As global markets experience a mix of record highs and inflationary pressures, investors are keenly observing the shifting dynamics across various indices. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to navigate market volatility while benefiting from steady cash flows.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.92% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.33% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

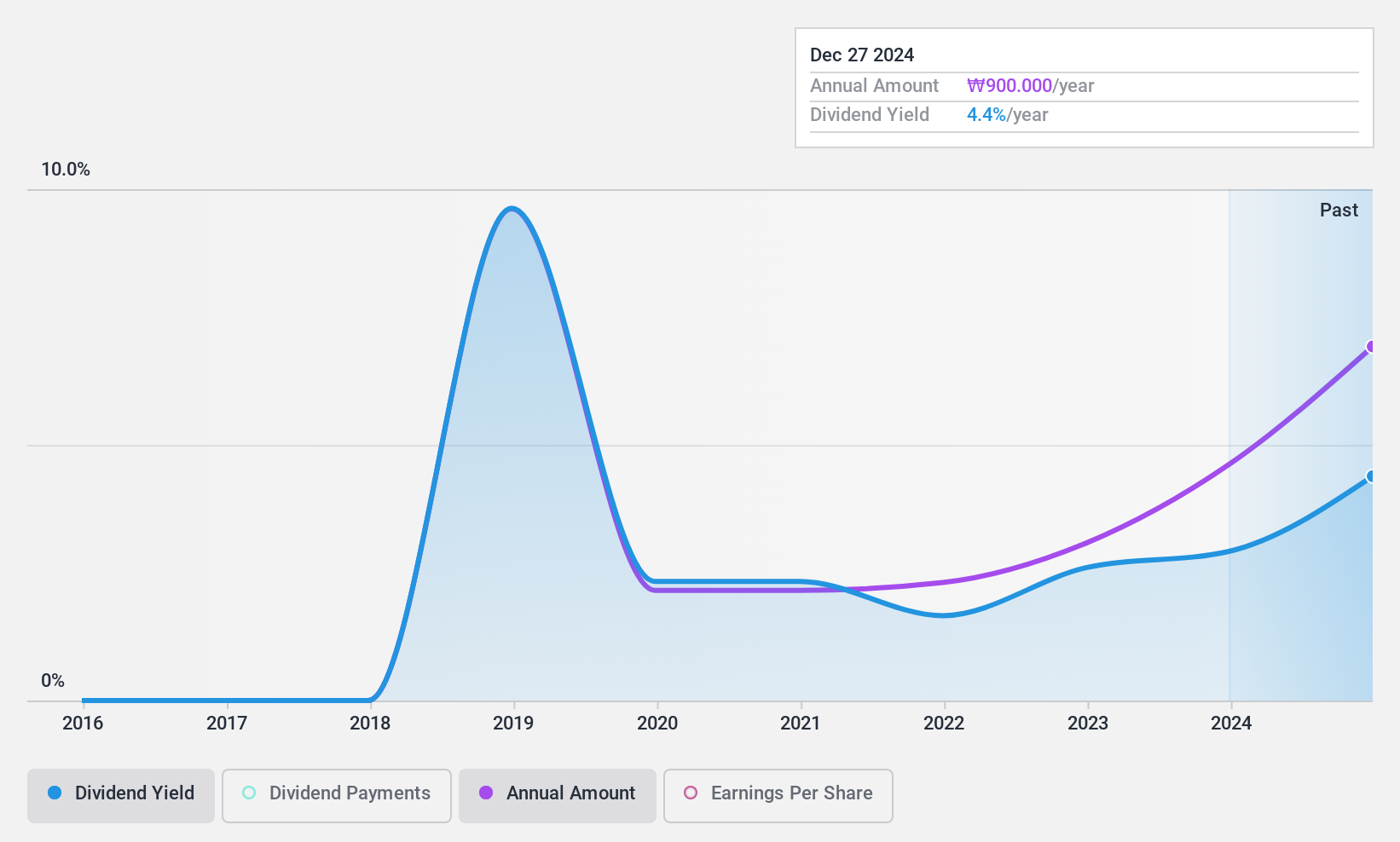

KISCO Holdings (KOSE:A001940)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KISCO Holdings Corp. operates through its subsidiaries to develop, produce, and sell steel products mainly in South Korea, with a market cap of approximately ₩200.90 billion.

Operations: KISCO Holdings Corp. generates revenue primarily from its Steel Manufacturing segment, which accounts for approximately ₩1.16 trillion, alongside its Holding segment contributing ₩25.61 billion.

Dividend Yield: 4.8%

KISCO Holdings offers a mixed dividend profile. While the dividend yield is attractive, ranking in the top 25% of KR market payers, its track record is less stable with only seven years of payments and volatility exceeding 20%. However, dividends are well-covered by earnings (payout ratio: 24.4%) and cash flows (cash payout ratio: 11.8%), suggesting sustainability despite recent margin declines from 6% to 4.1%. The stock trades significantly below estimated fair value, indicating potential valuation upside.

- Click here and access our complete dividend analysis report to understand the dynamics of KISCO Holdings.

- Our valuation report unveils the possibility KISCO Holdings' shares may be trading at a discount.

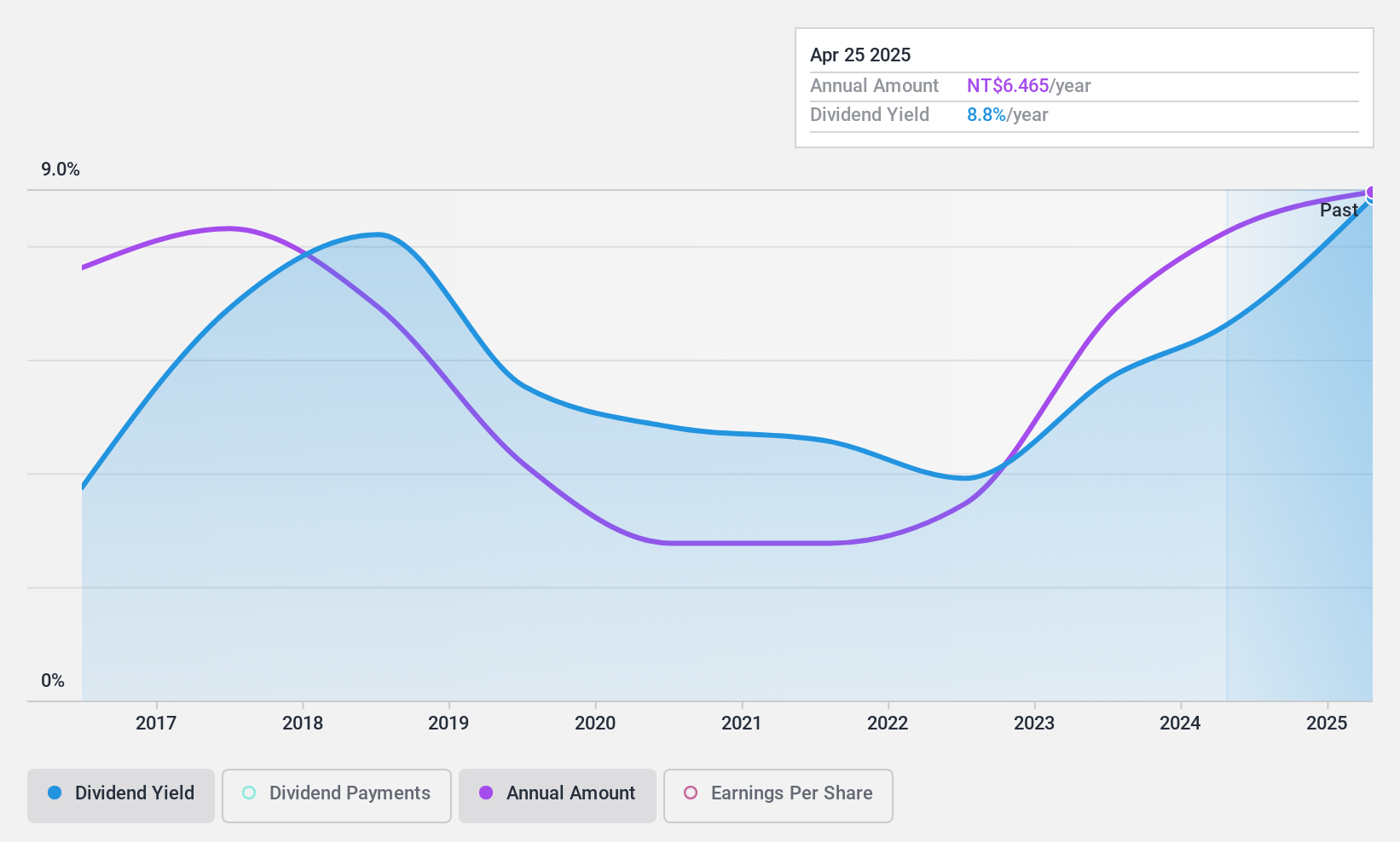

Bon Fame (TPEX:8433)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bon Fame Co., Ltd. operates in the fashion market in Taiwan with a market capitalization of NT$4.62 billion.

Operations: Bon Fame Co., Ltd. generates revenue primarily from the sales of ornaments, combs, and related accessories, amounting to NT$3.67 billion.

Dividend Yield: 6.9%

Bon Fame's dividend yield of 6.91% ranks in the top 25% of the TW market, yet its reliability is questionable due to volatility over the past decade. The dividends are covered by earnings with a payout ratio of 69.7%, but not by free cash flows, which are strained with a cash payout ratio at 124.7%. Despite these concerns, Bon Fame's earnings have grown significantly, and its price-to-earnings ratio (10.1x) suggests it is undervalued compared to the market average.

- Click here to discover the nuances of Bon Fame with our detailed analytical dividend report.

- The analysis detailed in our Bon Fame valuation report hints at an inflated share price compared to its estimated value.

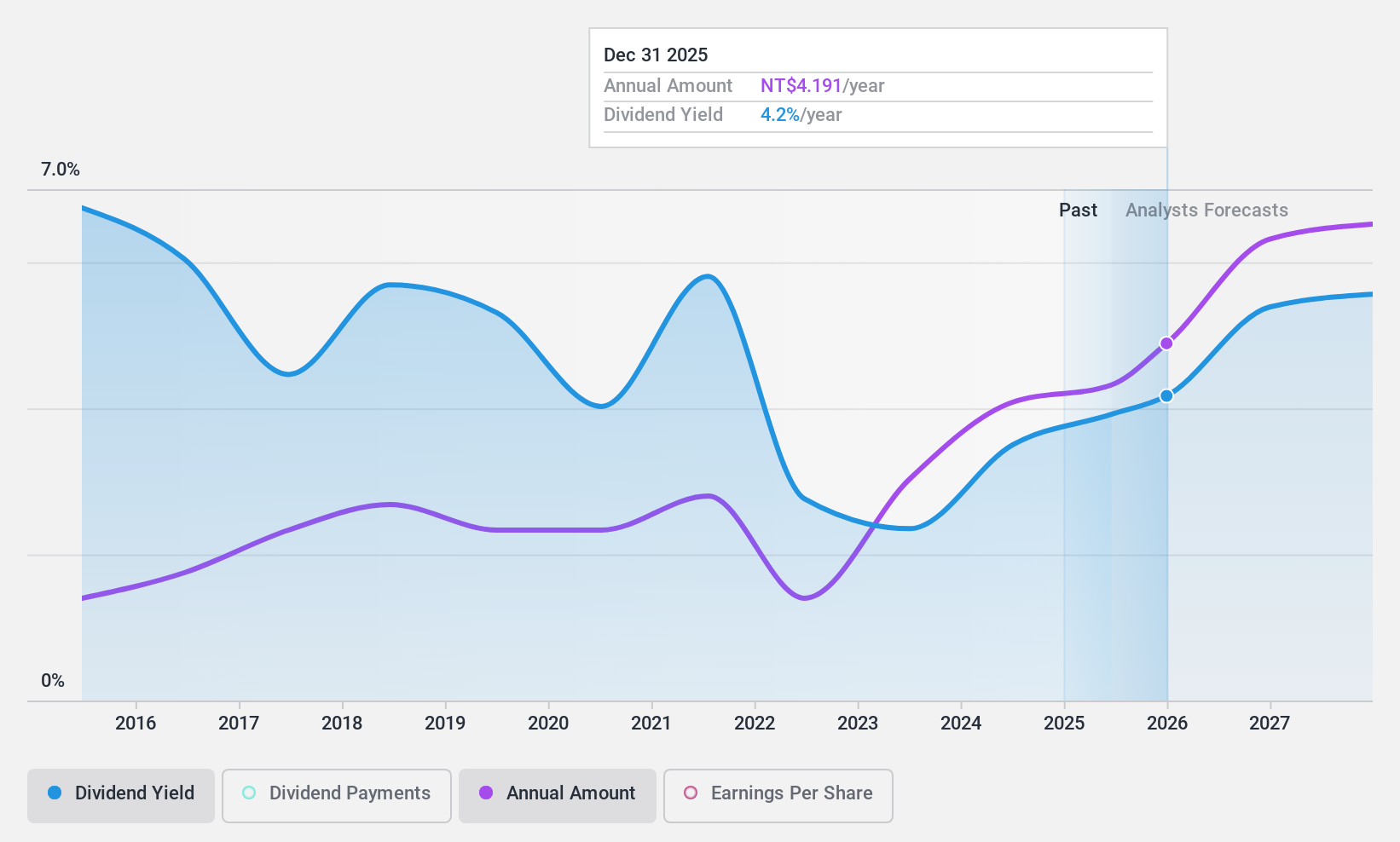

Sunonwealth Electric Machine Industry (TWSE:2421)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sunonwealth Electric Machine Industry Co., Ltd. is a global manufacturer and seller of precision motors and thermal solutions, with a market cap of NT$26.22 billion.

Operations: Sunonwealth Electric Machine Industry Co., Ltd. generates revenue primarily from Greater China (NT$22.93 billion) and Europe and North America (NT$790.64 million).

Dividend Yield: 3.6%

Sunonwealth Electric Machine Industry's dividend yield of 3.65% is below the top quartile in the TW market, with a payout ratio of 74% indicating coverage by earnings. Cash flow coverage is tighter at an 89.2% cash payout ratio, suggesting limited flexibility. While dividends have increased over ten years, they remain volatile and unreliable. The stock trades at a favorable price-to-earnings ratio of 20.3x compared to the market average, with analysts anticipating price appreciation.

- Unlock comprehensive insights into our analysis of Sunonwealth Electric Machine Industry stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Sunonwealth Electric Machine Industry is priced lower than what may be justified by its financials.

Next Steps

- Embark on your investment journey to our 1970 Top Dividend Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bon Fame might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8433

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives