As global markets navigate easing trade tensions and fluctuating economic indicators, investors are increasingly seeking stability amid uncertainty. In this environment, dividend stocks can offer a reliable income stream and potential resilience against market volatility, making them an attractive option for enhancing portfolio diversity.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.92% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.86% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.20% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.16% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.85% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.54% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.21% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.98% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.12% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.34% | ★★★★★★ |

Click here to see the full list of 1538 stocks from our Top Global Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

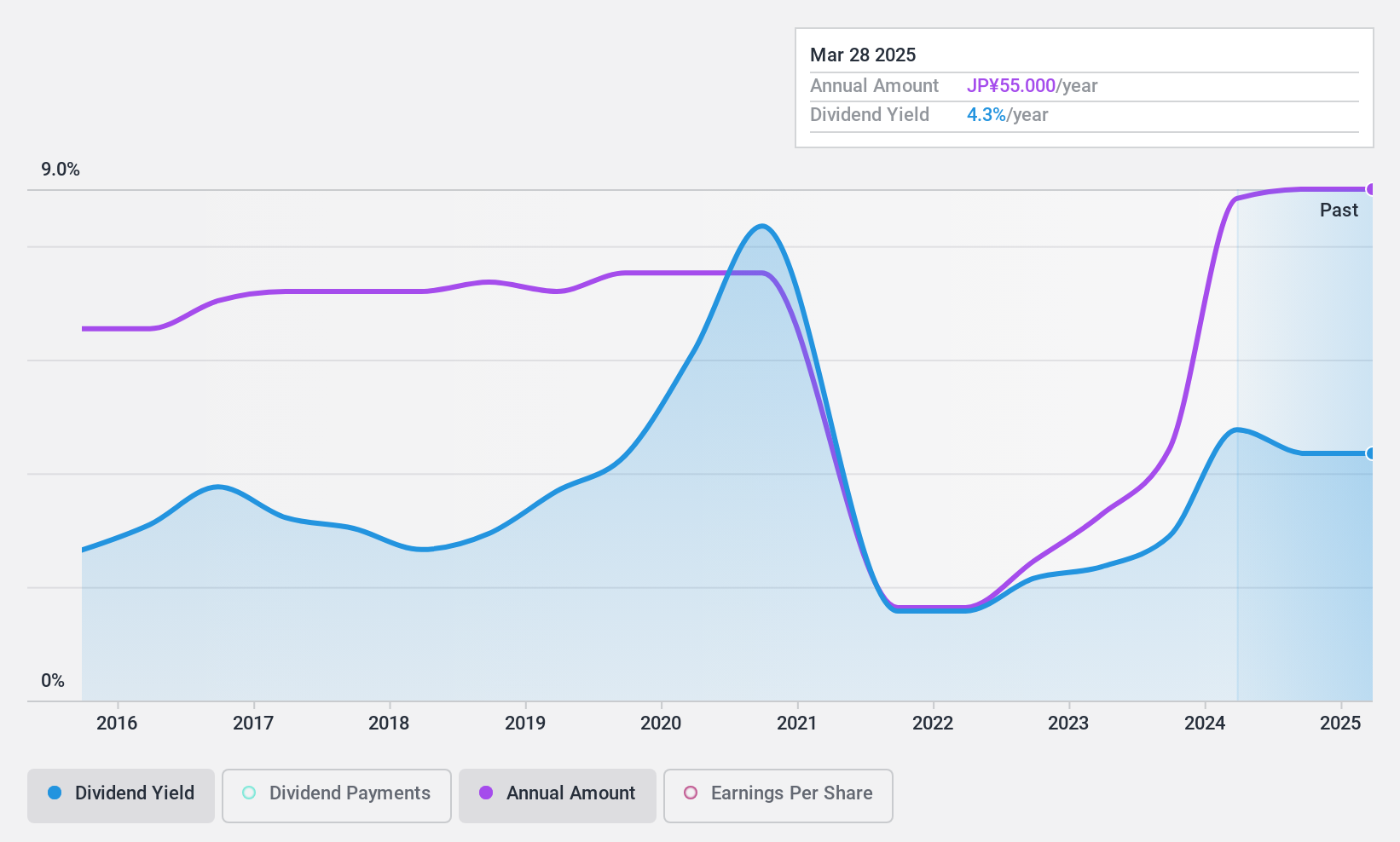

AOKI Holdings (TSE:8214)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AOKI Holdings Inc. operates in the fashion, anniversary and bridal, entertainment, and real estate rental sectors in Japan with a market cap of ¥106.30 billion.

Operations: AOKI Holdings Inc. generates revenue from several segments, including ¥101.20 billion from its Fashion Business, ¥76.47 billion from Entertainment, ¥11.28 billion from Anniversaire and Bridal, and ¥6.79 billion from Real Estate Leasing Business in Japan.

Dividend Yield: 3.9%

AOKI Holdings' dividend payments have been volatile over the past decade, with fluctuations exceeding 20% annually. Despite this instability, dividends are currently well-covered by earnings and cash flows, with payout ratios of 52.4% and 58.3%, respectively. The dividend yield of 3.88% is slightly below the top quartile in Japan's market but remains supported by robust earnings growth of 52.5% annually over five years. Recent board changes may impact strategic focus but do not directly affect dividend policies.

- Get an in-depth perspective on AOKI Holdings' performance by reading our dividend report here.

- The analysis detailed in our AOKI Holdings valuation report hints at an inflated share price compared to its estimated value.

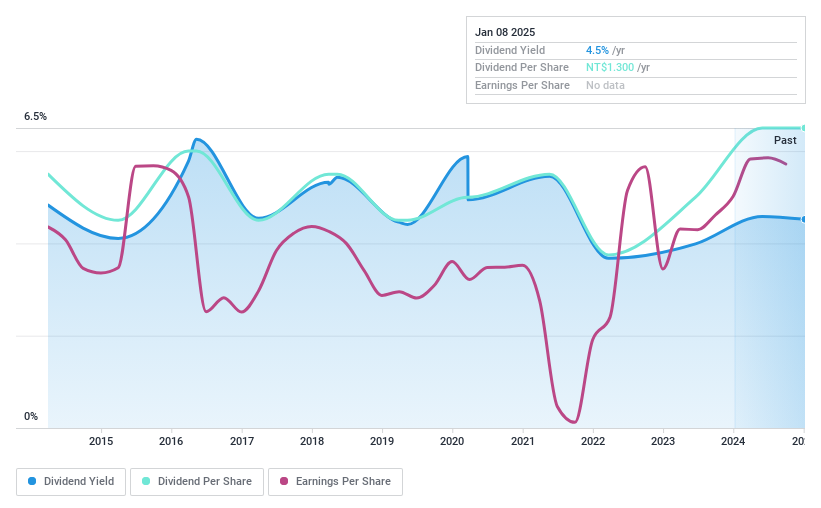

Taiwan Fire & Marine Insurance (TWSE:2832)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiwan Fire & Marine Insurance Co., Ltd. offers a range of insurance products and services in Taiwan, with a market cap of NT$12.42 billion.

Operations: Taiwan Fire & Marine Insurance Co., Ltd. generates revenue primarily from its property insurance segment, amounting to NT$7.22 billion.

Dividend Yield: 3.6%

Taiwan Fire & Marine Insurance's dividend payments have shown volatility over the past decade, though recent increases suggest a positive trend. The dividend yield of 3.57% is below Taiwan's top quartile, yet dividends are well-covered by earnings and cash flows with payout ratios at 42.2% and 41.8%, respectively. Earnings growth has been strong, with net income rising to TWD 1.16 billion in 2024 from TWD 978 million in the previous year, supporting potential future payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Taiwan Fire & Marine Insurance.

- Our valuation report unveils the possibility Taiwan Fire & Marine Insurance's shares may be trading at a premium.

Eastech Holding (TWSE:5225)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eastech Holding Limited, with a market cap of NT$8.07 billion, engages in the research, development, design, assembly, manufacturing, and sale of speakers and electronic entertainment systems across several countries including South Korea and Japan.

Operations: Eastech Holding Limited generates its revenue primarily from its Audio / Video Products segment, which accounts for NT$12.41 billion.

Dividend Yield: 10%

Eastech Holding's dividend yield of 9.97% is among the highest in Taiwan, although past payments have been volatile and unreliable. Despite recent earnings growth, with net income reaching TWD 952.62 million in 2024, the dividend is not well-covered by free cash flows due to a high cash payout ratio of 103.9%. The stock trades at a discount to its estimated fair value but has experienced significant price volatility recently.

- Navigate through the intricacies of Eastech Holding with our comprehensive dividend report here.

- Our valuation report here indicates Eastech Holding may be undervalued.

Where To Now?

- Take a closer look at our Top Global Dividend Stocks list of 1538 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Fire & Marine Insurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2832

Taiwan Fire & Marine Insurance

Provides various insurance products and services in Taiwan.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives