- Taiwan

- /

- Consumer Durables

- /

- TWSE:5225

Eastech Holding (TWSE:5225) Will Pay A Larger Dividend Than Last Year At NT$10.47

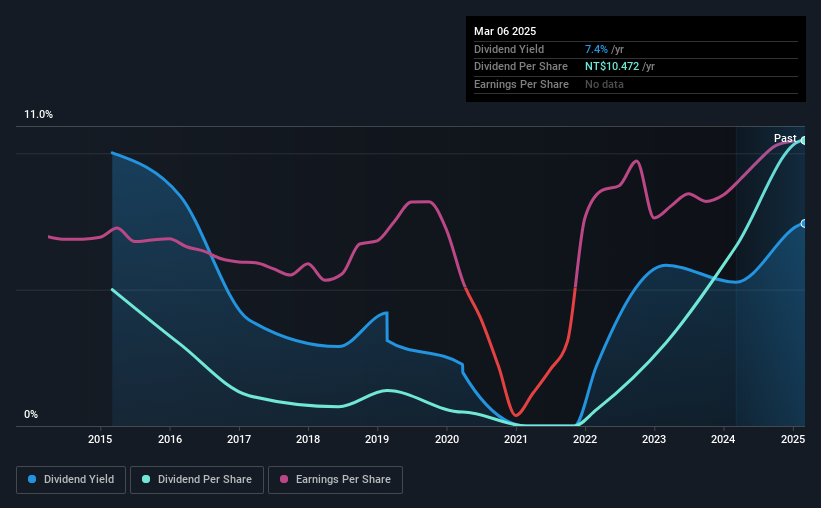

Eastech Holding Limited (TWSE:5225) will increase its dividend from last year's comparable payment on the 22nd of April to NT$10.47. This takes the dividend yield to 7.4%, which shareholders will be pleased with.

Check out our latest analysis for Eastech Holding

Eastech Holding's Payment Could Potentially Have Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. At the time of the last dividend payment, Eastech Holding was paying out a very large proportion of what it was earning and 102% of cash flows. This is certainly a risk factor, as reduced cash flows could force the company to pay a lower dividend.

Over the next year, EPS could expand by 19.7% if recent trends continue. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 73% which brings it into quite a comfortable range.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2015, the annual payment back then was NT$5.00, compared to the most recent full-year payment of NT$10.47. This implies that the company grew its distributions at a yearly rate of about 7.7% over that duration. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. Eastech Holding might have put its house in order since then, but we remain cautious.

Dividend Growth Could Be Constrained

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's encouraging to see that Eastech Holding has been growing its earnings per share at 20% a year over the past five years. EPS has been growing at a reasonable rate, although with most of the profits being paid out to shareholders, growth prospects could be more limited in the future.

The Dividend Could Prove To Be Unreliable

In summary, while it's always good to see the dividend being raised, we don't think Eastech Holding's payments are rock solid. While we generally think the level of distributions are a bit high, we wouldn't rule it out as becoming a good dividend payer in the future as its earnings are growing healthily. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for Eastech Holding that investors should take into consideration. Is Eastech Holding not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Eastech Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:5225

Eastech Holding

Researches, develops, designs, assembles, manufactures, and sells speakers, speaker systems, home electronic entertainment system, and earphones in South Korea, Japan, Sweden, China, Denmark, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026