Did Business Growth Power Tainan Enterprise (Cayman)'s (TPE:5906) Share Price Gain of 270%?

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, you can make far more than 100% on a really good stock. For example, the Tainan Enterprise (Cayman) Co., Limited (TPE:5906) share price has soared 270% in the last half decade. Most would be very happy with that. On top of that, the share price is up 36% in about a quarter. But this could be related to the strong market, which is up 16% in the last three months.

Check out our latest analysis for Tainan Enterprise (Cayman)

Given that Tainan Enterprise (Cayman) didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Tainan Enterprise (Cayman) saw its revenue grow at 13% per year. That's a pretty good long term growth rate. Broadly speaking, this solid progress may well be reflected by the healthy share price gain of 30% per year over five years. It's well worth monitoring the growth trend in revenue, because if growth accelerates, that might signal an opportunity. When a growth trend accelerates, be it in revenue or earnings, it can indicate an inflection point for the business, which is can often be an opportunity for investors.

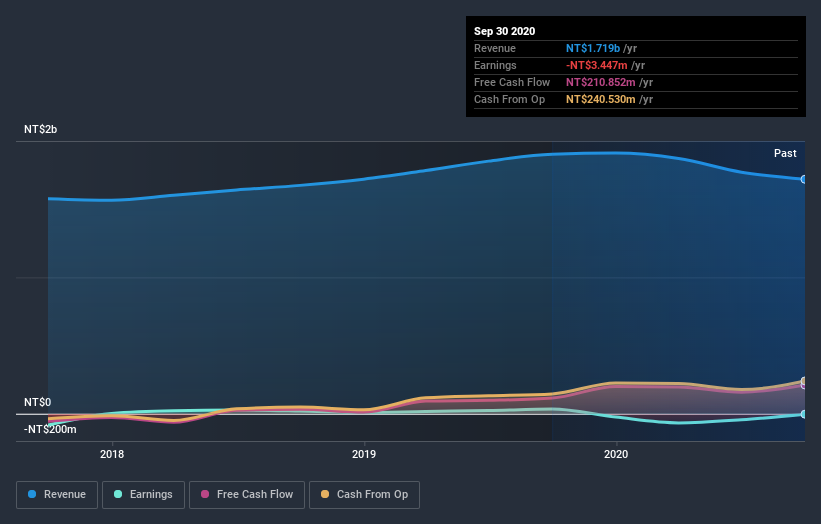

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Tainan Enterprise (Cayman)'s financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Tainan Enterprise (Cayman) shareholders have received a total shareholder return of 129% over the last year. That gain is better than the annual TSR over five years, which is 30%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Tainan Enterprise (Cayman) , and understanding them should be part of your investment process.

Of course Tainan Enterprise (Cayman) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Tainan Enterprise (Cayman), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tainan Enterprise (Cayman) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:5906

Tainan Enterprise (Cayman)

Designs, develops, produces, and sells clothing products in China.

Low risk with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026