- Taiwan

- /

- Consumer Durables

- /

- TWSE:1614

Taiwan Sanyo ElectricLtd's (TWSE:1614) 11% CAGR outpaced the company's earnings growth over the same five-year period

When you buy and hold a stock for the long term, you definitely want it to provide a positive return. But more than that, you probably want to see it rise more than the market average. But Taiwan Sanyo Electric Co.,Ltd. (TWSE:1614) has fallen short of that second goal, with a share price rise of 47% over five years, which is below the market return. On a brighter note, more newer shareholders are probably rather content with the 29% share price gain over twelve months.

Since the stock has added NT$1.5b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Taiwan Sanyo ElectricLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

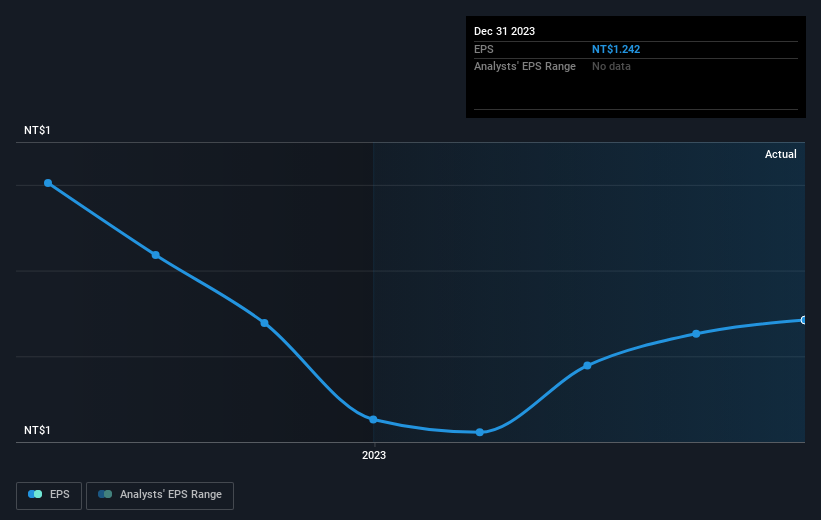

During five years of share price growth, Taiwan Sanyo ElectricLtd achieved compound earnings per share (EPS) growth of 9.8% per year. This EPS growth is higher than the 8% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Taiwan Sanyo ElectricLtd's key metrics by checking this interactive graph of Taiwan Sanyo ElectricLtd's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Taiwan Sanyo ElectricLtd's TSR for the last 5 years was 70%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Taiwan Sanyo ElectricLtd shareholders have received returns of 32% over twelve months (even including dividends), which isn't far from the general market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 11%. It is possible that management foresight will bring growth well into the future, even if the share price slows down. It's always interesting to track share price performance over the longer term. But to understand Taiwan Sanyo ElectricLtd better, we need to consider many other factors. Even so, be aware that Taiwan Sanyo ElectricLtd is showing 1 warning sign in our investment analysis , you should know about...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Sanyo ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1614

Taiwan Sanyo ElectricLtd

Manufactures and sells home appliances in Taiwan and internationally.

Flawless balance sheet low.

Market Insights

Community Narratives