Investors Could Be Concerned With TST Group Holding's (TWSE:4439) Returns On Capital

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after briefly looking over the numbers, we don't think TST Group Holding (TWSE:4439) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for TST Group Holding:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.10 = NT$405m ÷ (NT$5.5b - NT$1.4b) (Based on the trailing twelve months to March 2024).

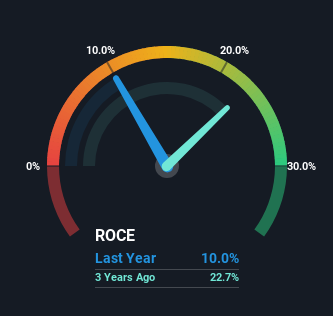

Thus, TST Group Holding has an ROCE of 10.0%. On its own that's a low return, but compared to the average of 1.8% generated by the Luxury industry, it's much better.

View our latest analysis for TST Group Holding

Historical performance is a great place to start when researching a stock so above you can see the gauge for TST Group Holding's ROCE against it's prior returns. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of TST Group Holding.

What The Trend Of ROCE Can Tell Us

In terms of TST Group Holding's historical ROCE movements, the trend isn't fantastic. Over the last five years, returns on capital have decreased to 10.0% from 26% five years ago. And considering revenue has dropped while employing more capital, we'd be cautious. If this were to continue, you might be looking at a company that is trying to reinvest for growth but is actually losing market share since sales haven't increased.

On a related note, TST Group Holding has decreased its current liabilities to 26% of total assets. That could partly explain why the ROCE has dropped. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.

The Key Takeaway

From the above analysis, we find it rather worrisome that returns on capital and sales for TST Group Holding have fallen, meanwhile the business is employing more capital than it was five years ago. Investors haven't taken kindly to these developments, since the stock has declined 11% from where it was three years ago. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

If you'd like to know more about TST Group Holding, we've spotted 2 warning signs, and 1 of them can't be ignored.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you're looking to trade TST Group Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TST Group Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4439

TST Group Holding

Manufactures and sales of cotton fabric in textile industry.

Adequate balance sheet low.

Market Insights

Community Narratives