- Taiwan

- /

- Metals and Mining

- /

- TWSE:9958

Exploring Undiscovered Gems in Global Markets July 2025

Reviewed by Simply Wall St

Amid a backdrop of muted responses to new U.S. tariffs and mixed reactions in global markets, small-cap stocks have shown resilience, with indices like the Russell 2000 experiencing modest gains. As investors navigate these complex economic waters, identifying promising opportunities often involves looking beyond headline-grabbing mega-caps to discover lesser-known companies with strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Changjiu Holdings | NA | 11.55% | 10.44% | ★★★★★★ |

| Daphne International Holdings | NA | -40.78% | 85.98% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 15.01% | 0.09% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Tai Sin Electric | 28.69% | 9.56% | 4.66% | ★★★★★☆ |

| Hong Leong Finance | 0.07% | 6.89% | 6.61% | ★★★★★☆ |

| Wison Engineering Services | 41.36% | -3.70% | -15.32% | ★★★★★☆ |

| Sing Investments & Finance | 0.29% | 9.07% | 12.24% | ★★★★☆☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

NIPPON KANZAI HoldingsLtd (TSE:9347)

Simply Wall St Value Rating: ★★★★★★

Overview: NIPPON KANZAI Holdings Co., Ltd. offers building management and operations services in Japan, with a market capitalization of approximately ¥99.12 billion.

Operations: NIPPON KANZAI Holdings Co., Ltd. generates revenue primarily from its Building Management and Operations segment, which contributes ¥85.60 billion, followed by the Housing Management Operating Business at ¥32.18 billion. The Environmental Facilities Management Business adds ¥14.82 billion to the total revenue stream, while Real Estate Fund Management brings in ¥5 billion.

