Brokers Are Upgrading Their Views On FuSheng Precision Co., Ltd. (TPE:6670) With These New Forecasts

Celebrations may be in order for FuSheng Precision Co., Ltd. (TPE:6670) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects. FuSheng Precision has also found favour with investors, with the stock up a noteworthy 17% to NT$234 over the past week. Could this upgrade be enough to drive the stock even higher?

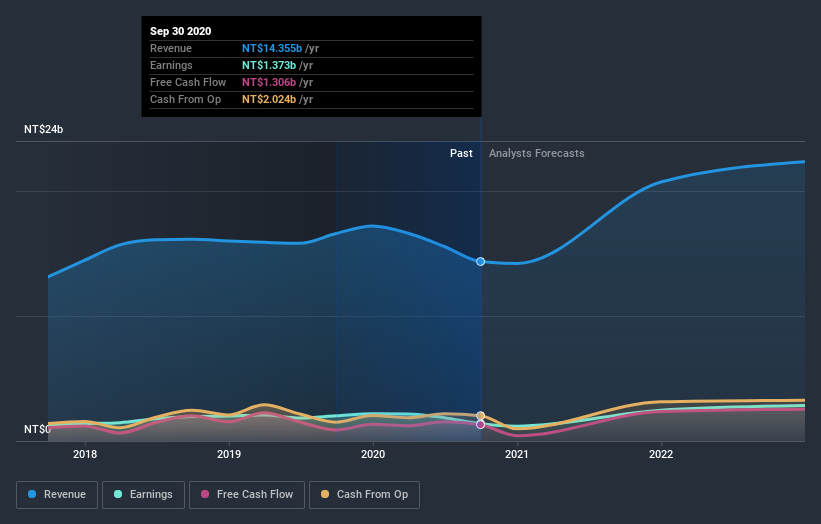

After this upgrade, FuSheng Precision's twin analysts are now forecasting revenues of NT$23b in 2021. This would be a huge 59% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to surge 109% to NT$21.87. Before this latest update, the analysts had been forecasting revenues of NT$18b and earnings per share (EPS) of NT$16.16 in 2021. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

Check out our latest analysis for FuSheng Precision

It will come as no surprise to learn that the analysts have increased their price target for FuSheng Precision 27% to NT$263 on the back of these upgrades. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic FuSheng Precision analyst has a price target of NT$270 per share, while the most pessimistic values it at NT$213. Still, with such a tight range of estimates, it suggests the analysts have a pretty good idea of what they think the company is worth.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the FuSheng Precision's past performance and to peers in the same industry. The analysts are definitely expecting FuSheng Precision's growth to accelerate, with the forecast 45% annualised growth to the end of 2021 ranking favourably alongside historical growth of 2.7% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 12% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect FuSheng Precision to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for next year. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, FuSheng Precision could be worth investigating further.

Using these estimates as a starting point, we've run a discounted cash flow calculation (DCF) on FuSheng Precision that suggests the company could be somewhat undervalued. For more information, you can click through to our platform to learn more about our valuation approach.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading FuSheng Precision or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6670

FuSheng Precision

Engages in the golf and sports equipment businesses in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion