- Taiwan

- /

- Consumer Durables

- /

- TWSE:2477

Read This Before Buying Meiloon Industrial Co., Ltd. (TPE:2477) For Its Dividend

Today we'll take a closer look at Meiloon Industrial Co., Ltd. (TPE:2477) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

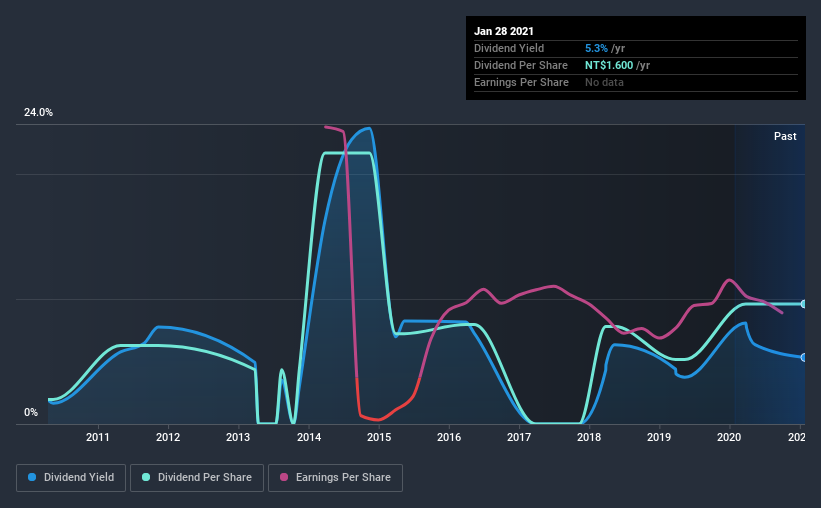

In this case, Meiloon Industrial likely looks attractive to investors, given its 5.3% dividend yield and a payment history of over ten years. It would not be a surprise to discover that many investors buy it for the dividends. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, Meiloon Industrial paid out 114% of its profit as dividends. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Last year, Meiloon Industrial paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

With a strong net cash balance, Meiloon Industrial investors may not have much to worry about in the near term from a dividend perspective.

Consider getting our latest analysis on Meiloon Industrial's financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Meiloon Industrial has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. This dividend has been unstable, which we define as having been cut one or more times over this time. During the past 10-year period, the first annual payment was NT$0.3 in 2011, compared to NT$1.6 last year. This works out to be a compound annual growth rate (CAGR) of approximately 17% a year over that time. The dividends haven't grown at precisely 17% every year, but this is a useful way to average out the historical rate of growth.

It's not great to see that the payment has been cut in the past. We're generally more wary of companies that have cut their dividend before, as they tend to perform worse in an economic downturn.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Meiloon Industrial has grown its earnings per share at 11% per annum over the past five years. With a payout ratio of 114%, Meiloon Industrial is paying out substantially more than it earned in dividends. This is a risky practice.

Conclusion

To summarise, shareholders should always check that Meiloon Industrial's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're a bit uncomfortable with Meiloon Industrial paying out a high percentage of both its cashflow and earnings. We were also glad to see it growing earnings, but it was concerning to see the dividend has been cut at least once in the past. In summary, Meiloon Industrial has a number of shortcomings that we'd find it hard to get past. Things could change, but we think there are likely more attractive alternatives out there.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, Meiloon Industrial has 3 warning signs (and 2 which are potentially serious) we think you should know about.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

When trading Meiloon Industrial or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Meiloon Industrial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2477

Meiloon Industrial

Designs and manufactures speakers in Taiwan, Europe, the United States, Asia, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives