As global markets navigate the complexities of tariff uncertainties and fluctuating economic indicators, investors are increasingly seeking stability amid volatility. With U.S. stocks ending the week lower and concerns about trade policies affecting sentiment, dividend stocks can offer a measure of reliability through consistent income streams. In such an environment, selecting dividend stocks with strong fundamentals and attractive yields can be a prudent strategy for those looking to balance risk while generating income.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.83% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.85% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.45% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.11% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.90% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.35% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

Click here to see the full list of 1971 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Kwong Lung Enterprise (TPEX:8916)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kwong Lung Enterprise Co., Ltd. manufactures and sells apparel in Taiwan, China, Vietnam, and Japan with a market cap of NT$8.98 billion.

Operations: Kwong Lung Enterprise Co., Ltd.'s revenue is primarily derived from Ready-To-Wear Clothing at NT$4.45 billion, Raw Dawn Material at NT$1.74 billion, and Home Textiles at NT$1.47 billion.

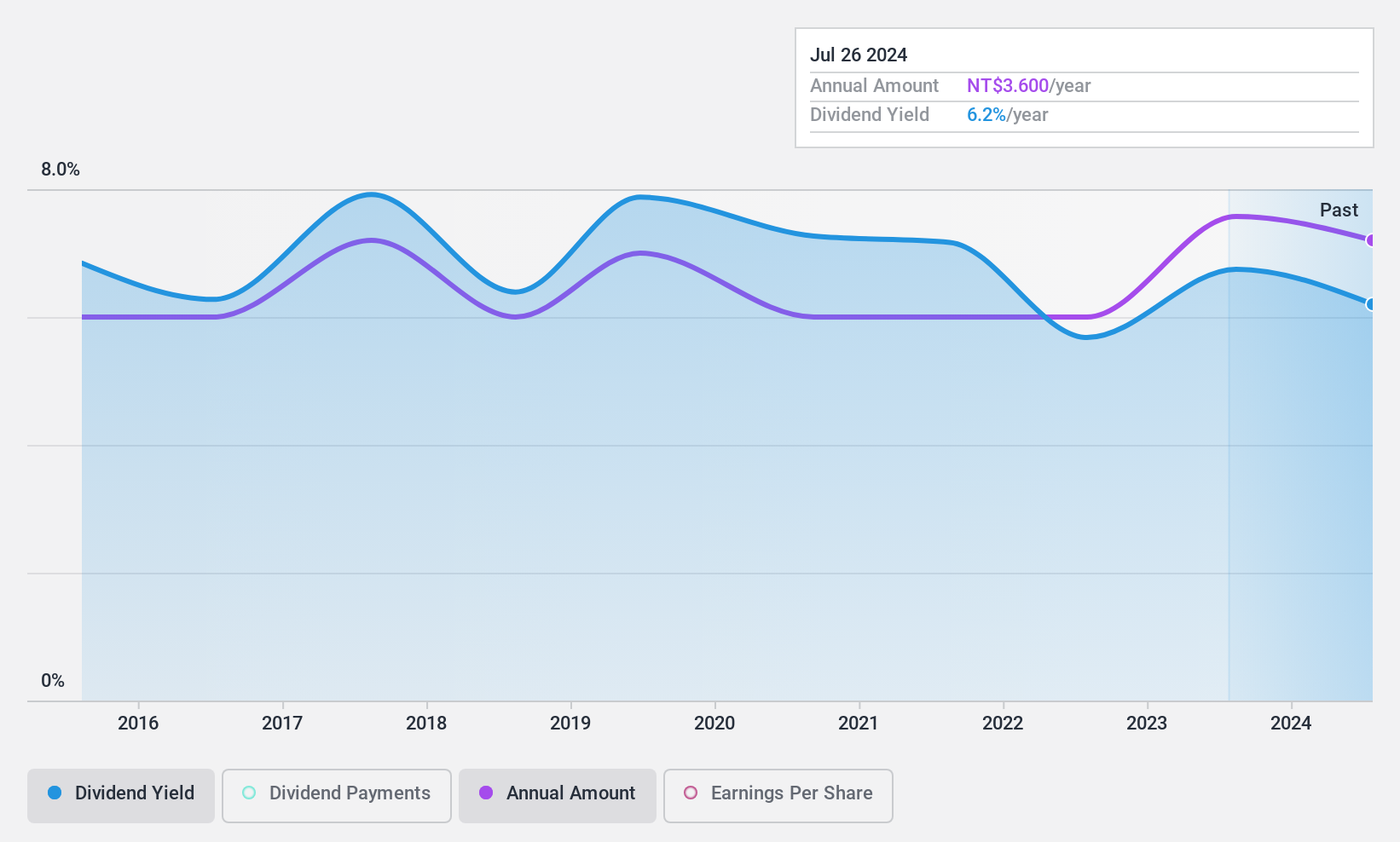

Dividend Yield: 6%

Kwong Lung Enterprise offers a high dividend yield of 6.02%, placing it in the top 25% of Taiwan's market. However, its dividends are not well-covered by earnings or cash flows, with a payout ratio of 98.8% and a cash payout ratio of 125.1%. Despite this, dividends have been stable and growing over the past decade with minimal volatility. The stock is valued attractively with a P/E ratio below the market average at 16.5x.

- Click here to discover the nuances of Kwong Lung Enterprise with our detailed analytical dividend report.

- According our valuation report, there's an indication that Kwong Lung Enterprise's share price might be on the expensive side.

Soken Chemical & Engineering (TSE:4972)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Soken Chemical & Engineering Co., Ltd. manufactures and sells acrylic pressure-sensitive adhesives, functional polymers, organic fine particles, and adhesive tapes in Japan, China, and internationally with a market cap of ¥26.24 billion.

Operations: Soken Chemical & Engineering Co., Ltd.'s revenue segments include the production and sale of acrylic pressure-sensitive adhesives, functional polymers, organic fine particles, and adhesive tapes across Japan, China, and international markets.

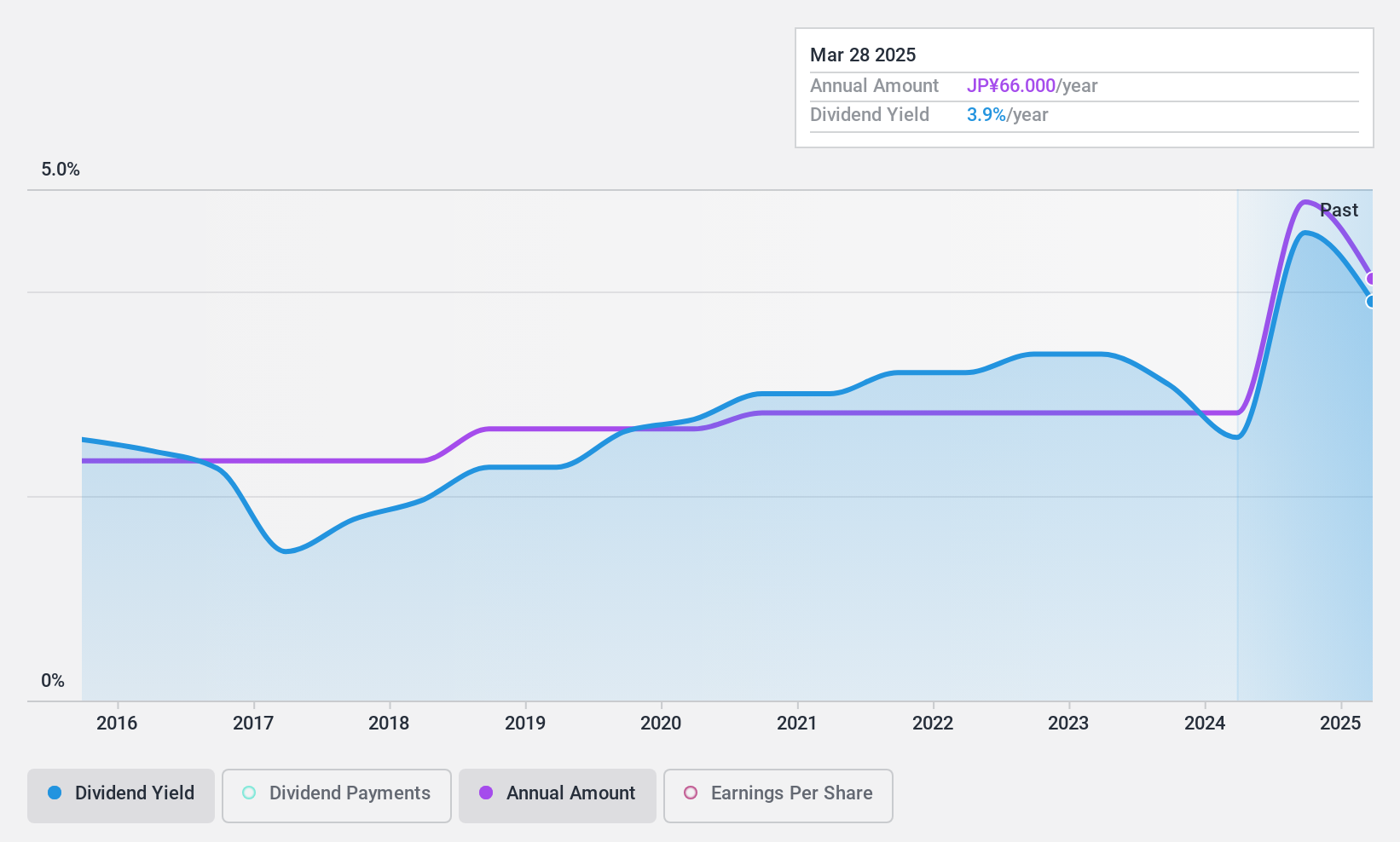

Dividend Yield: 3%

Soken Chemical & Engineering's dividend yield of 3.01% is below the top 25% in Japan, with a history of volatility and unreliability over the past decade. Despite this, dividends are well covered by earnings and cash flows, with low payout ratios of 18.6% and 19.6%, respectively. The company trades at a significant discount to its estimated fair value and shows strong earnings growth, enhancing its appeal despite an unstable dividend track record.

- Unlock comprehensive insights into our analysis of Soken Chemical & Engineering stock in this dividend report.

- Upon reviewing our latest valuation report, Soken Chemical & Engineering's share price might be too pessimistic.

Hokkan Holdings (TSE:5902)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hokkan Holdings Limited operates through its subsidiaries in the container, filling, and machinery production sectors in Taiwan and has a market cap of ¥20.66 billion.

Operations: Hokkan Holdings Limited generates revenue through its operations in container production, filling services, and machinery manufacturing in Taiwan.

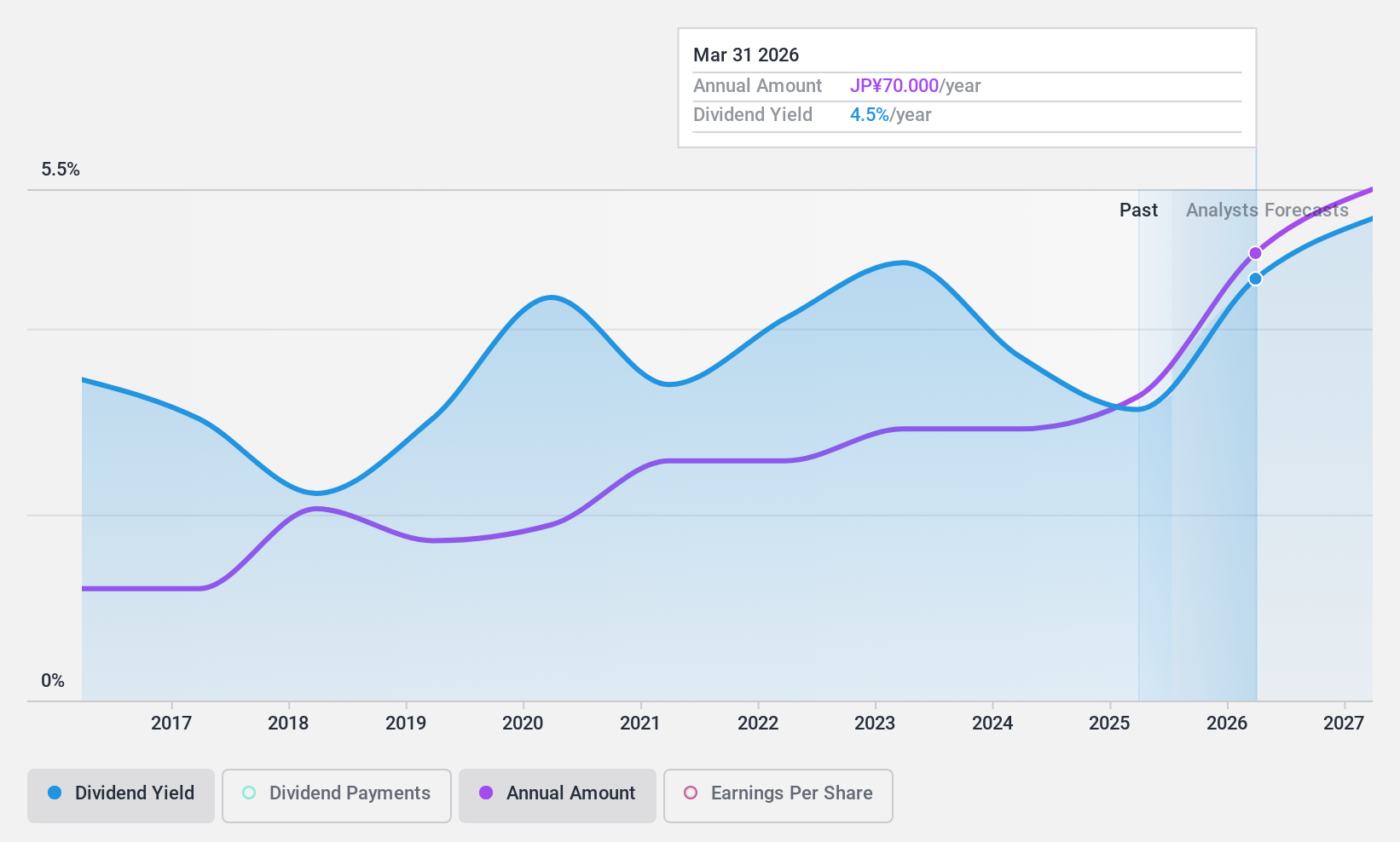

Dividend Yield: 3.9%

Hokkan Holdings' dividend yield of 3.94% ranks in the top 25% of Japanese dividend payers, yet its dividends have been volatile over the past decade. Despite this instability, dividends are well covered by earnings and cash flows with low payout ratios of 32.3% and 12.3%, respectively. The company faces challenges with a high debt level but trades at a substantial discount to its estimated fair value, offering potential value for investors seeking growth opportunities.

- Take a closer look at Hokkan Holdings' potential here in our dividend report.

- The analysis detailed in our Hokkan Holdings valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Dive into all 1971 of the Top Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hokkan Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5902

Hokkan Holdings

Through its subsidiaries, engages in the container, filling, and machinery production, and other businesses in Japan and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)