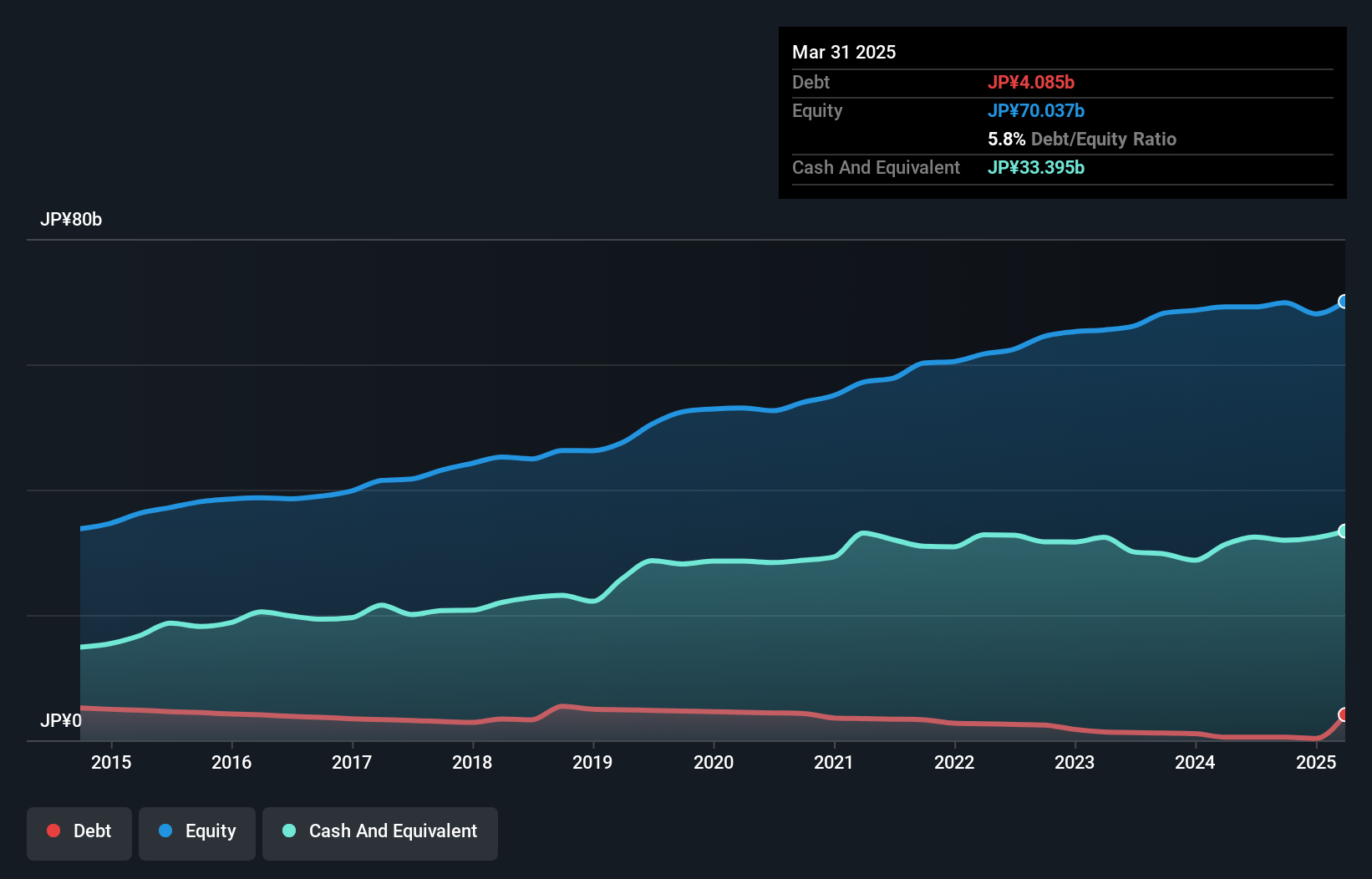

Nippon Kanzai Holdings, a smaller player in the commercial services sector, has shown stable financial management with its debt to equity ratio decreasing from 8.4% to 5.8% over five years and earnings growing at an annual rate of 1.3%. Despite this growth, it lags behind the industry average of 8.7%, suggesting room for improvement. The company remains profitable with high-quality past earnings and sufficient interest coverage, though shares are highly illiquid. Looking ahead, Nippon Kanzai projects full-year net sales of ¥148 billion (around US$1 billion) and operating income of ¥8.7 billion (approximately US$59 million), reflecting steady performance expectations.

Taiwan Paiho (TWSE:9938)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taiwan Paiho Limited specializes in the production and sale of a diverse range of textile-related products, including touch fasteners, digital woven fabrics, and shoelaces, serving both domestic and international markets with a market cap of NT$15.91 billion.

Operations: The company's revenue primarily comes from the Main Sub-Materials and Accessories Segment, generating NT$16.09 billion, while the Construction Sector contributes NT$66.77 million.

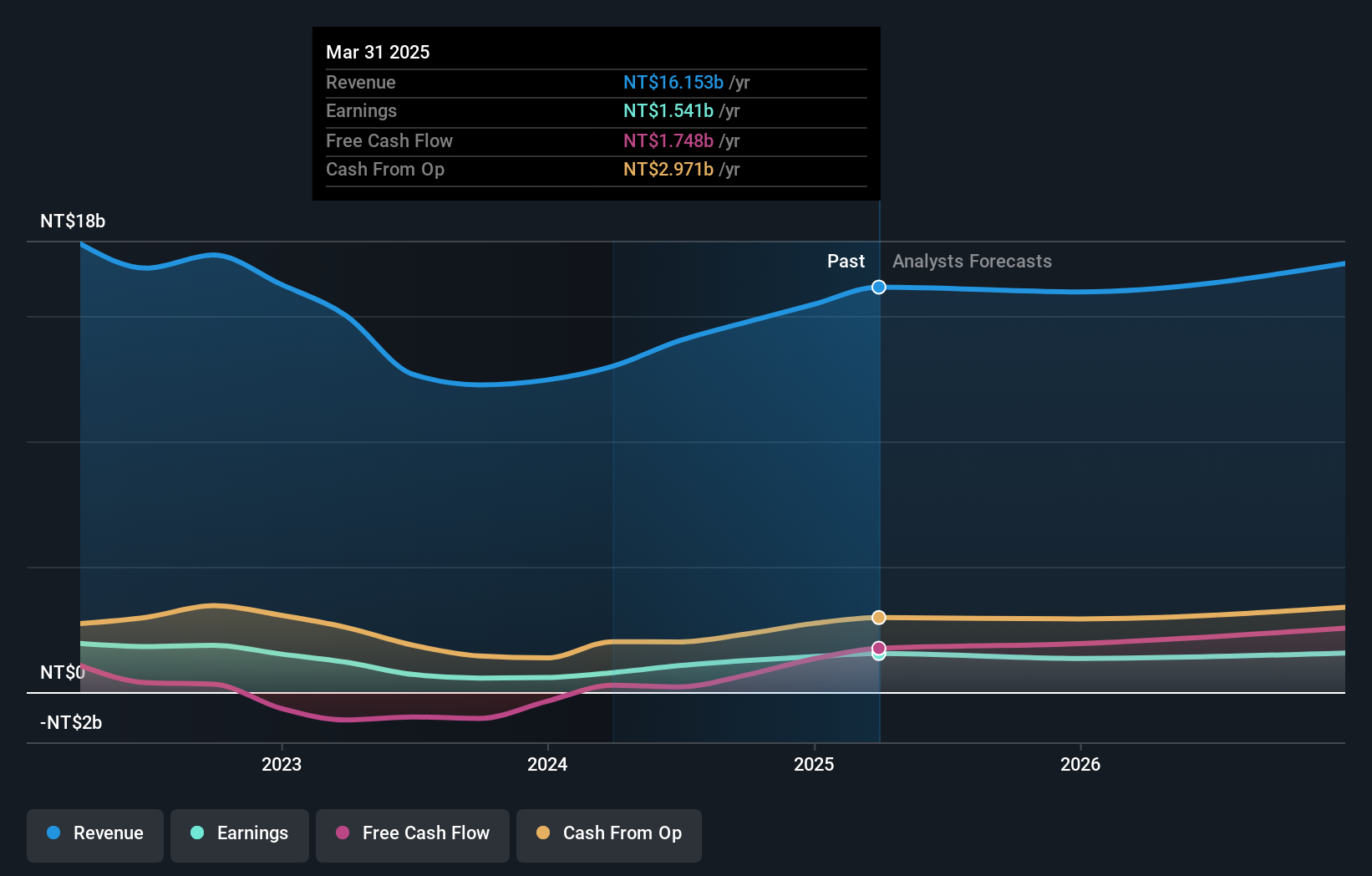

Taiwan Paiho, a small player in the textile industry, has been making waves with its impressive financial strides. Over the past year, earnings surged by 97.9%, far outpacing the luxury sector's growth of 4.9%. The company seems to be trading at a bargain, valued at 65.5% below its estimated fair value. Despite high net debt to equity ratio of 49.1%, interest payments are well covered with EBIT covering them 5.4 times over, indicating robust profitability. Recent sales figures show net income climbing to TWD 457 million from TWD 333 million last year, reflecting strong operational performance amidst market challenges.

- Click here to discover the nuances of Taiwan Paiho with our detailed analytical health report.

Gain insights into Taiwan Paiho's historical performance by reviewing our past performance report.

Century Iron and Steel IndustrialLtd (TWSE:9958)

Simply Wall St Value Rating: ★★★★★☆

Overview: Century Iron and Steel Industrial Co., Ltd. operates in the construction industry, focusing on manufacturing and supplying steel structures, with a market cap of NT$50.38 billion.

Operations: Century Iron and Steel Industrial Co., Ltd. generates revenue primarily from its Building Reinforcing Steel Structure segment, amounting to NT$13.24 billion.

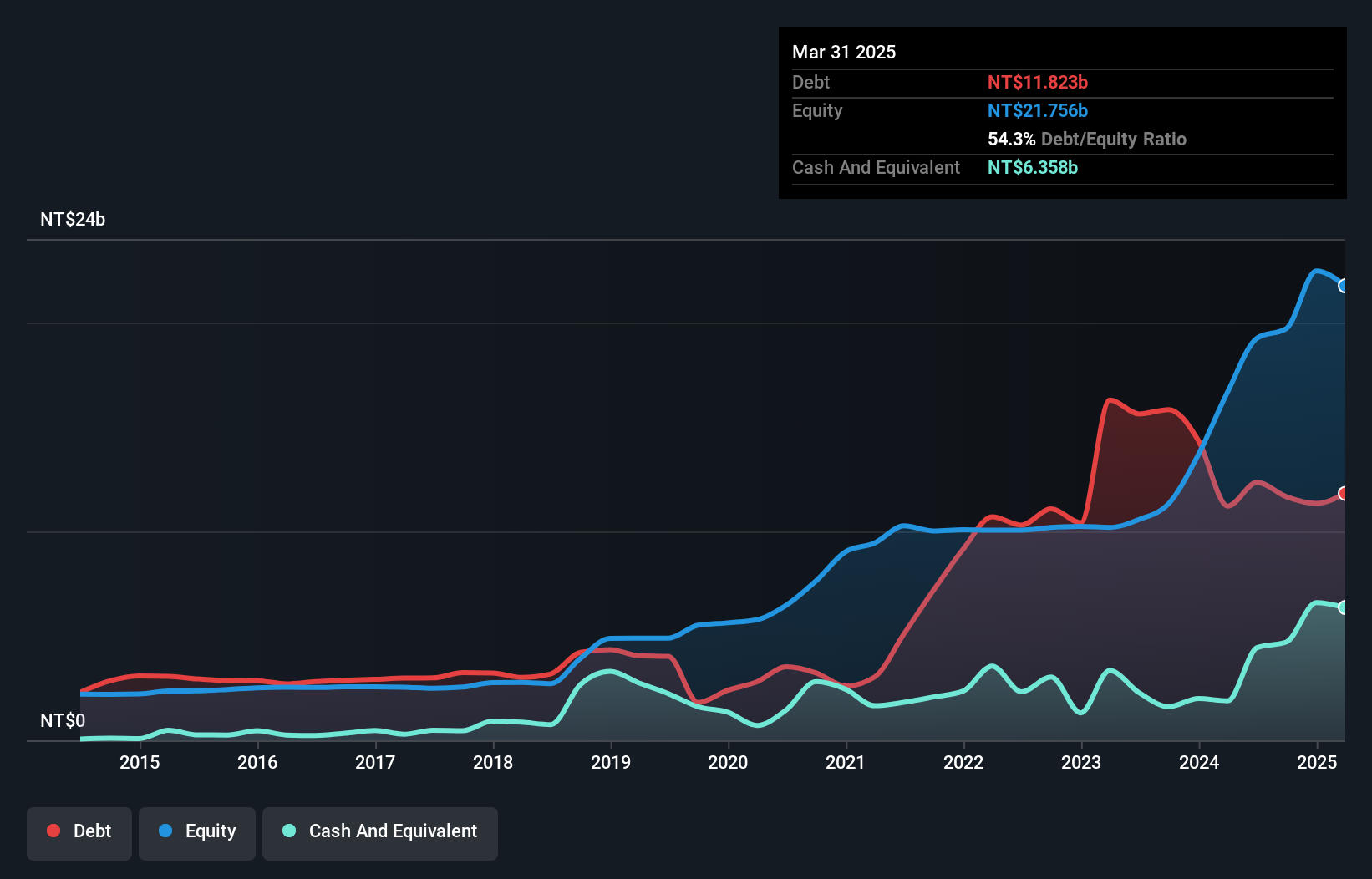

Century Iron and Steel Industrial Co.,Ltd. showcases a balanced financial profile with a net debt to equity ratio of 25.1%, deemed satisfactory, and EBIT covering interest payments 15.3 times over, indicating strong debt management. Despite the recent dip in earnings growth by 10.8%, the company remains profitable with high-quality past earnings and forecasts projecting a robust annual growth rate of over 70%. The firm recently announced a share repurchase program worth TWD 8,338 million to enhance shareholder value, alongside approving TWD 4 per share dividends, reflecting its commitment to shareholder returns despite facing liquidity challenges in trading shares.

Turning Ideas Into Actions

- Discover the full array of 3161 Global Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:9958

Century Iron and Steel IndustrialLtd

Century Iron and Steel Industrial Co.,Ltd.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026