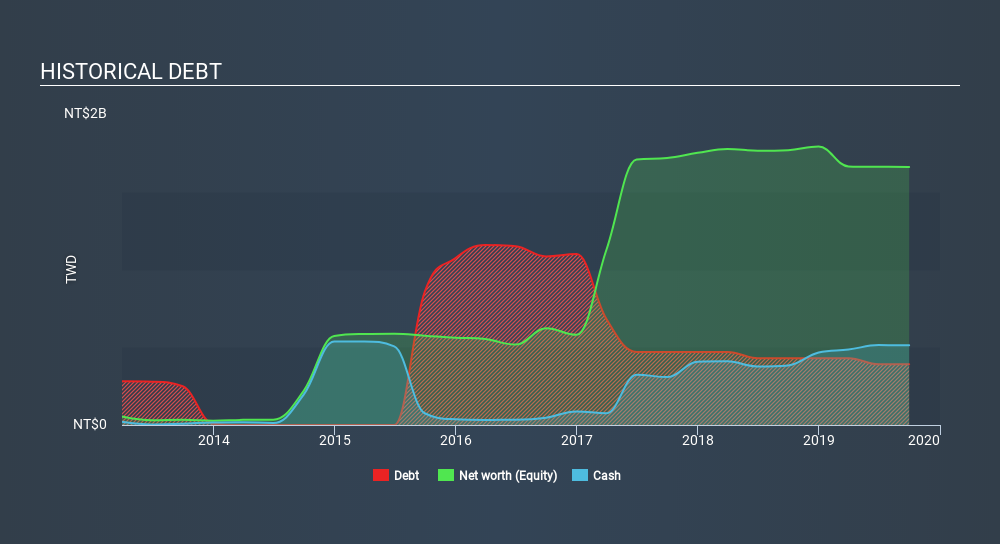

As you can see below, at the end of September 2019, Green World Hotels had NT$390.0m of debt, up from NT$430 a year ago. Click the image for more detail. However, it does have NT$512.6m in cash offsetting this, leading to net cash of NT$122.6m.

A Look At Green World Hotels's Liabilities

According to the last reported balance sheet, Green World Hotels had liabilities of NT$867.9m due within 12 months, and liabilities of NT$3.34b due beyond 12 months. On the other hand, it had cash of NT$512.6m and NT$90.1m worth of receivables due within a year. So it has liabilities totalling NT$3.60b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the NT$1.53b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Green World Hotels would probably need a major re-capitalization if its creditors were to demand repayment. Green World Hotels boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total.

In fact Green World Hotels's saving grace is its low debt levels, because its EBIT has tanked 54% in the last twelve months. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Green World Hotels's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Green World Hotels has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, Green World Hotels actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

While Green World Hotels does have more liabilities than liquid assets, it also has net cash of NT$122.6m. The cherry on top was that in converted 175% of that EBIT to free cash flow, bringing in NT$192m. Despite the cash, we do find Green World Hotels's level of total liabilities concerning, so we're not particularly comfortable with the stock. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 1 warning sign we've spotted with Green World Hotels .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TPEX:8077

Good value with acceptable track record.

Market Insights

Community Narratives