- Sweden

- /

- Professional Services

- /

- OM:BTS B

Three Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

In a week marked by volatility, global markets have been influenced by fluctuating corporate earnings and geopolitical developments, with U.S. stocks experiencing mixed results and European indices reaching new highs following interest rate adjustments. Amid these dynamic conditions, investors are increasingly seeking opportunities in lesser-known small-cap stocks that may offer unique growth potential despite broader market uncertainties. Identifying a good stock often involves looking for companies with solid fundamentals and innovative offerings that can thrive even when larger sectors face headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

BTS Group (OM:BTS B)

Simply Wall St Value Rating: ★★★★★☆

Overview: BTS Group AB (publ) is a professional services firm with a market capitalization of approximately SEK5.55 billion.

Operations: BTS Group AB generates revenue primarily from BTS North America, contributing SEK1.53 billion, followed by BTS Other Markets and BTS Europe at SEK829.95 million and SEK558.39 million respectively. Advantage Performance Group adds SEK157.62 million to the revenue stream, while segment adjustments account for a reduction of SEK298.25 million.

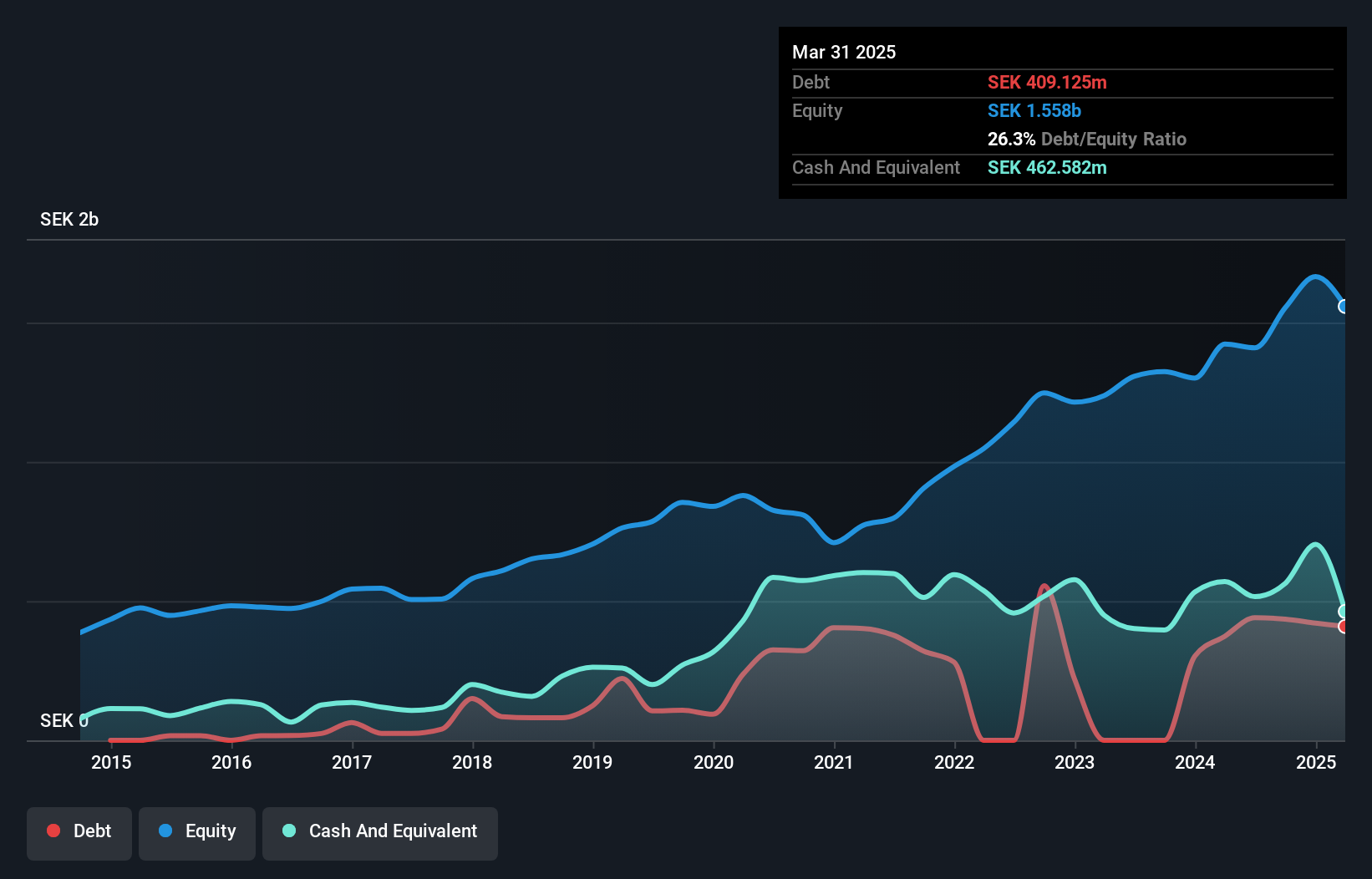

BTS Group's recent performance paints an intriguing picture, with earnings surging 138.8% over the past year, overshadowing the Professional Services industry's growth of 26.9%. Despite a one-off gain of SEK222.6 million influencing results, the company remains profitable and boasts more cash than total debt, with interest payments well-covered at 9.6 times EBIT. Revenue for Q3 reached SEK657 million compared to SEK633 million last year, while net income jumped to SEK189 million from SEK22 million. However, future earnings are expected to decline by an average of 18.5% annually over the next three years despite revenue forecasts showing a potential increase of nearly 10%.

Automatic Bank Services (TASE:SHVA)

Simply Wall St Value Rating: ★★★★★★

Overview: Automatic Bank Services Limited operates payment systems for international debit cards in Israel and has a market cap of ₪1.06 billion.

Operations: The company generates revenue through its payment systems for international debit cards in Israel. It has a market cap of ₪1.06 billion, reflecting its scale within the financial services sector.

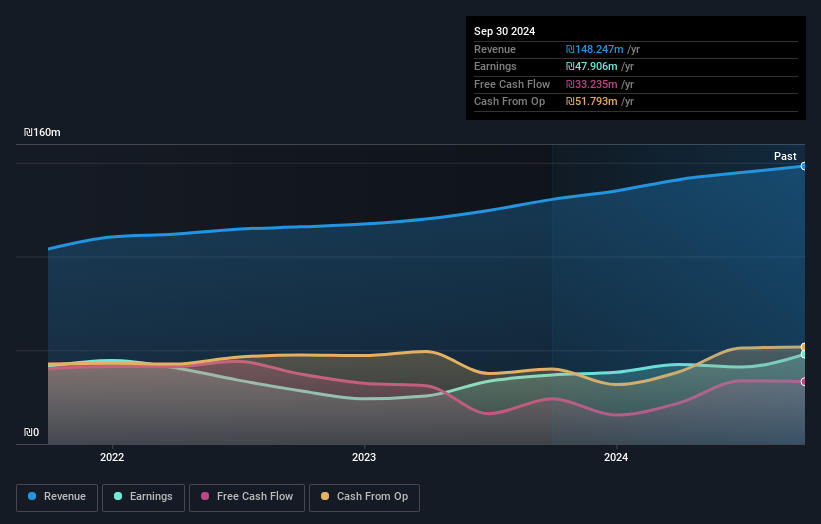

Automatic Bank Services, a nimble player in the financial sector, recently reported impressive earnings growth of 30.2%, outpacing its industry peers by a significant margin. The company is debt-free and has maintained this status for the past five years, ensuring that interest coverage is not an issue. Its net income rose to ILS 15.55 million for Q3 2024 from ILS 8.69 million the previous year, with basic earnings per share increasing to ILS 0.39 from ILS 0.22 over the same period. These figures highlight robust performance and suggest potential for continued success in its market niche.

- Take a closer look at Automatic Bank Services' potential here in our health report.

Understand Automatic Bank Services' track record by examining our Past report.

Wiselink (TPEX:8932)

Simply Wall St Value Rating: ★★★★★★

Overview: Wiselink Co., Ltd. manufactures and sells zippers globally under the MAX Zipper brand name, with a market capitalization of NT$16.36 billion.

Operations: Wiselink's revenue is primarily derived from the Asia Pacific regions, with notable contributions from Taiwan (NT$397.80 million) and Mainland China (NT$475.96 million). The company has a market capitalization of NT$16.36 billion.

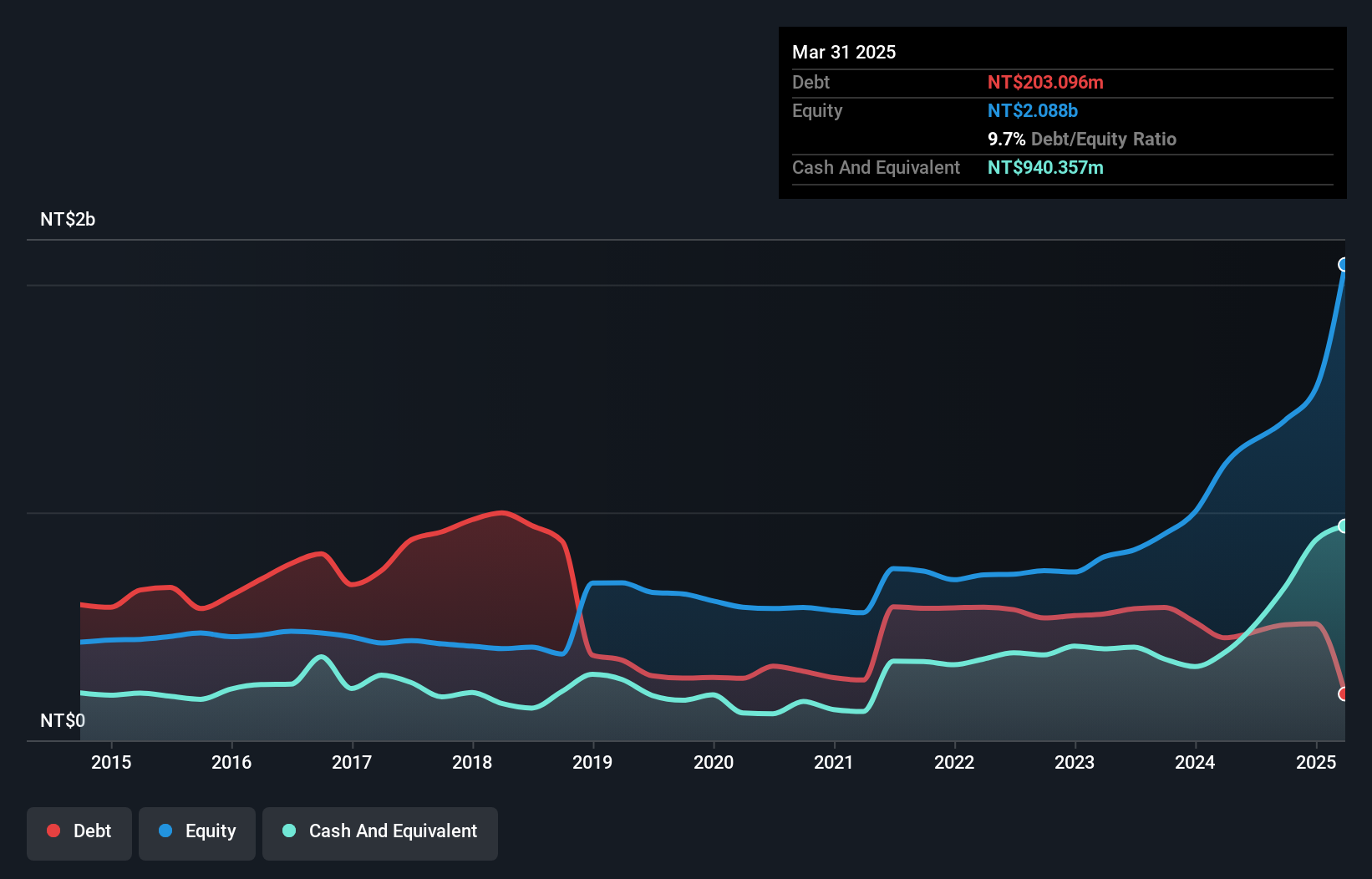

Wiselink, a smaller player in the market, is showing impressive growth with earnings surging by 630% over the past year, outpacing industry averages. The company has been proactive with its capital structure; its debt to equity ratio improved from 42.5% to 36.1% in five years and it trades at a significant discount of 36.8% below estimated fair value. Recent financials reflect solid performance: third-quarter sales reached TWD 169 million and net income hit TWD 33 million, both up from last year’s figures. However, shareholders experienced dilution due to a follow-on equity offering of four million shares recently filed by Wiselink.

- Click here and access our complete health analysis report to understand the dynamics of Wiselink.

Gain insights into Wiselink's historical performance by reviewing our past performance report.

Make It Happen

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4678 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BTS Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BTS B

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives