If You Had Bought Eclat Textile (TPE:1476) Stock A Year Ago, You Could Pocket A 94% Gain Today

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick the right individual stocks, you could make more than that. For example, the Eclat Textile Co., Ltd. (TPE:1476) share price is up 94% in the last year, clearly besting the market return of around 73% (not including dividends). That's a solid performance by our standards! Also impressive, the stock is up 35% over three years, making long term shareholders happy, too.

View our latest analysis for Eclat Textile

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year, Eclat Textile actually saw its earnings per share drop 1.1%.

The mild decline in EPS may be a result of the fact that the company is more focused on other aspects of the business, right now. It makes sense to check some of the other fundamental data for an explanation of the share price rise.

Revenue was pretty stable on last year, so deeper research might be needed to explain the share price rise.

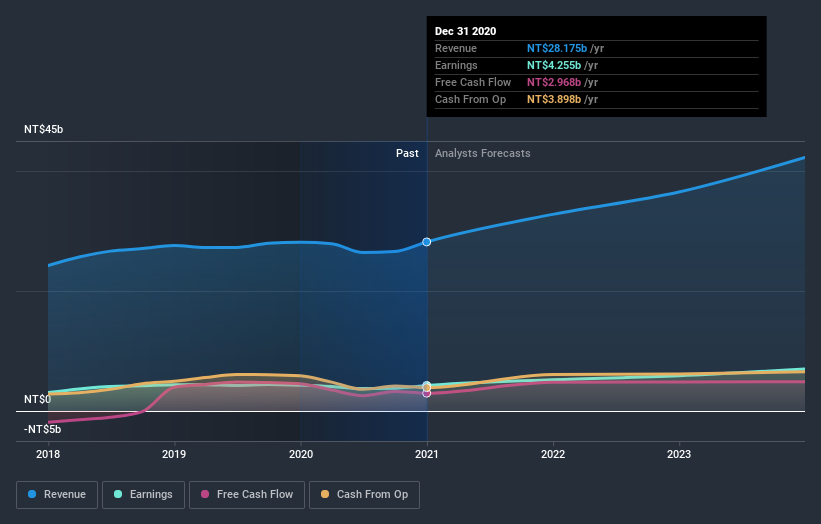

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Eclat Textile is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Eclat Textile the TSR over the last year was 100%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Eclat Textile has rewarded shareholders with a total shareholder return of 100% in the last twelve months. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 6% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Eclat Textile .

Of course Eclat Textile may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading Eclat Textile or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eclat Textile might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1476

Eclat Textile

Engages in the design, manufactures, processing, dyeing, trade, marketing, and sale of elastic knitted fabrics, garments, and clothing in Taiwan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives