Zig Sheng Industrial (TWSE:1455) pulls back 14% this week, but still delivers shareholders respectable 9.9% CAGR over 5 years

It's been a soft week for Zig Sheng Industrial Co., Ltd. (TWSE:1455) shares, which are down 14%. But the silver lining is the stock is up over five years. In that time, it is up 42%, which isn't bad, but is below the market return of 125%.

In light of the stock dropping 14% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

See our latest analysis for Zig Sheng Industrial

Because Zig Sheng Industrial made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Zig Sheng Industrial saw its revenue shrink by 11% per year. The stock is only up 7% for each year during the period. Arguably that's not bad given the soft revenue and loss-making position. Of course, a closer look at the bottom line - and any available analyst forecasts - could reveal an opportunity (if they point to future growth).

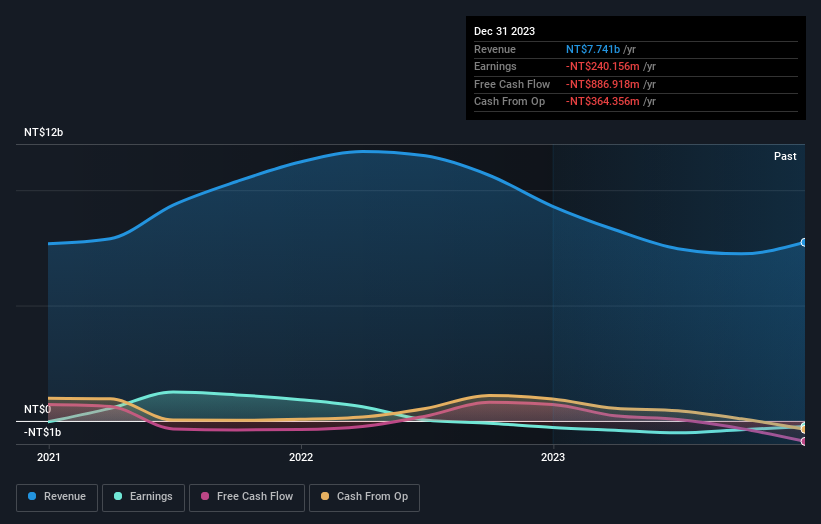

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

We've already covered Zig Sheng Industrial's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Zig Sheng Industrial shareholders, and that cash payout contributed to why its TSR of 60%, over the last 5 years, is better than the share price return.

A Different Perspective

Zig Sheng Industrial shareholders gained a total return of 18% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 10% over half a decade This suggests the company might be improving over time. You could get a better understanding of Zig Sheng Industrial's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zig Sheng Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1455

Zig Sheng Industrial

Engages in the spinning, weaving, dyeing, finishing, printing, buying, and selling of fibers, synthetic cotton, and nylon yarn in Taiwan.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives